What is the current ratio for this company? Round your answer to two decimal places.

What is the current ratio for this company? Round your answer to two decimal places.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter8: Liabilities And Stockholders' Equity

Section: Chapter Questions

Problem 8.24E

Related questions

Question

Practice Pack

Transcribed Image Text:2:27

0 491 ..l 60

:4G

ill

bartleby.com/questions

10

= bartleby

®

Q&A I 8

DIAN OCAMPO GARCIA

Business / Accounti... / Q&A Libr... / The follow

The following information pertains

Question

Net income

$24,394

Number of shares of common stock

6,158

Market price of common stock

$26

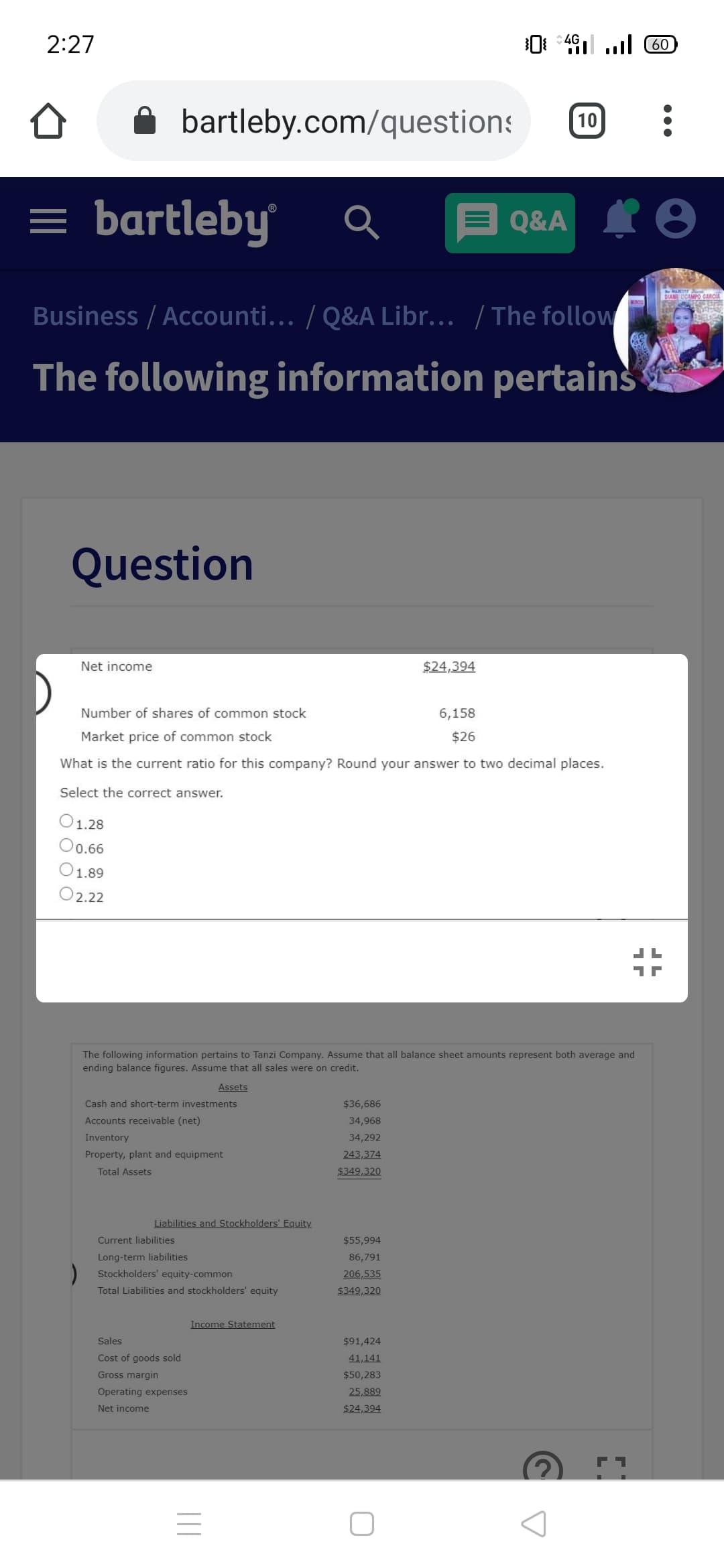

What is the current ratio for this company? Round your answer to two decimal places.

Select the correct answer.

O1.28

O0.66

O1.89

O2.22

The following information pertains to Tanzi Company. Assume that all balance sheet amounts represent both average and

ending balance figures. Assume that all sales were on credit.

Assets

Cash and short-term investments

$36,686

Accounts receivable (net)

34,968

Inventory

34,292

Property, plant and equipment

243,374

Total Assets

$349,320

Liabilities and Stockholders' Equity

Current liabilities

$55,994

Long-term liabilities

86,791

) Stockholders' equity-common

206,535

Total Liabilities and stockholders' equity

$349,320

Income Statement

Sales

$91,424

Cost of goods sold

41,141

Gross margin

$50,283

Operating expenses

25,889

Net income

$24,394

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Includes step-by-step video

Trending now

This is a popular solution!

Learn your way

Includes step-by-step video

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning