View Policies Current Attempt in Progress For the year ended June 30, 2024, Tamarisk Inc. had service revenue of $780,000 and operating expenses of $546,000. The company has a 15% income tax rate. No income tax instalments have been paid or recorded. Prepare the journal entry to record income tax. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List debit entry before credit entry.) Date Account Titles June 30 Debit Credit

View Policies Current Attempt in Progress For the year ended June 30, 2024, Tamarisk Inc. had service revenue of $780,000 and operating expenses of $546,000. The company has a 15% income tax rate. No income tax instalments have been paid or recorded. Prepare the journal entry to record income tax. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List debit entry before credit entry.) Date Account Titles June 30 Debit Credit

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter10: Liabilities: Current, Installment Notes, And Contingencies

Section: Chapter Questions

Problem 10.11EX: Payroll tax entries According to a summary of the payroll of Mountain Streaming Co., 120,000 was...

Related questions

Question

Transcribed Image Text:Question 6 of 11

View Policies

Current Attempt in Progress

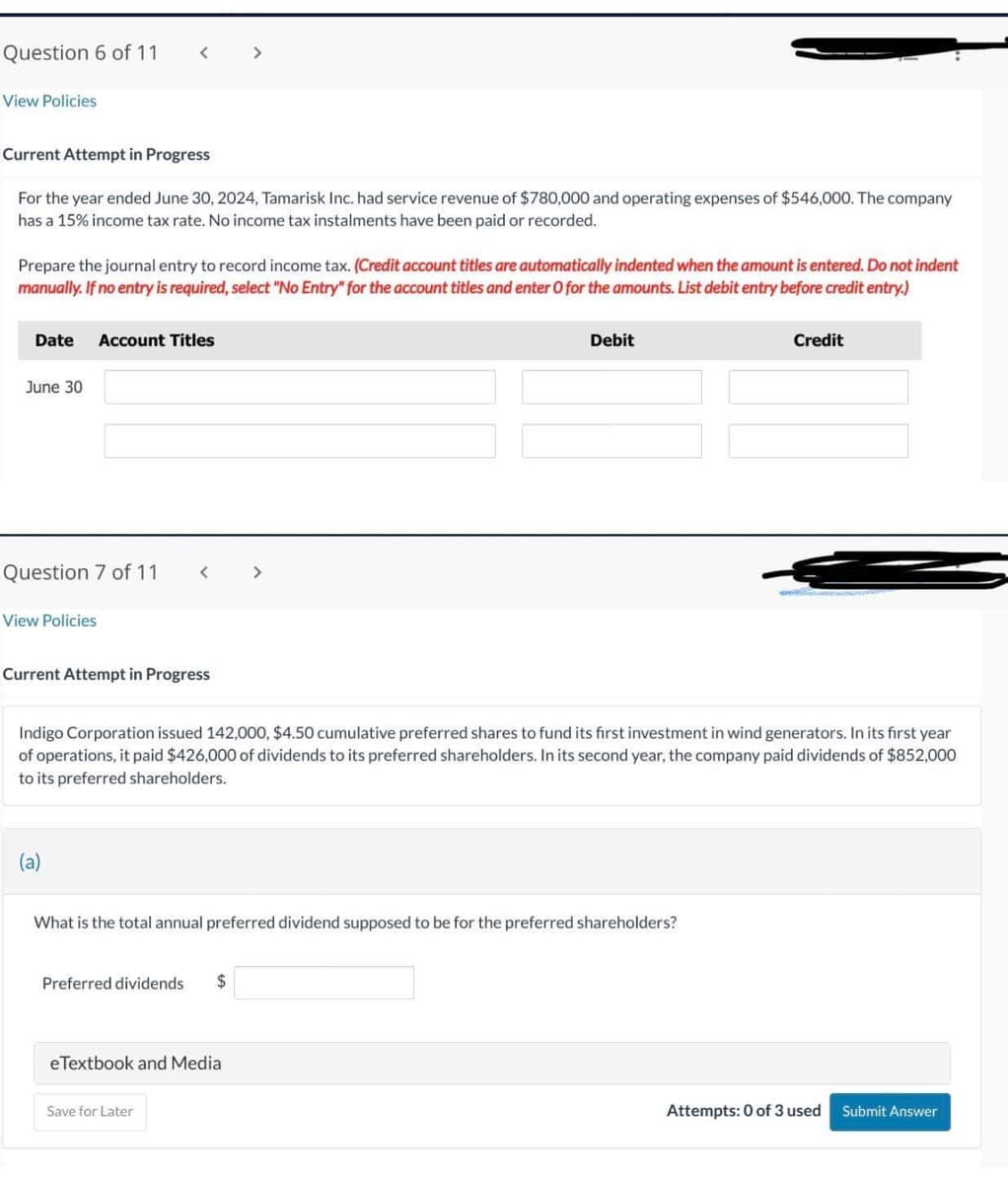

For the year ended June 30, 2024, Tamarisk Inc. had service revenue of $780,000 and operating expenses of $546,000. The company

has a 15% income tax rate. No income tax instalments have been paid or recorded.

Prepare the journal entry to record income tax. (Credit account titles are automatically indented when the amount is entered. Do not indent

manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List debit entry before credit entry.)

Date Account Titles

June 30

Question 7 of 11

View Policies

Current Attempt in Progress

<

(a)

Indigo Corporation issued 142,000, $4.50 cumulative preferred shares to fund its first investment in wind generators. In its first year

of operations, it paid $426,000 of dividends to its preferred shareholders. In its second year, the company paid dividends of $852,000

to its preferred shareholders.

Preferred dividends $

>

What is the total annual preferred dividend supposed to be for the preferred shareholders?

eTextbook and Media

Save for Later

Debit

Credit

Attempts: 0 of 3 used

Submit Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning