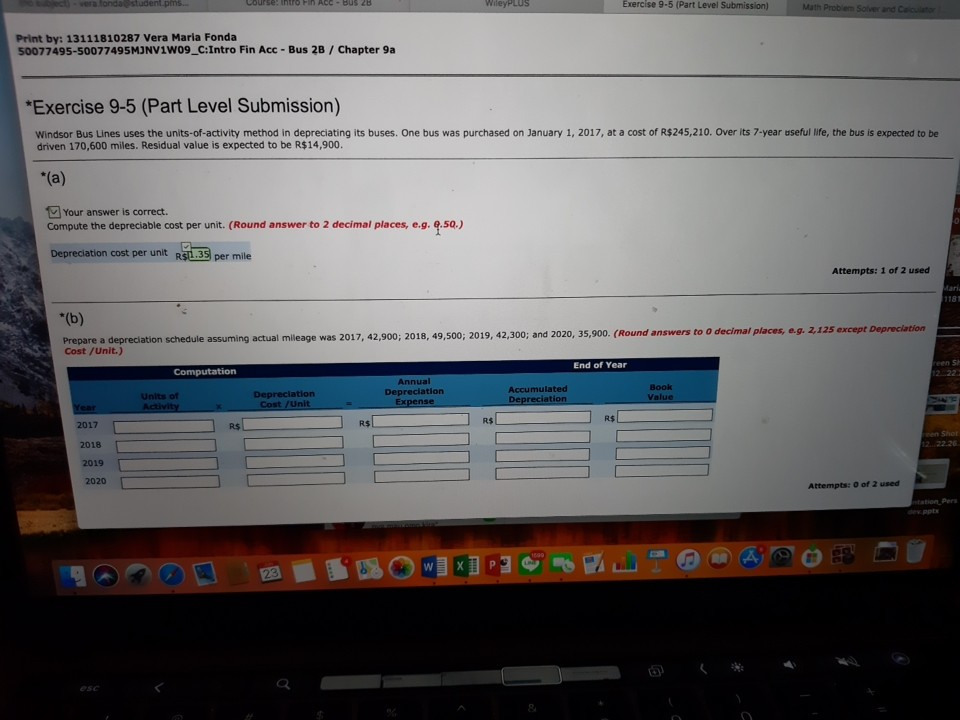

-vera fonda@student.pms.. Course: Intro Fin Acc- Bus 28 WileyPLUS Exercise 9-5 (Part Level Submission) Math Problem Solver and Caiculator Print by: 13111810287 Vera Maria Fonda 50077495-50077495MJNV1W09_C:Intro Fin Acc - Bus 28 / Chapter 9a *Exercise 9-5 (Part Level Submission) Windsor Bus Lines uses the units-of-activity method in depreciating its buses. One bus was purchased on January 1, 2017, at a cost of R$245,210. Over its 7-year useful life, the bus is expected to be driven 170,600 miles. Residual value is expected to be R$14,900. V Your answer is correct. Compute the depreciable cost per unit. (Round answer to 2 decimal places, e.g. e.50.) Depreciation cost per unit RSL.35 per mile Attempts: 1 of 2 used Mari 1181 *(b) Prepare a depreciation schedule assuming actual mileage was 2017, 42,900; 2018, 49,500; 2019, 42,300; and 2020, 35,900. (Round answers to o decimal places, e.g. 2,125 except Depreciation Cost /Unit.) reen Sh 1222 End of Year Computation Annual Accumulated Depreciation Book Units of Activity Depreciation Cost /Unit Depreciation Expense Value Year R$ R$ 2017 R$ R$ Feen Shot 2018 12..22.26 2019 2020 Attempts: O of 2 used ntation Pers dev pptx WEX 23 esc

-vera fonda@student.pms.. Course: Intro Fin Acc- Bus 28 WileyPLUS Exercise 9-5 (Part Level Submission) Math Problem Solver and Caiculator Print by: 13111810287 Vera Maria Fonda 50077495-50077495MJNV1W09_C:Intro Fin Acc - Bus 28 / Chapter 9a *Exercise 9-5 (Part Level Submission) Windsor Bus Lines uses the units-of-activity method in depreciating its buses. One bus was purchased on January 1, 2017, at a cost of R$245,210. Over its 7-year useful life, the bus is expected to be driven 170,600 miles. Residual value is expected to be R$14,900. V Your answer is correct. Compute the depreciable cost per unit. (Round answer to 2 decimal places, e.g. e.50.) Depreciation cost per unit RSL.35 per mile Attempts: 1 of 2 used Mari 1181 *(b) Prepare a depreciation schedule assuming actual mileage was 2017, 42,900; 2018, 49,500; 2019, 42,300; and 2020, 35,900. (Round answers to o decimal places, e.g. 2,125 except Depreciation Cost /Unit.) reen Sh 1222 End of Year Computation Annual Accumulated Depreciation Book Units of Activity Depreciation Cost /Unit Depreciation Expense Value Year R$ R$ 2017 R$ R$ Feen Shot 2018 12..22.26 2019 2020 Attempts: O of 2 used ntation Pers dev pptx WEX 23 esc

Pkg Acc Infor Systems MS VISIO CD

10th Edition

ISBN:9781133935940

Author:Ulric J. Gelinas

Publisher:Ulric J. Gelinas

Chapter5: Database Management System

Section: Chapter Questions

Problem 11DQ

Related questions

Question

Transcribed Image Text:-vera fonda@student.pms..

Course: Intro Fin Acc- Bus 28

WileyPLUS

Exercise 9-5 (Part Level Submission)

Math Problem Solver and Caiculator

Print by: 13111810287 Vera Maria Fonda

50077495-50077495MJNV1W09_C:Intro Fin Acc - Bus 28 / Chapter 9a

*Exercise 9-5 (Part Level Submission)

Windsor Bus Lines uses the units-of-activity method in depreciating its buses. One bus was purchased on January 1, 2017, at a cost of R$245,210. Over its 7-year useful life, the bus is expected to be

driven 170,600 miles. Residual value is expected to be R$14,900.

V Your answer is correct.

Compute the depreciable cost per unit. (Round answer to 2 decimal places, e.g. e.50.)

Depreciation cost per unit

RSL.35

per mile

Attempts: 1 of 2 used

Mari

1181

*(b)

Prepare a depreciation schedule assuming actual mileage was 2017, 42,900; 2018, 49,500; 2019, 42,300; and 2020, 35,900. (Round answers to o decimal places, e.g. 2,125 except Depreciation

Cost /Unit.)

reen Sh

1222

End of Year

Computation

Annual

Accumulated

Depreciation

Book

Units of

Activity

Depreciation

Cost /Unit

Depreciation

Expense

Value

Year

R$

R$

2017

R$

R$

Feen Shot

2018

12..22.26

2019

2020

Attempts: O of 2 used

ntation Pers

dev pptx

WEX

23

esc

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Pkg Acc Infor Systems MS VISIO CD

Finance

ISBN:

9781133935940

Author:

Ulric J. Gelinas

Publisher:

CENGAGE L

Accounting Information Systems

Finance

ISBN:

9781337552127

Author:

Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:

Cengage Learning

Pkg Acc Infor Systems MS VISIO CD

Finance

ISBN:

9781133935940

Author:

Ulric J. Gelinas

Publisher:

CENGAGE L

Accounting Information Systems

Finance

ISBN:

9781337552127

Author:

Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:

Cengage Learning