Calculate the amount of revenue to be recognized in 2020 and 2021. Calculate the construction costs to be expensed in 2021. Prepare the journal entry at December 31, 2021, to record long-term contract revenues, expenses, and losses for 2021.

Calculate the amount of revenue to be recognized in 2020 and 2021. Calculate the construction costs to be expensed in 2021. Prepare the journal entry at December 31, 2021, to record long-term contract revenues, expenses, and losses for 2021.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter17: Advanced Issues In Revenue Recognition

Section: Chapter Questions

Problem 9MC

Related questions

Question

- Calculate the amount of revenue to be recognized in 2020 and 2021.

- Calculate the construction costs to be expensed in 2021.

- Prepare the

journal entry at December 31, 2021, to record long-term contract revenues, expenses, and losses for 2021. - What is the balance in the Contract Asset/Liability account at December 31, 2020 and 2021?

- Show how the construction contract would be reported on the SFP and the income statement for the year ended December 31, 2021.

- Assume that Cullumber uses the zero-profit or completed-contract method. What would be the journal entry recorded on December 31, 2021?

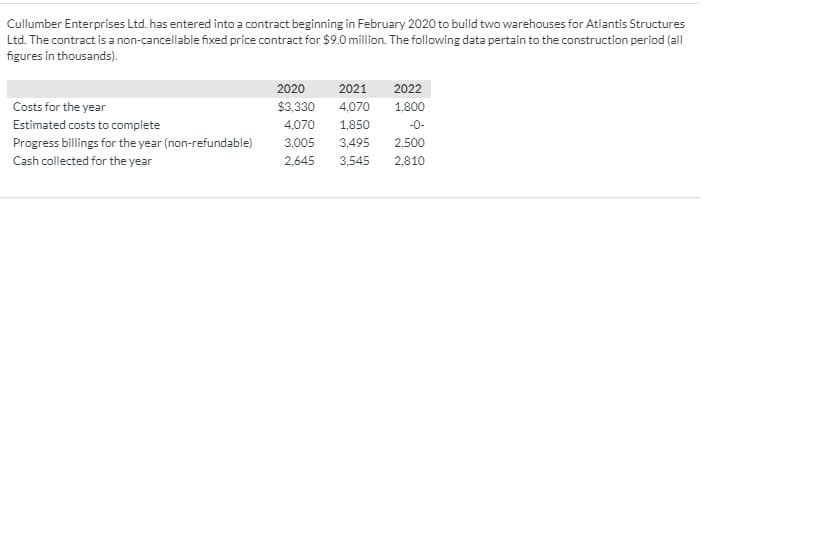

Transcribed Image Text:Cullumber Enterprises Ltd. has entered into a contract beginning in February 2020 to build two warehouses for Atlantis Structures

Ltd. The contract is a non-cancellable fixed price contract for $9.0 million. The following data pertain to the construction period (all

figures in thousands).

2020

2021

2022

Costs for the year

$3,330

4,070

1,800

Estimated costs to complete

4,070

1,850

-0-

Progress billings for the year (non-refundable)

3,005

3.495

2,500

Cash collected for the year

2,645

2,810

3,545

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub