Warrick Water Company, a privately owned business, supplies water to several communities. Warrick has just performed an extensive overhaul on one of its water pumps. The overhaul is expected to extend the life of the pump by 10 years. The residual value of the pump is unchanged. You have been asked to determine which of the following costs should be capitalized as a part of this overhaul. Those costs not capitalized should be expensed. Required: Conceptual Connection: Classify each cost as part of the overhaul as an expense. New pump motor Repacking of bearings (performed monthly) New impeller (rotating component of a pump) Painting of pump housing (performed annually) Replacement of pump foundation New wiring (needed every 5 years) Installation labor, motor Installation labor, impeller Installation labor, wiring Paint labor (performed annually) Placement of fence around pump ("A requirement of the Occupational Safety and Health Administration that will add to maintenance costs over the remaining life of the pump.)

Warrick Water Company, a privately owned business, supplies water to several communities. Warrick has just performed an extensive overhaul on one of its water pumps. The overhaul is expected to extend the life of the pump by 10 years. The residual value of the pump is unchanged. You have been asked to determine which of the following costs should be capitalized as a part of this overhaul. Those costs not capitalized should be expensed. Required: Conceptual Connection: Classify each cost as part of the overhaul as an expense. New pump motor Repacking of bearings (performed monthly) New impeller (rotating component of a pump) Painting of pump housing (performed annually) Replacement of pump foundation New wiring (needed every 5 years) Installation labor, motor Installation labor, impeller Installation labor, wiring Paint labor (performed annually) Placement of fence around pump ("A requirement of the Occupational Safety and Health Administration that will add to maintenance costs over the remaining life of the pump.)

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter3: Cost Behavior

Section: Chapter Questions

Problem 13E

Related questions

Question

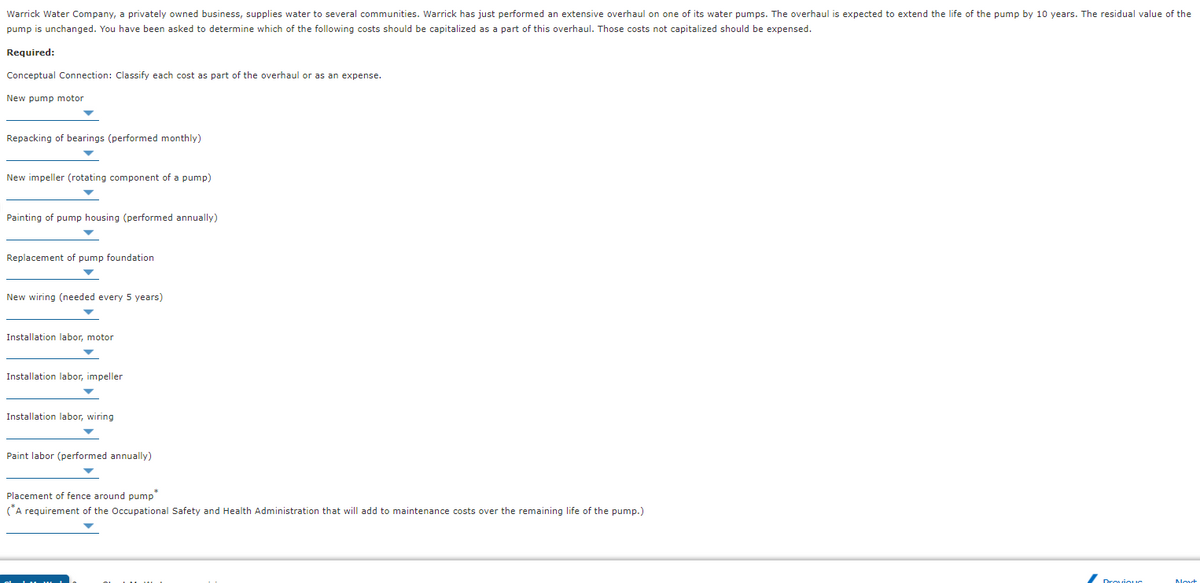

Transcribed Image Text:Warrick Water Company, a privately owned business, supplies water to several communities. Warrick has just performed an extensive overhaul on one of its water pumps. The overhaul is expected to extend the life of the pump by 10 years. The residual value of the

pump is unchanged. You have been asked to determine which of the following costs should be capitalized as a part of this overhaul. Those costs not capitalized should be expensed.

Required:

Conceptual Connection: Classify each cost as part of the overhaul or as an expense.

New pump motor

Repacking of bearings (performed monthly)

New impeller (rotating component of a pump)

Painting of pump housing (performed annually)

Replacement of pump foundation

New wiring (needed every 5 years)

Installation labor, motor

Installation labor, impeller

Installation labor, wiring

Paint labor (performed annually)

Placement of fence around pump*

ČA requirement of the Occupational Safety and Health Administration that will add to maintenance costs over the remaining life of the pump.)

Droviouc

Novt

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College