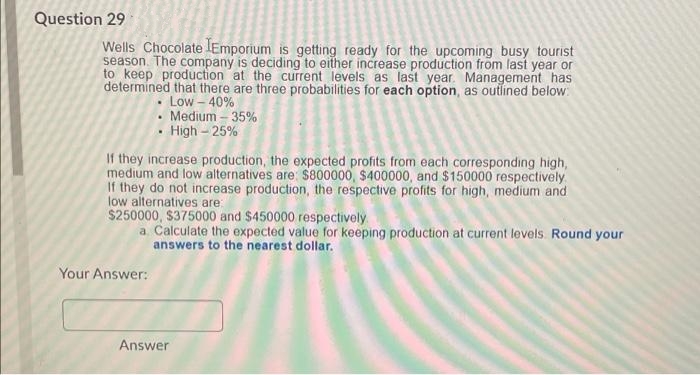

Wells Chocolate lEmporium is getting ready for the upcoming busy tourist season. The company is deciding to either increase production from last year or to keep production at the current levels as last year. Management has determined that there are three probabilities for each option, as outlined below Low - 40% Medium - 35% High - 25% If they increase production, the expected profits from each corresponding high, medium and low alternatives are: $800000, $400000, and $150000 respectively If they do not increase production, the respective profits for high, medium and low alternatives are: $250000, $375000 and $450000 respectively a. Calculate the expected value for keeping production at current levels Round your answers to the nearest dollar.

Wells Chocolate lEmporium is getting ready for the upcoming busy tourist season. The company is deciding to either increase production from last year or to keep production at the current levels as last year. Management has determined that there are three probabilities for each option, as outlined below Low - 40% Medium - 35% High - 25% If they increase production, the expected profits from each corresponding high, medium and low alternatives are: $800000, $400000, and $150000 respectively If they do not increase production, the respective profits for high, medium and low alternatives are: $250000, $375000 and $450000 respectively a. Calculate the expected value for keeping production at current levels Round your answers to the nearest dollar.

Managerial Economics: A Problem Solving Approach

5th Edition

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Chapter17: Making Decisions With Uncertainty

Section: Chapter Questions

Problem 2MC

Related questions

Question

6.

Transcribed Image Text:Question 29

Wells Chocolate lEmporium is getting ready for the upcoming busy tourist

season. The company is deciding to either increase production from last year or

to keep production at the current levels as last year. Management has

determined that there are three probabilities for each option, as outlined below:

• Low – 40%

Medium – 35%

· High – 25%

If they increase production, the expected profits from each corresponding high,

medium and low alternatives are: $800000, $400000, and $150000 respectively

If they do not increase production, the respective profits for high, medium and

low alternatives are

$250000, $375000 and $450000 respectively

a Calculate the expected value for keeping production at current levels. Round your

answers to the nearest dollar.

Your Answer:

Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning