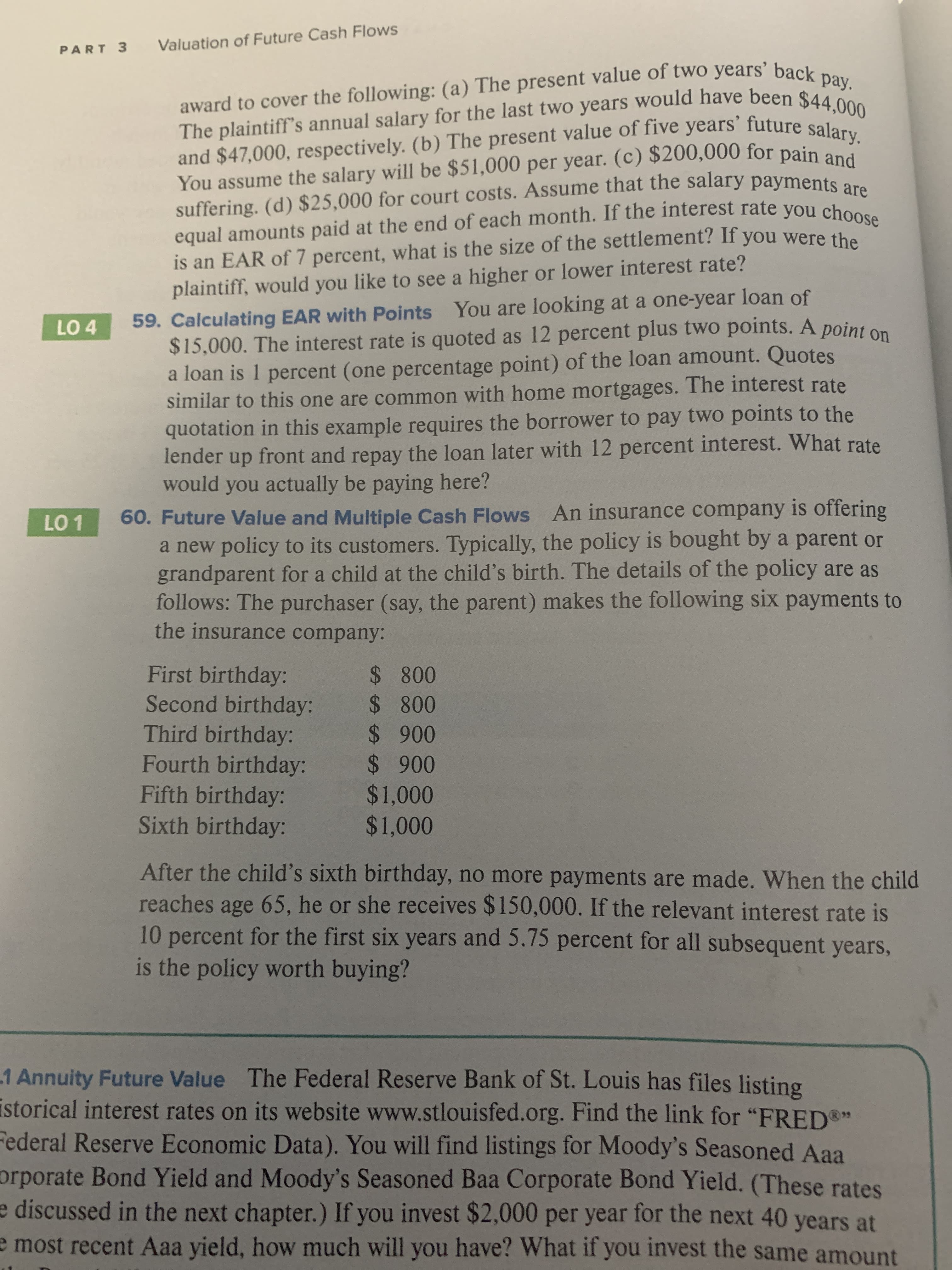

Valuation of Future Cash Flows PART 3 award to cover the following: (a) The present value of two years' back pay. The plaintiff's annual salary for the last two years would have been $44,000 and $47,000, respectively. (b) The present value of five years' future salary. You assume the salary will be $51,000 per year. (c) $200,000 for pain and suffering. (d) $25,000 for court costs. ASsume that the salary payments are equal amounts paid at the end of each month. If the interest rate you choose is an EAR of 7 percent, what is the size of the settlement? If you were the plaintiff, would you like to see a higher or lower interest rate? 59. Calculating EAR with Points You are looking at a one-year loan of $15,000. The interest rate is quoted as 12 percent plus two points. A pointon loan is 1 percent (one percentage point) of the loan amount. Quotes similar to this one are common with home mortgages. The interest rate quotation in this example requires the borrower to pay two points to the lender up front and repay the loan later with 12 percent interest. What rate would you actually be paying here? LO 4 60. Future Value and Multiple Cash Flows An insurance company is offering a new policy to its customers. Typically, the policy is bought by a parent or grandparent for a child at the child's birth. The details of the policy are as follows: The purchaser (say, the parent) makes the following six payments to the insurance company: LO 1 First birthday: Second birthday: Third birthday: Fourth birthday: Fifth birthday: Sixth birthday: $ 800 $ 800 $ 900 $ 900 $1,000 $1,000 After the child's sixth birthday, no more payments are made. When the child reaches age 65, he or she receives $150,000. If the relevant interest rate is 10 percent for the first six years and 5.75 percent for all subsequent years, is the policy worth buying? .1 Annuity Future Value The Federal Reserve Bank of St. Louis has files listing istorical interest rates on its website www.stlouisfed.org. Find the link for "FRED Federal Reserve Economic Data). You will find listings for Moody's Seasoned Aaa orporate Bond Yield and Moody's Seasoned Baa Corporate Bond Yield. (These rates e discussed in the next chapter.) If you invest $2,000 per year for the next 40 years at e most recent Aaa yield, how much will you have? What if you invest the same amount

