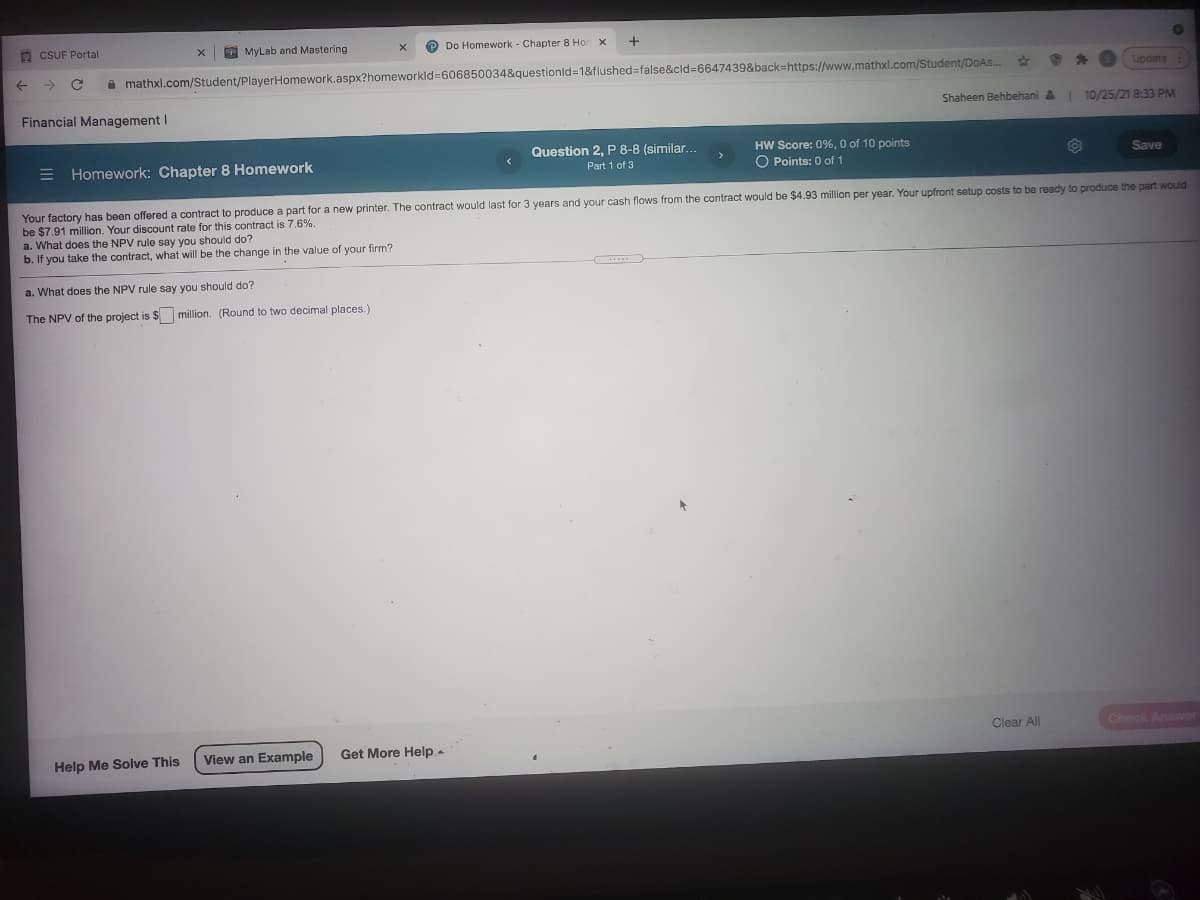

A CSUF Portal E MyLab and Mastering P Do Homework - Chapter 8 Hon x -> a mathxl.com/Student/PlayerHomework.aspx?homeworkld=606850034&questionld=1&flushed%3false&cld%36647439&back=https://www.mathxl.com/Student/DOA.. ipdate Financial Management I Shaheen Behbehani a 10/25/21 8:33 PM Question 2, P 8-8 (similar... HW Score: 0%, 0 of 10 points E Homework: Chapter 8 Homework O Points: 0 of 1 Save Part 1 of 3 Your factory has been offered a contract to produce a part for a new printer. The contract would last for 3 years and your cash flows from the contract would be $4.93 million per year. Your upfront setup costs to be ready to produce the part would be $7.91 million. Your discount rate for this contract is 7.6%. a. What does the NPV rule say you should do? b. If you take the contract, what will be the change in the value of your firm? a. What does the NPV rule say you should do? The NPV of the project is $ million. (Round to two decimal places.) Clear All Check Answer View an Example Get More Help- Help Me Solve This

A CSUF Portal E MyLab and Mastering P Do Homework - Chapter 8 Hon x -> a mathxl.com/Student/PlayerHomework.aspx?homeworkld=606850034&questionld=1&flushed%3false&cld%36647439&back=https://www.mathxl.com/Student/DOA.. ipdate Financial Management I Shaheen Behbehani a 10/25/21 8:33 PM Question 2, P 8-8 (similar... HW Score: 0%, 0 of 10 points E Homework: Chapter 8 Homework O Points: 0 of 1 Save Part 1 of 3 Your factory has been offered a contract to produce a part for a new printer. The contract would last for 3 years and your cash flows from the contract would be $4.93 million per year. Your upfront setup costs to be ready to produce the part would be $7.91 million. Your discount rate for this contract is 7.6%. a. What does the NPV rule say you should do? b. If you take the contract, what will be the change in the value of your firm? a. What does the NPV rule say you should do? The NPV of the project is $ million. (Round to two decimal places.) Clear All Check Answer View an Example Get More Help- Help Me Solve This

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter2: Working With The Tax Law

Section: Chapter Questions

Problem 1RP

Related questions

Question

Transcribed Image Text:A CSUF Portal

E MyLab and Mastering

P Do Homework - Chapter 8 Hon x

->

->

a mathxl.com/Student/PlayerHomework.aspx?homeworkld=606850034&questionld=1&flushed%3false&cld%3D6647439&back=https://www.mathxl.com/Student/DOAS..

Update

Financial Management I

Shaheen Behbehani a

10/25/21 8:33 PM

Question 2, P 8-8 (similar...

HW Score: 0%, 0 of 10 points

E Homework: Chapter 8 Homework

O Points: 0 of 1

Save

Part 1 of 3

Your factory has been offered a contract to produce a part for a new printer. The contract would last for 3 years and your cash flows from the contract would be $4.93 million per year. Your upfront setup costs to be ready to produce the part would

be $7.91 million. Your discount rate for this contract is 7.6%.

a. What does the NPV rule say you should do?

b. If you take the contract, what will be the change in the value of your firm?

a. What does the NPV rule say you should do?

The NPV of the project is $ million. (Round to two decimal places.)

Clear All

Check Answer

Help Me Solve This

View an Example

Get More Help -

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you