What is Jackson's deduction in 2020 for the use of his car if he uses: If required, round your answers to nearest dollar. a. The actual cost method? b. The automatic mileage method? c. What records must Jackson maintain? Keeping a written or electronic log of miles driven, the dates the automobile was used, the location of travel, and the business purpose is enough evidence for the If the is used, keeping copies of receipts, canceled checks, and bills in addition to a mileage log is sufficient. Records and logs should be kept contemporaneously (e.g., updated weekly or daily).

What is Jackson's deduction in 2020 for the use of his car if he uses: If required, round your answers to nearest dollar. a. The actual cost method? b. The automatic mileage method? c. What records must Jackson maintain? Keeping a written or electronic log of miles driven, the dates the automobile was used, the location of travel, and the business purpose is enough evidence for the If the is used, keeping copies of receipts, canceled checks, and bills in addition to a mileage log is sufficient. Records and logs should be kept contemporaneously (e.g., updated weekly or daily).

Chapter9: Deductions: Employee And Self- Employed-related Expenses

Section: Chapter Questions

Problem 28P

Related questions

Question

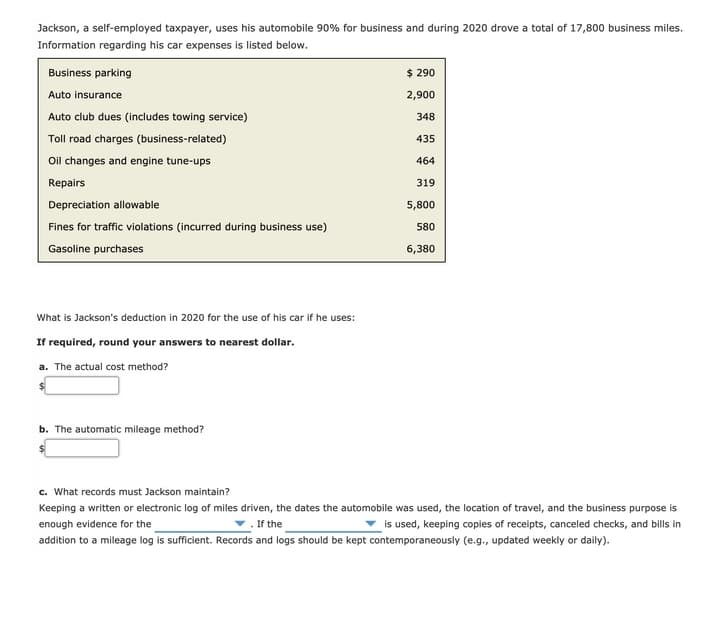

Transcribed Image Text:Jackson, a self-employed taxpayer, uses his automobile 90% for business and during 2020 drove a total of 17,800 business miles.

Information regarding his car expenses is listed below.

Business parking

$ 290

Auto insurance

2,900

Auto club dues (includes towing service)

348

Toll road charges (business-related)

435

Oil changes and engine tune-ups

464

Repairs

319

Depreciation allowable

5,800

Fines for traffic violations (incurred during business use)

580

Gasoline purchases

6,380

What is Jackson's deduction in 2020 for the use of his car if he uses:

If required, round your answers to nearest dollar.

a. The actual cost method?

b. The automatic mileage method?

c. What records must Jackson maintain?

Keeping a written or electronic log of miles driven, the dates the automobile was used, the location of travel, and the business purpose is

enough evidence for the

. If the

is used, keeping copies of receipts, canceled checks, and bills in

addition to a mileage log is sufficient. Records and logs should be kept contemporaneously (e.g., updated weekly or daily).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT