Concept explainers

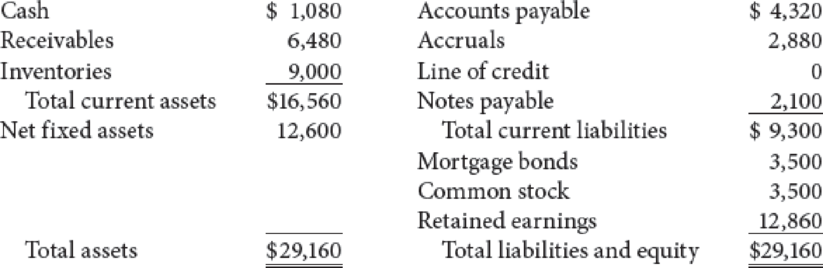

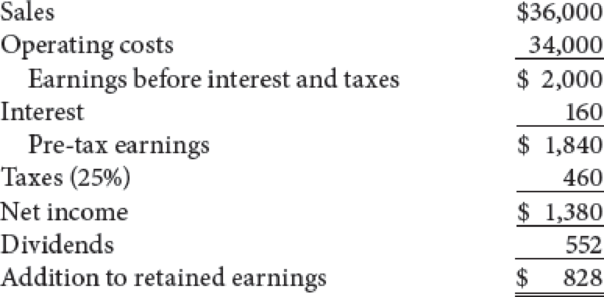

Stevens Textile Corporation’s 2019 financial statements are shown here. Stevens grew rapidly in 2019 and financed the growth with notes payable and long-term bonds. Stevens expects sales to grow by 15% in the next year but will finance the growth with a line of credit, not notes payable or long-term bonds. Use the

- a. What is the projected value for earnings before interest and taxes?

- b. What is the projected value for pre-tax earnings?

- c. What is the projected net income?

- d. What is the projected addition to retained earnings?

- e. What is the projected value of total current assets?

- f. What is the projected value of total assets?

- g. What is the projected sum of accounts payable, accruals, and notes payable?

- h. What is the forecasted line of credit?

Balance Sheet as of December 31, 2019 (Thousands of Dollars)

Income Statement for December 31, 2019 (Thousands of Dollars)

Trending nowThis is a popular solution!

Chapter 12 Solutions

Financial Management: Theory & Practice

- LONG-TERM FINANCING NEEDED At year-end 2019, total assets for Arrington Inc. were 1.8 million and accounts payable were 450,000. Sales, which in 2019 were 3.0 million, are expected to increase by 25% in 2020. Total assets and accounts payable are proportional to sales, and that relationship will be maintained; that is, they will grow at the same rate as sales. Arrington typically uses no current liabilities other than accounts payable. Common stock amounted to 500,000 in 2019, and retained earnings were 475,000. Arrington plans to sell new common stock in the amount of 130,000. The firms profit margin on sates is 5%; 35% of earnings will be retained. a. What were Arringtons total liabilities in 2019? b. How much new long-term debt financing will be needed in 2020? (Hint: AFN - New stock = New long-term debt.)arrow_forwardUsing the Value Line Investment Survey report in Exhibit 11.5, find the following information for Apple. What was the amount of revenues (i.e., sales) generated by the company in 2017? What were the latest annual dividends per share and dividend yield? What is the earnings per share (EPS) projection for 2019? How many shares of common stock were outstanding? What were the book value per share and EPS in 2017? How much long-term debt did the company have in the third quarter of 2018?arrow_forwardThe table below shows the forecast cash flow information of Good Time Inc. for the nextyear. The required debt payment in the next year is $88 million, with a current market valueof $60 million. The company pays no tax. If you invest in the corporate debt of Good TimeInc. today, what is your expected return on this investment?arrow_forward

- Use the percentage of sales forecasting method to compute the additional financing needed by Lambrechts Specialty Shops, Inc. (LSS), if sales are expected to increase from a current level of $20 million to a new level of $25 million over the coming year. LSS expects earnings after taxes to equal $1 million over the next year. LSS intends to pay a $300,000 dividend next year. The current year balance sheet for LSS is as follows: Lambrechts Specialty Shops, Inc. Balance Sheet as of December 31, 20X3 Cash $1,000,000 Accounts payable $3,000,000 Accounts receivable 1,500,000 Notes payable 3,000,000 inventories 6,000,000 Long-term debt 2,000,000 Net fixed assets 3,000,000 Stockholders’ equity 3,500,000 Total Assets $11,500,000 Total…arrow_forwardUse the percentage of sales forecasting method to compute the additional financing needed by Lambrechts Specialty Shops, Inc. (LSS), if sales are expected to increase from a current level of $20 million to a new level of $25 million over the coming year. LSS expects earnings after taxes to equal $1 million over the next year. LSS intends to pay a $300,000 dividend next year. The current year balance sheet for LSS is as follows: Lambrechts Specialty Shops, Inc. Balance Sheet as of December 31, 20X3 Cash $1,000,000 Accounts Payable $3,000,000 Accounts Receivable 1,500,000 Notes Payable 3,000,000 Inventories 6,000,000 Long-Term Debt 2,000,000 Net Fixed Assets 3,000,000 Stockholders’ Equity 3,500,00 Total Assets $11,500,000 Total Liabilities and Equity $11,500,000arrow_forwarda) At the end of its financial year 2021, an analyst made the following forecast for Next plc for financial years 2022 – 2025 (in millions of pounds): Year Cash In-flows from Operations £ Cash Out-flows Investment £ 2022 2560 1200 2023 3420 1500 2024 3500 2400 2025 3600 2000 Next plc reported £5500 million in total debt at the end of 2021. Required:I. Use a required rate of return of 10% to calculate both the enterprise value and equity value for Next plc at the end of 2021 under the following two scenarios for the…arrow_forward

