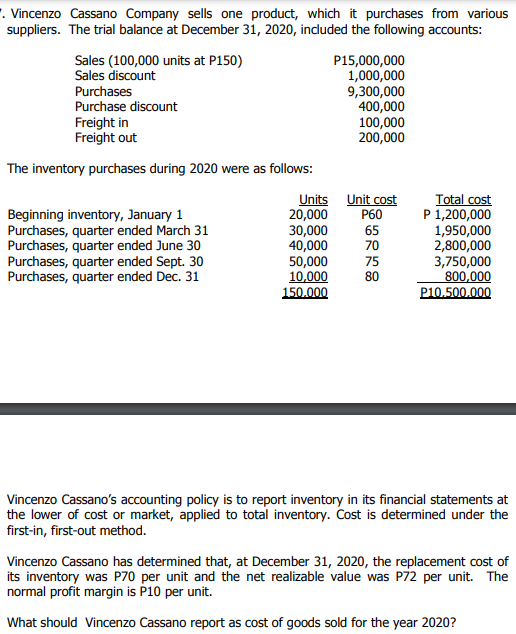

Vincenzo Cassano Company sells one product, which it purchases from various suppliers. The trial balance at December 31, 2020, included the following accounts: Sales (100,000 units at P150) Sales discount Purchases Purchase discount P15,000,000 1,000,000 9,300,000 400,000 100,000 200,000 Freight in Freight out The inventory purchases during 2020 were as follows: Units Unit cost 20,000 30,000 40,000 50,000 10,000 150.000 Total cost P 1,200,000 1,950,000 2,800,000 3,750,000 800,000 P10.500,000 P60 Beginning inventory, January 1 Purchases, quarter ended March 31 Purchases, quarter ended June 30 Purchases, quarter ended Sept. 30 Purchases, quarter ended Dec. 31 65 70 75 80 Vincenzo Cassano's accounting policy is to report inventory in its financial statements a the lower of cost or market, applied to total inventory. Cost is determined under the first-in, first-out method. Vincenzo Cassano has determined that, at December 31, 2020, the replacement cost o its inventory was P70 per unit and the net realizable value was P72 per unit. The normal profit margin is P10 per unit. What should Vincenzo Cassano report as cost of goods sold for the year 2020?

Vincenzo Cassano Company sells one product, which it purchases from various suppliers. The trial balance at December 31, 2020, included the following accounts: Sales (100,000 units at P150) Sales discount Purchases Purchase discount P15,000,000 1,000,000 9,300,000 400,000 100,000 200,000 Freight in Freight out The inventory purchases during 2020 were as follows: Units Unit cost 20,000 30,000 40,000 50,000 10,000 150.000 Total cost P 1,200,000 1,950,000 2,800,000 3,750,000 800,000 P10.500,000 P60 Beginning inventory, January 1 Purchases, quarter ended March 31 Purchases, quarter ended June 30 Purchases, quarter ended Sept. 30 Purchases, quarter ended Dec. 31 65 70 75 80 Vincenzo Cassano's accounting policy is to report inventory in its financial statements a the lower of cost or market, applied to total inventory. Cost is determined under the first-in, first-out method. Vincenzo Cassano has determined that, at December 31, 2020, the replacement cost o its inventory was P70 per unit and the net realizable value was P72 per unit. The normal profit margin is P10 per unit. What should Vincenzo Cassano report as cost of goods sold for the year 2020?

Chapter18: Accounting Periods And Methods

Section: Chapter Questions

Problem 67P

Related questions

Question

The answer is 6,400,000

Please help me provide a solution. Thank you

Transcribed Image Text:. Vincenzo Cassano Company sells one product, which it purchases from various

suppliers. The trial balance at December 31, 2020, indluded the following accounts:

Sales (100,000 units at P150)

Sales discount

P15,000,000

1,000,000

9,300,000

400,000

100,000

200,000

Purchases

Purchase discount

Freight in

Freight out

The inventory purchases during 2020 were as follows:

Beginning inventory, January 1

Purchases, quarter ended March 31

Purchases, quarter ended June 30

Purchases, quarter ended Sept. 30

Purchases, quarter ended Dec. 31

Units Unit cost

20,000

30,000

40,000

50,000

10,000

150.000

Total cost

P 1,200,000

1,950,000

2,800,000

3,750,000

800,000

P10.500.000

P60

65

70

75

80

Vincenzo Cassano's accounting policy is to report inventory in its financial statements at

the lower of cost or market, applied to total inventory. Cost is determined under the

first-in, first-out method.

Vincenzo Cassano has determined that, at December 31, 2020, the replacement cost of

its inventory was P70 per unit and the net realizable value was P72 per unit. The

normal profit margin is P10 per unit.

What should Vincenzo Cassano report as cost of goods sold for the year 2020?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,