Using the information that you gathered and the general ledger accounts that you prepared through Chapter 2, plus the new information above, to Prepare a trial balance as of October 31, 2015.

Getting ready for the upcoming holiday season is traditionally a busy time for greeting card com-panies, and it was no exception for Kate. The following transactions occurred during the month of October:

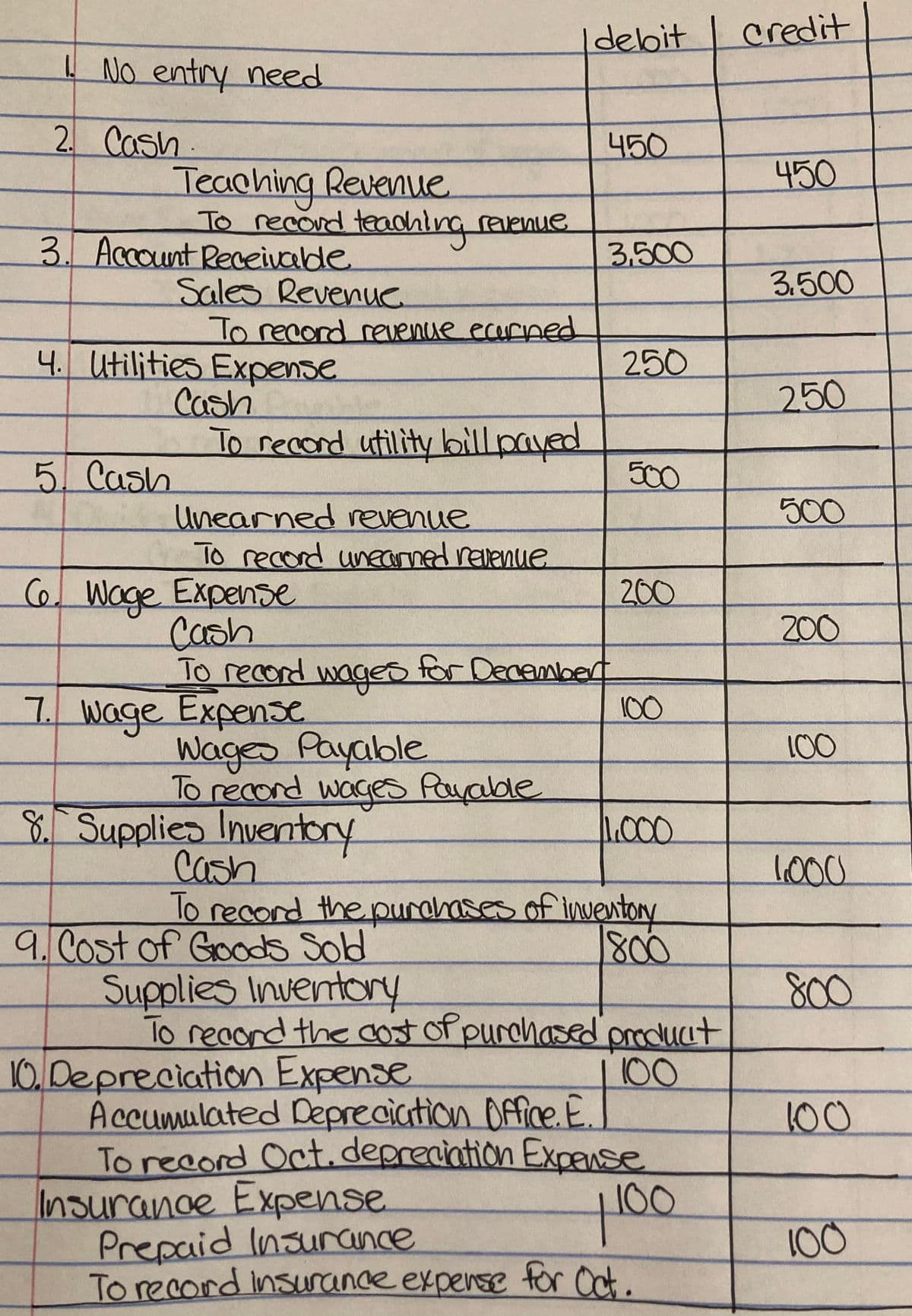

1. Hired an assistant at an hourly rate of $10 per hour to help with some of the computer layouts and administrative chores.

2. Supplements her business by teaching a class to aspiring card designers. She charges and receives a total of $450.

3. Delivers greeting cards to several new customers. She bills them a total of $3,500.

4. Pays a utility bill in the amount of $250 that she determines is the business portion of her utility bill.

5. Receives an advance deposit of $500 for a new set of cards she is designing for a new customer.

6. Pays her assistant $200 for the work done this month.

7. Determines that the assistant has worked 10 additional hours this month that have not yet been paid.

8. Ordered and receives additional supplies in the amount of $1,000. These were paid for during the month.

9. Counts her remaining inventory of supplies at the end of the month and determines the balance to be $300. Don't forget to consider the supplies inventory balance at September 30, from Chapter 2 which ended with $100. (Hint: This expense will be a debit to Cost of Goods Sold.)

10. Records the

11. Pays herself a salary of $1,000.

12. Paid monthly rent of $1,200 in cash.

13. Deciding she needs a little more cash, Kate pays herself a $100 dividend.

14. Receives her next utility bill during December and determines $85 applies to October's operations.

Using the information that you gathered and the general ledger accounts that you prepared through Chapter 2, plus the new information above, to Prepare a

Trending now

This is a popular solution!

Step by step

Solved in 2 steps