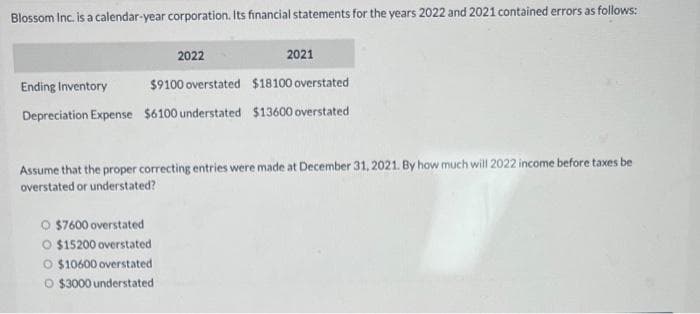

Blossom Inc. is a calendar-year corporation. Its financial statements for the years 2022 and 2021 contained errors as follows 2022 2021 Ending Inventory $9100 overstated $18100 overstated Depreciation Expense $6100 understated $13600 overstated O $7600 overstated O $15200 overstated O $10600 overstated Assume that the proper correcting entries were made at December 31, 2021. By how much will 2022 income before taxes be overstated or understated?

Blossom Inc. is a calendar-year corporation. Its financial statements for the years 2022 and 2021 contained errors as follows 2022 2021 Ending Inventory $9100 overstated $18100 overstated Depreciation Expense $6100 understated $13600 overstated O $7600 overstated O $15200 overstated O $10600 overstated Assume that the proper correcting entries were made at December 31, 2021. By how much will 2022 income before taxes be overstated or understated?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 10MC: Shannon Corporation began operations on January 1, 2019. Financial statements for the years ended...

Related questions

Question

Transcribed Image Text:Blossom Inc. is a calendar-year corporation. Its financial statements for the years 2022 and 2021 contained errors as follows:

2022

2021

Ending Inventory

$9100 overstated $18100 overstated

Depreciation Expense $6100 understated $13600 overstated

O $7600 overstated

O $15200 overstated

O $10600 overstated

O $3000 understated

Assume that the proper correcting entries were made at December 31, 2021. By how much will 2022 income before taxes be

overstated or understated?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning