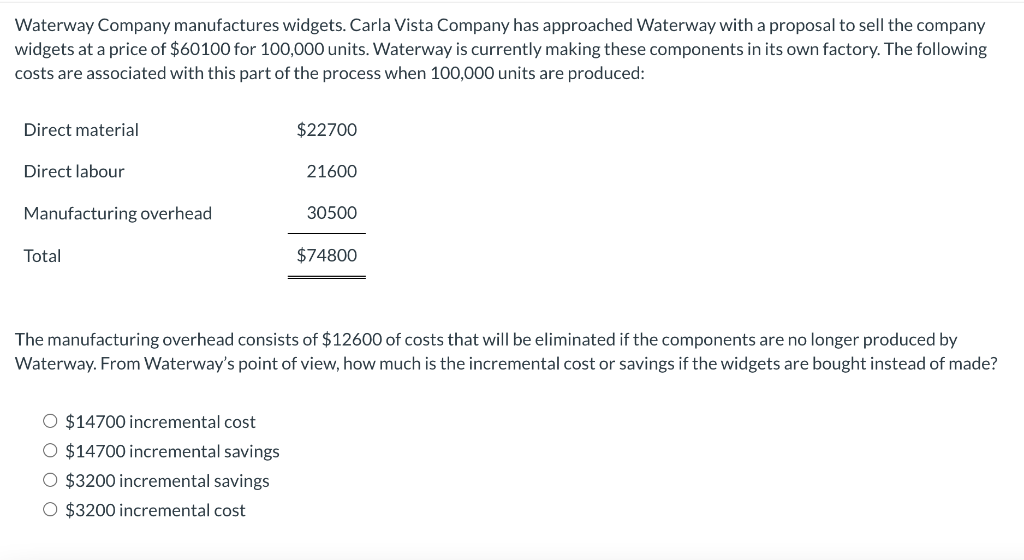

Waterway Company manufactures widgets. Carla Vista Company has approached Waterway with a proposal to sell the company widgets at a price of $60100 for 100,000 units. Waterway is currently making these components in its own factory. The following costs are associated with this part of the process when 100,000 units are produced: Direct material $22700 Direct labour 21600 Manufacturing overhead 30500 Total $74800 The manufacturing overhead consists of $12600 of costs that will be eliminated if the components are no longer produced by Waterway. From Waterway's point of view, how much is the incremental cost or savings if the widgets are bought instead of made? O $14700 incremental cost O $14700 incremental savings O $3200 incremental savings O $3200 incremental cost

Waterway Company manufactures widgets. Carla Vista Company has approached Waterway with a proposal to sell the company widgets at a price of $60100 for 100,000 units. Waterway is currently making these components in its own factory. The following costs are associated with this part of the process when 100,000 units are produced: Direct material $22700 Direct labour 21600 Manufacturing overhead 30500 Total $74800 The manufacturing overhead consists of $12600 of costs that will be eliminated if the components are no longer produced by Waterway. From Waterway's point of view, how much is the incremental cost or savings if the widgets are bought instead of made? O $14700 incremental cost O $14700 incremental savings O $3200 incremental savings O $3200 incremental cost

Chapter10: Short-term Decision Making

Section: Chapter Questions

Problem 7EB: Oat Treats manufactures various types of cereal bars featuring oats. Simmons Cereal Company has...

Related questions

Question

Transcribed Image Text:Waterway Company manufactures widgets. Carla Vista Company has approached Waterway with a proposal to sell the company

widgets at a price of $60100 for 100,000 units. Waterway is currently making these components in its own factory. The following

costs are associated with this part of the process when 100,000 units are produced:

Direct material

$22700

Direct labour

21600

Manufacturing overhead

30500

Total

$74800

The manufacturing overhead consists of $12600 of costs that will be eliminated if the components are no longer produced by

Waterway. From Waterway's point of view, how much is the incremental cost or savings if the widgets are bought instead of made?

O $14700 incremental cost

O $14700 incremental savings

O $3200 incremental savings

O $3200 incremental cost

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning