Using the information provided, prepare the following financial statements: (1) Statement of comprehensive income for the year ended 31 December 20.7, using the function basis. Administrative expenses include depreciation on the office buildings. Distribution costs include marketing and delivery-related costs. Statement of comprehensive income for the year ended 31 December 20.7, using the nature basis. (ii)

Using the information provided, prepare the following financial statements: (1) Statement of comprehensive income for the year ended 31 December 20.7, using the function basis. Administrative expenses include depreciation on the office buildings. Distribution costs include marketing and delivery-related costs. Statement of comprehensive income for the year ended 31 December 20.7, using the nature basis. (ii)

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter12: Corporations: Organization, Capital Structure, And Operating Rules

Section: Chapter Questions

Problem 4BCRQ

Related questions

Question

Please assist with this question

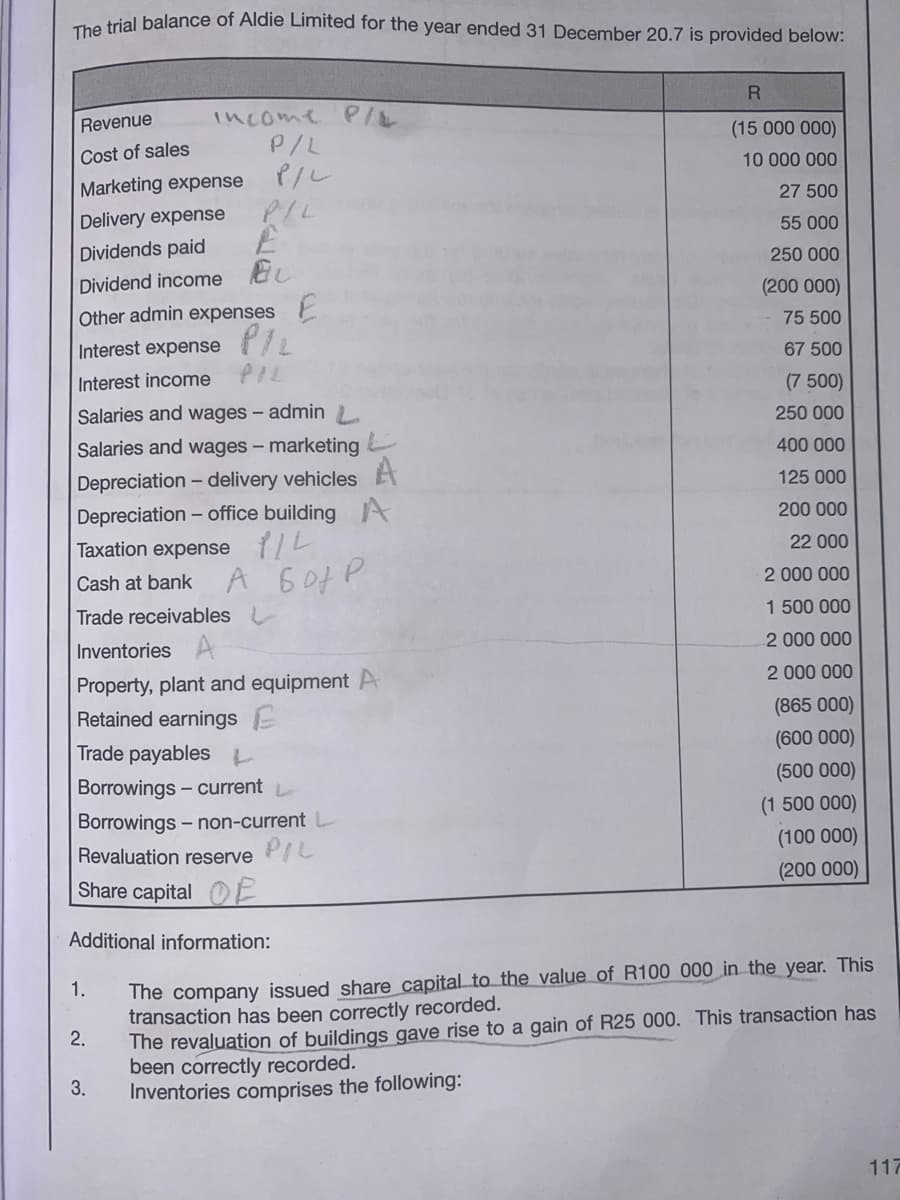

Transcribed Image Text:Tre trial balance of Aldie Limited for the year ended 31 December 20.7 is provided below:

Revenue

income

(15 000 000)

P/L

Cost of sales

10 000 000

Marketing expense

27 500

Delivery expense

55 000

Dividends paid

250 000

Dividend income

(200 000)

Other admin expenses E

PIL

75 500

Interest expense

67 500

Interest income

(7 500)

Salaries and wages - admin.

250 000

Salaries and wages - marketing

400 000

Depreciation – delivery vehiclesA

Depreciation – office building A

Taxation expense /L

A 60¢P

125 000

200 000

22 000

2 000 000

Cash at bank

1 500 000

Trade receivables

2 000 000

Inventories A

2 000 000

Property, plant and equipment A

(865 000)

Retained earnings

(600 000)

Trade payables L

(500 000)

Borrowings - current

(1 500 000)

Borrowings - non-current

(100 000)

Revaluation reserve PL

(200 000)

Share capital E

Additional information:

1.

The company issued share capital to the value of R100 000 in the year. This

transaction has been correctly recorded.

2.

The revaluation of buildings gave rise to a gain of R25 000. This transaction has

been correctly recorded.

3.

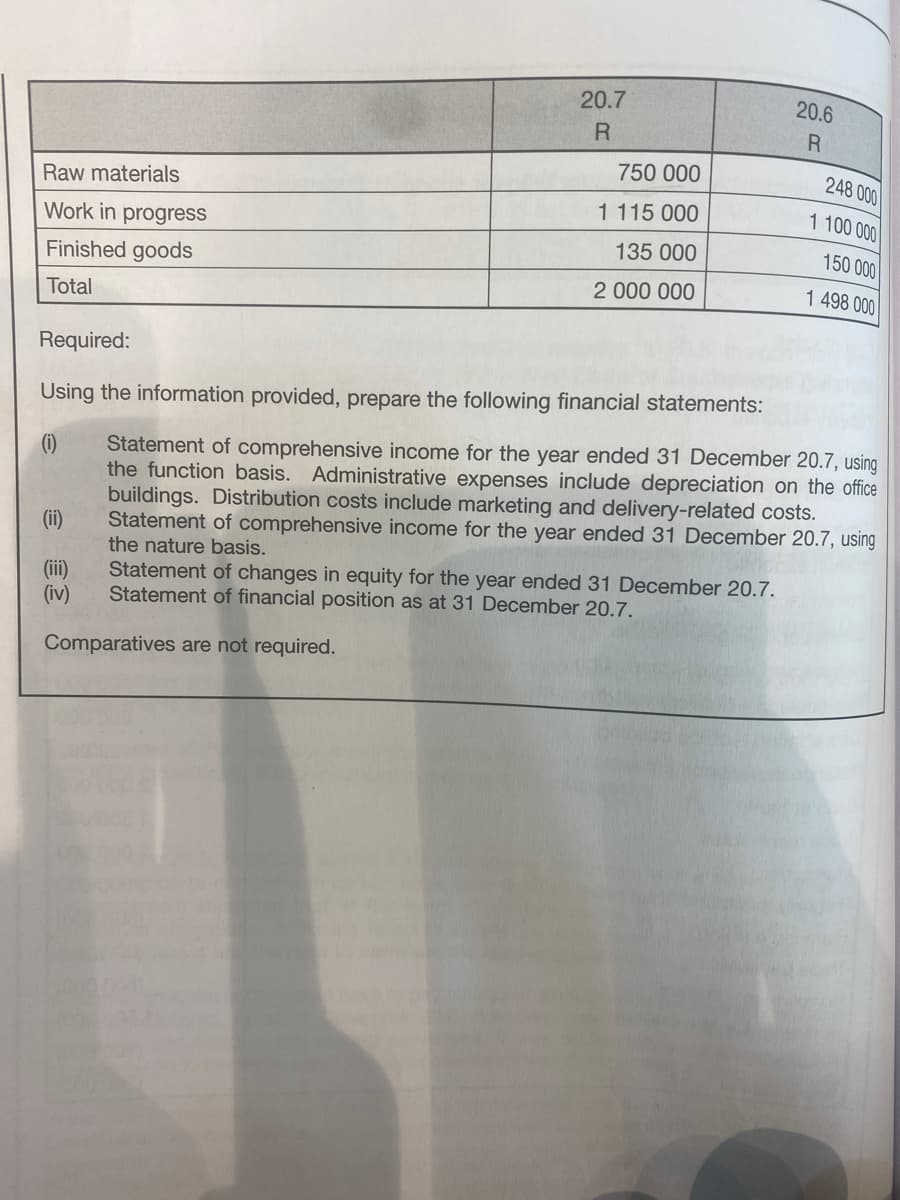

Inventories comprises the following:

117

Transcribed Image Text:20.7

20.6

R

750 000

248 000

Raw materials

1 115 000

1 100 000

Work in progress

135 000

150 000

Finished goods

2 000 000

1 498 000

Total

Required:

Using the information provided, prepare the following financial statements:

Statement of comprehensive income for the year ended 31 December 20.7, using

the function basis. Administrative expenses include depreciation on the office

buildings. Distribution costs include marketing and delivery-related costs.

Statement of comprehensive income for the year ended 31 December 20.7, using

the nature basis.

(1)

(ii)

(iii)

(iv)

Statement of changes in equity for the year ended 31 December 20.7.

Statement of financial position as at 31 December 20.7.

Comparatives are not required.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Please draw the

Solution

Follow-up Question

Please draw the Statement of changes in equity for the year ended 31 December 20.7

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you