- The sales revenue of Business Strategy Limited for 2019 is $100 million. The CEO told the sales director in December of 2019 that the board had set a target of $145 million in sales revenue for 2022 and expected that there should be stable annual growth of sales over the 3 years. The board expects the growth rate will be maintained continuously in future years. The market has the same expectation of the board. Business Strategy Limited is expected to pay dividend of $20 per common stock at the end of the year 2020. The market price of the common stock at the beginning of 2020 is $1,000.What is the required rate of return on Business Strategy Limited’s common stock?arrow_forwardBobek Inc. has recently reported steadily increasing income. The company reported income of $20,000 in 2017, $25,000 in 2018, and $30,000 in 2019. A number of market analysts have recommended that investors buy the stock because they expect the steady growth in income to continue. Bobek is approaching the end of its fiscal year in 2020, and it again appears to be a good year. However, it has not yet recorded warranty expense. Based on prior experience, this year’s warranty expense should be around $5,000, but some managers have approached the controller to suggest a larger, more conservative warranty expense should be recorded this year. Income before warranty expense is $43,000. Specifically, by recording a $7,000 warranty accrual this year, Bobek could report an increase in income for this year and still be in a position to cover its warranty costs in future years. Instructions a. What is earnings management? b. Assume income before warranty expense is $43,000 for both 2020 and…arrow_forwardViva Airlines had a debt-to-equity ratio of 40 in 2021 and -105 in 2022 Evaluate the trend in this, and briefly discuss how this trend would imply to Viva Airlines' ability to borrow money.arrow_forward

- The 2020 balance sheet of Osaka's Tennis Shop, Incorporated, showed long-term debt of $2.5 million, and the 2021 balance sheet showed long-term debt of $2.65 million. The 2021 income statement showed an interest expense of $100,000. During 2021, the company had a cash flow to creditors of –$50,000 and the cash flow to stockholders for the year was $60,000. Suppose you also know that the firm’s net capital spending for 2021 was $1.31 million and that the firm reduced its net working capital investment by $57,000. What was the firm’s 2021 operating cash flow, or OCF? (Enter your answer in dollars, not millions of dollars, e.g., 1,234,567.)arrow_forwardBoehm Corporation has had stable earnings growth of 7% a year for the past 10 years, and in 2019 Boehm paid dividends of $3 million on net income of $5 million. However, net income is expected to grow by 28% in 2020, and Boehm plans to invest $3.0 million in a plant expansion. This one-time unusual earnings growth won't be maintained, though, and after 2020 Boehm will return to its previous 7% earnings growth rate. Its target debt ratio is 34%. Boehm has 1 million shares of stock. Calculate Boehm's dividend per share for 2020 under each of the following policies: Its 2020 dividend payment is set to force dividends per share to grow at the long-run growth rate in earnings. Round your answer to the nearest cent. $ It continues the 2019 dividend payout ratio. Round your answer to the nearest cent. $ It uses a pure residual policy with all distributions in the form of dividends (34% of the $3.0 million investment is financed with debt). Round your answer to the nearest cent. $…arrow_forwardBoehm Corporation has had stable earnings growth of 7% a year for the past 10 years, and in 2019 Boehm paid dividends of $2 million on net income of $5 million. However, net income is expected to grow by 34% in 2020, and Boehm plans to invest $3.5 million in a plant expansion. This one-time unusual earnings growth won't be maintained, though, and after 2020 Boehm will return to its previous 7% earnings growth rate. Its target debt ratio is 35%. Boehm has 1 million shares of stock. Calculate Boehm's dividend per share for 2020 under each of the following policies: -Its 2020 dividend payment is set to force dividends per share to grow at the long-run growth rate in earnings. Round your answer to the nearest cent. -It continues the 2019 dividend payout ratio. Round your answer to the nearest cent. -It uses a pure residual policy with all distributions in the form of dividends (35% of the $3.5 million investment is financed with debt). Round your answer to the nearest cent. -It employs a…arrow_forward

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning