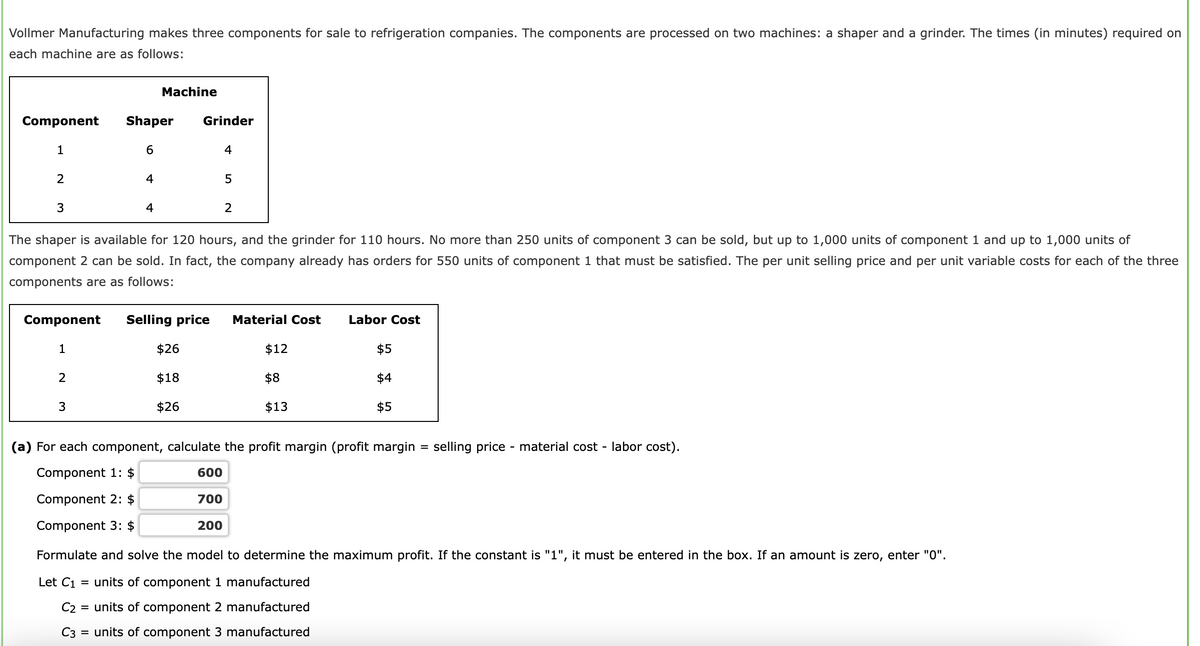

Vollmer Manufacturing makes three components for sale to refrigeration companies. The components are processed on two machines: a shaper and a grinder. The times (in minutes) required on each machine are as follows: Component 1 2 3 Shaper 6 4 Machine 4 Grinder 4 5 2 The shaper is available for 120 hours, and the grinder for 110 hours. No more than 250 units of component 3 can be sold, but up to 1,000 units of component 1 and up to 1,000 units of component 2 can be sold. In fact, the company already has orders for 550 units of component 1 that must be satisfied. The per unit selling price and per unit variable costs for each of the three components are as follows:

Vollmer Manufacturing makes three components for sale to refrigeration companies. The components are processed on two machines: a shaper and a grinder. The times (in minutes) required on each machine are as follows: Component 1 2 3 Shaper 6 4 Machine 4 Grinder 4 5 2 The shaper is available for 120 hours, and the grinder for 110 hours. No more than 250 units of component 3 can be sold, but up to 1,000 units of component 1 and up to 1,000 units of component 2 can be sold. In fact, the company already has orders for 550 units of component 1 that must be satisfied. The per unit selling price and per unit variable costs for each of the three components are as follows:

Practical Management Science

6th Edition

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:WINSTON, Wayne L.

Chapter2: Introduction To Spreadsheet Modeling

Section: Chapter Questions

Problem 20P: Julie James is opening a lemonade stand. She believes the fixed cost per week of running the stand...

Related questions

Question

help!

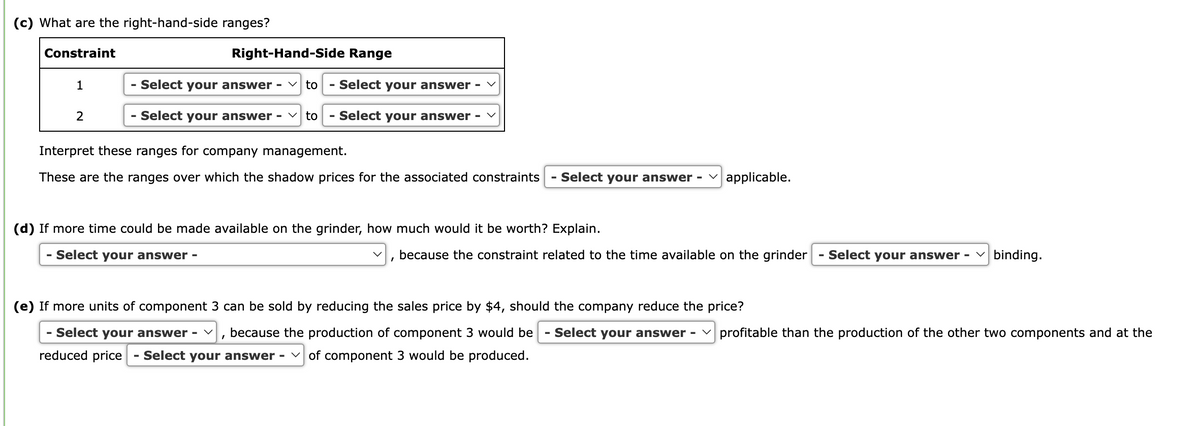

Transcribed Image Text:(c) What are the right-hand-side ranges?

Constraint

1

2

Right-Hand-Side Range

Select your answer - ✓to Select your answer - ✓

Select your answer to - Select your answer

Interpret these ranges for company management.

These are the ranges over which the shadow prices for the associated constraints Select your answer - applicable.

(d) If more time could be made available on the grinder, how much would it be worth? Explain.

Select your answer -

because the constraint related to the time available on the grinder

Select your answer - binding.

(e) If more units of component 3 can be sold by reducing the sales price by $4, should the company reduce the price?

I

- Select your answer - ✓ because the production of component 3 would be - Select your answer - profitable than the production of the other two components and at the

reduced price

Select your answer - ✓of component 3 would be produced.

Transcribed Image Text:Vollmer Manufacturing makes three components for sale to refrigeration companies. The components are processed on two machines: a shaper and a grinder. The times (in minutes) required on

each machine are as follows:

Component

1

2

3

1

2

Shaper

6

4

3

Machine

4

Grinder

4

The shaper is available for 120 hours, and the grinder for 110 hours. No more than 250 units of component 3 can be sold, but up to 1,000 units of component 1 and up to 1,000 units of

component 2 can be sold. In fact, the company already has orders for 550 units of component 1 that must be satisfied. The per unit selling price and per unit variable costs for each of the three

components are as follows:

5

Component Selling price Material Cost Labor Cost

$26

T⠀⠀

$18

$26

2

$12

$8

$13

$5

$4

$5

(a) For each component, calculate the profit margin (profit margin

Component 1: $

600

Component 2: $

700

Component 3: $

200

=

selling price - material cost - labor cost).

Formulate and solve the model to determine the maximum profit. If the constant is "1", it must be entered in the box. If an amount is zero, enter "0".

Let C1

= units of component 1 manufactured

C2 = units of component 2 manufactured

C3 = units of component 3 manufactured

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 14 images

Recommended textbooks for you

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Operations Management

Operations Management

ISBN:

9781259667473

Author:

William J Stevenson

Publisher:

McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi…

Operations Management

ISBN:

9781259666100

Author:

F. Robert Jacobs, Richard B Chase

Publisher:

McGraw-Hill Education

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Operations Management

Operations Management

ISBN:

9781259667473

Author:

William J Stevenson

Publisher:

McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi…

Operations Management

ISBN:

9781259666100

Author:

F. Robert Jacobs, Richard B Chase

Publisher:

McGraw-Hill Education

Purchasing and Supply Chain Management

Operations Management

ISBN:

9781285869681

Author:

Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:

Cengage Learning

Production and Operations Analysis, Seventh Editi…

Operations Management

ISBN:

9781478623069

Author:

Steven Nahmias, Tava Lennon Olsen

Publisher:

Waveland Press, Inc.