value on the improvement on the lot was 1,500,000. The lot was purchased at a cost of 2,000,000. Compute the monetary value to be reported in the quarterly fringe benefit tax return. O 250,000 O 125,000 62,500 O 31,250

value on the improvement on the lot was 1,500,000. The lot was purchased at a cost of 2,000,000. Compute the monetary value to be reported in the quarterly fringe benefit tax return. O 250,000 O 125,000 62,500 O 31,250

Chapter14: Property Transactions: Capital Gains And Losses, § 1231, And Recapture Provisions

Section: Chapter Questions

Problem 30CE

Related questions

Question

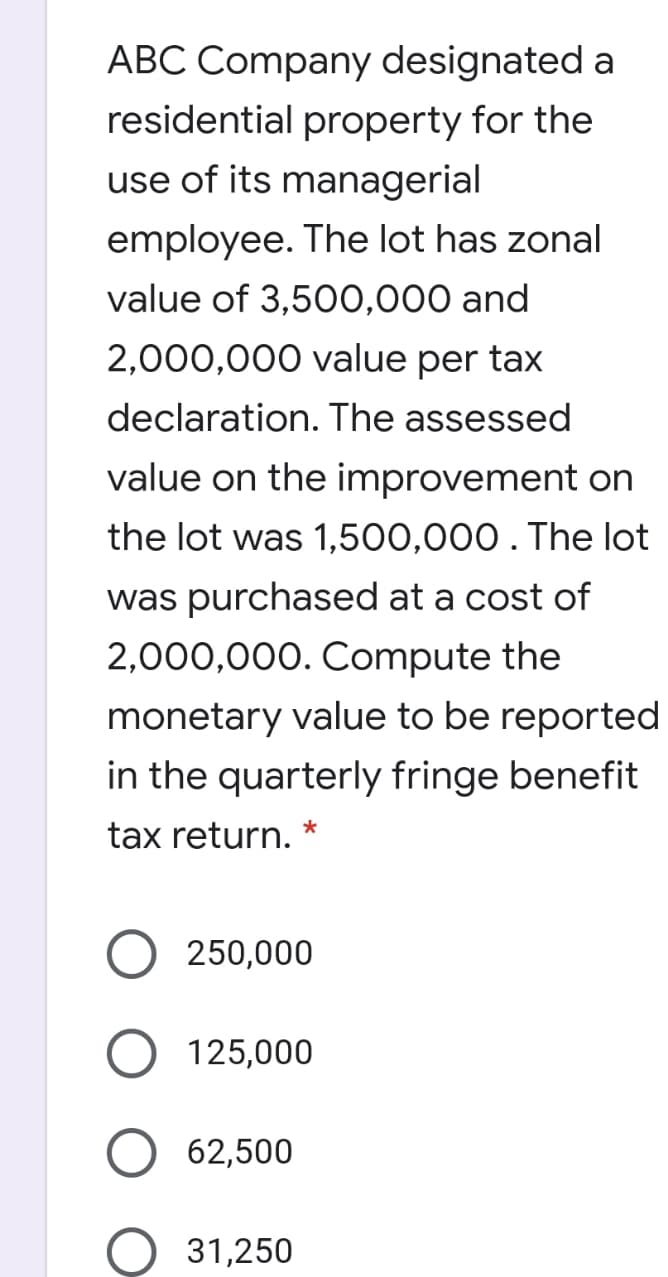

Transcribed Image Text:ABC Company designated a

residential property for the

use of its managerial

employee. The lot has zonal

value of 3,500,000 and

2,000,000 value per tax

declaration. The assessed

value on the improvement on

the lot was 1,500,000 . The lot

was purchased at a cost of

2,000,000. Compute the

monetary value to be reported

in the quarterly fringe benefit

tax return.

250,000

125,000

62,500

31,250

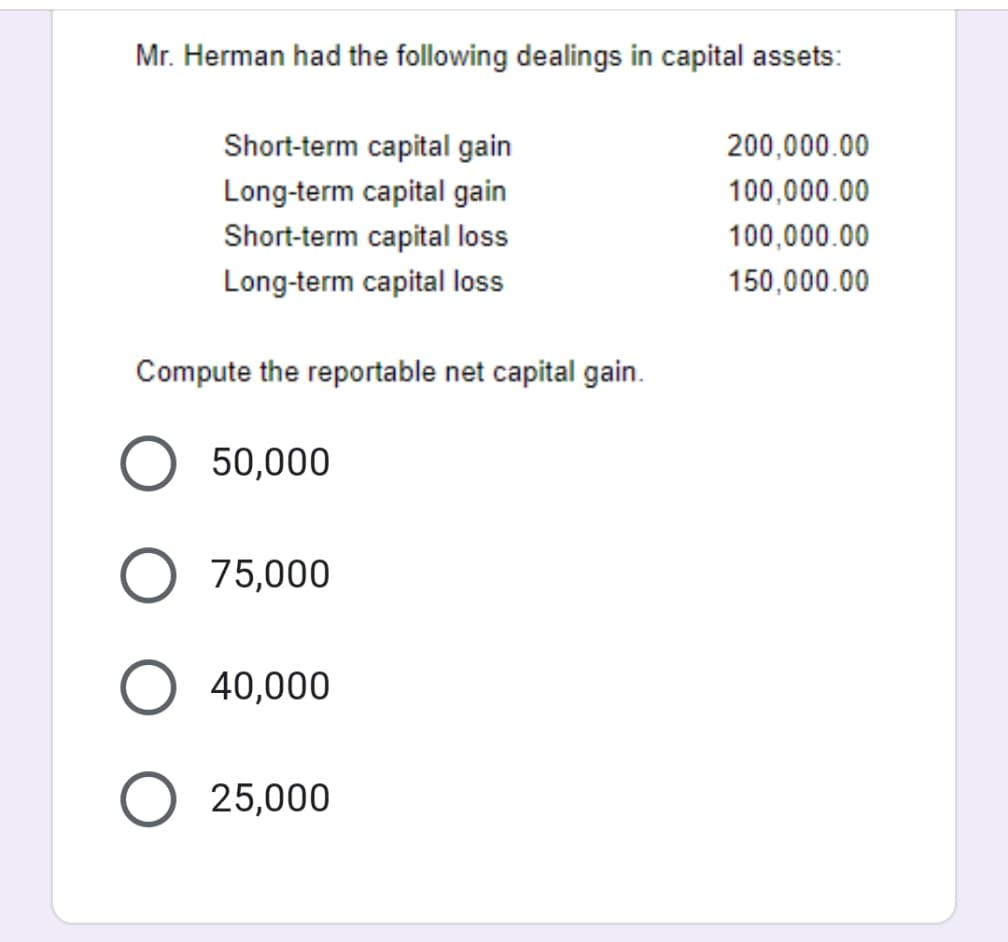

Transcribed Image Text:Mr. Herman had the following dealings in capital assets:

Short-term capital gain

200,000.00

Long-term capital gain

100,000.00

Short-term capital loss

100,000.00

Long-term capital loss

150,000.00

Compute the reportable net capital gain.

50,000

O 75,000

O 40,000

25,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT