Wen was recently granted 1,000 shares of restricted stock from his employer when the share price

Wen was recently granted 1,000 shares of restricted stock from his employer when the share price

Chapter22: S Corporations

Section: Chapter Questions

Problem 51P

Related questions

Question

V1.

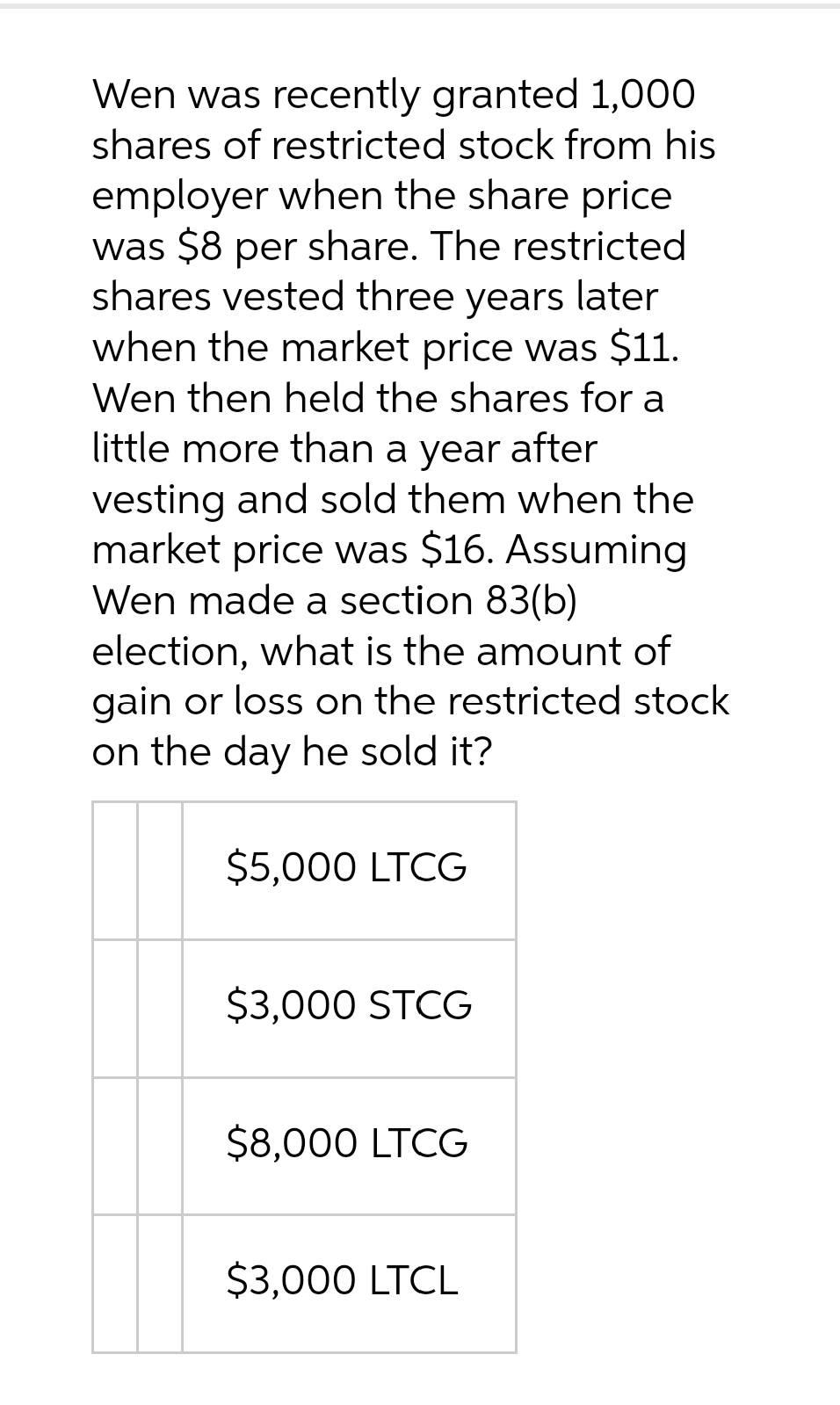

Transcribed Image Text:Wen was recently granted 1,000

shares of restricted stock from his

employer when the share price

was $8 per share. The restricted

shares vested three years later

when the market price was $11.

Wen then held the shares for a

little more than a year after

vesting and sold them when the

market price was $16. Assuming

Wen made a section 83(b)

election, what is the amount of

gain or loss on the restricted stock

on the day he sold it?

$5,000 LTCG

$3,000 STCG

$8,000 LTCG

$3,000 LTCL

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you