Valuation of Future Cash Flows PART 3 award to cover the following: (a) The present value of two years' back pay. The plaintiff's annual salary for the last two years would have been $44,000 and $47,000, respectively. (b) The present value of five years' future salary. You assume the salary will be $51,000 per year. (c) $200,000 for pain and suffering. (d) $25,000 for court costs. ASsume that the salary payments are equal amounts paid at the end of each month. If the interest rate you choose is an EAR of 7 percent, what is the size of the settlement? If you were the plaintiff, would you like to see a higher or lower interest rate? 59. Calculating EAR with Points You are looking at a one-year loan of $15,000. The interest rate is quoted as 12 percent plus two points. A pointon loan is 1 percent (one percentage point) of the loan amount. Quotes similar to this one are common with home mortgages. The interest rate quotation in this example requires the borrower to pay two points to the lender up front and repay the loan later with 12 percent interest. What rate would you actually be paying here? LO 4 60. Future Value and Multiple Cash Flows An insurance company is offering a new policy to its customers. Typically, the policy is bought by a parent or grandparent for a child at the child's birth. The details of the policy are as follows: The purchaser (say, the parent) makes the following six payments to the insurance company: LO 1 First birthday: Second birthday: Third birthday: Fourth birthday: Fifth birthday: Sixth birthday: $ 800 $ 800 $ 900 $ 900 $1,000 $1,000 After the child's sixth birthday, no more payments are made. When the child reaches age 65, he or she receives $150,000. If the relevant interest rate is 10 percent for the first six years and 5.75 percent for all subsequent years, is the policy worth buying? .1 Annuity Future Value The Federal Reserve Bank of St. Louis has files listing istorical interest rates on its website www.stlouisfed.org. Find the link for "FRED Federal Reserve Economic Data). You will find listings for Moody's Seasoned Aaa orporate Bond Yield and Moody's Seasoned Baa Corporate Bond Yield. (These rates e discussed in the next chapter.) If you invest $2,000 per year for the next 40 years at e most recent Aaa yield, how much will you have? What if you invest the same amount

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

ChapterM: Time Value Of Money Module

Section: Chapter Questions

Problem 9P

Related questions

Question

#60

Transcribed Image Text:Valuation of Future Cash Flows

PART 3

award to cover the following: (a) The present value of two years' back pay.

The plaintiff's annual salary for the last two years would have been $44,000

and $47,000, respectively. (b) The present value of five years' future salary.

You assume the salary will be $51,000 per year. (c) $200,000 for pain and

suffering. (d) $25,000 for court costs. ASsume that the salary payments are

equal amounts paid at the end of each month. If the interest rate you choose

is an EAR of 7 percent, what is the size of the settlement? If you were the

plaintiff, would you like to see a higher or lower interest rate?

59. Calculating EAR with Points You are looking at a one-year loan of

$15,000. The interest rate is quoted as 12 percent plus two points. A pointon

loan is 1 percent (one percentage point) of the loan amount. Quotes

similar to this one are common with home mortgages. The interest rate

quotation in this example requires the borrower to pay two points to the

lender up front and repay the loan later with 12 percent interest. What rate

would you actually be paying here?

LO 4

60. Future Value and Multiple Cash Flows An insurance company is offering

a new policy to its customers. Typically, the policy is bought by a parent or

grandparent for a child at the child's birth. The details of the policy are as

follows: The purchaser (say, the parent) makes the following six payments to

the insurance company:

LO 1

First birthday:

Second birthday:

Third birthday:

Fourth birthday:

Fifth birthday:

Sixth birthday:

$ 800

$ 800

$ 900

$ 900

$1,000

$1,000

After the child's sixth birthday, no more payments are made. When the child

reaches age 65, he or she receives $150,000. If the relevant interest rate is

10 percent for the first six years and 5.75 percent for all subsequent years,

is the policy worth buying?

.1 Annuity Future Value The Federal Reserve Bank of St. Louis has files listing

istorical interest rates on its website www.stlouisfed.org. Find the link for "FRED

Federal Reserve Economic Data). You will find listings for Moody's Seasoned Aaa

orporate Bond Yield and Moody's Seasoned Baa Corporate Bond Yield. (These rates

e discussed in the next chapter.) If you invest $2,000 per year for the next 40 years at

e most recent Aaa yield, how much will you have? What if you invest the same amount

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning