Required: 1. Complete the below table to calculate each year's current ratio.

Accounting (Text Only)

26th Edition

ISBN:9781285743615

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter17: Financial Statement Analysis

Section: Chapter Questions

Problem 17.3CP: Vertical analysis The condensed income statements through income from operations for Dell Inc. and...

Related questions

Question

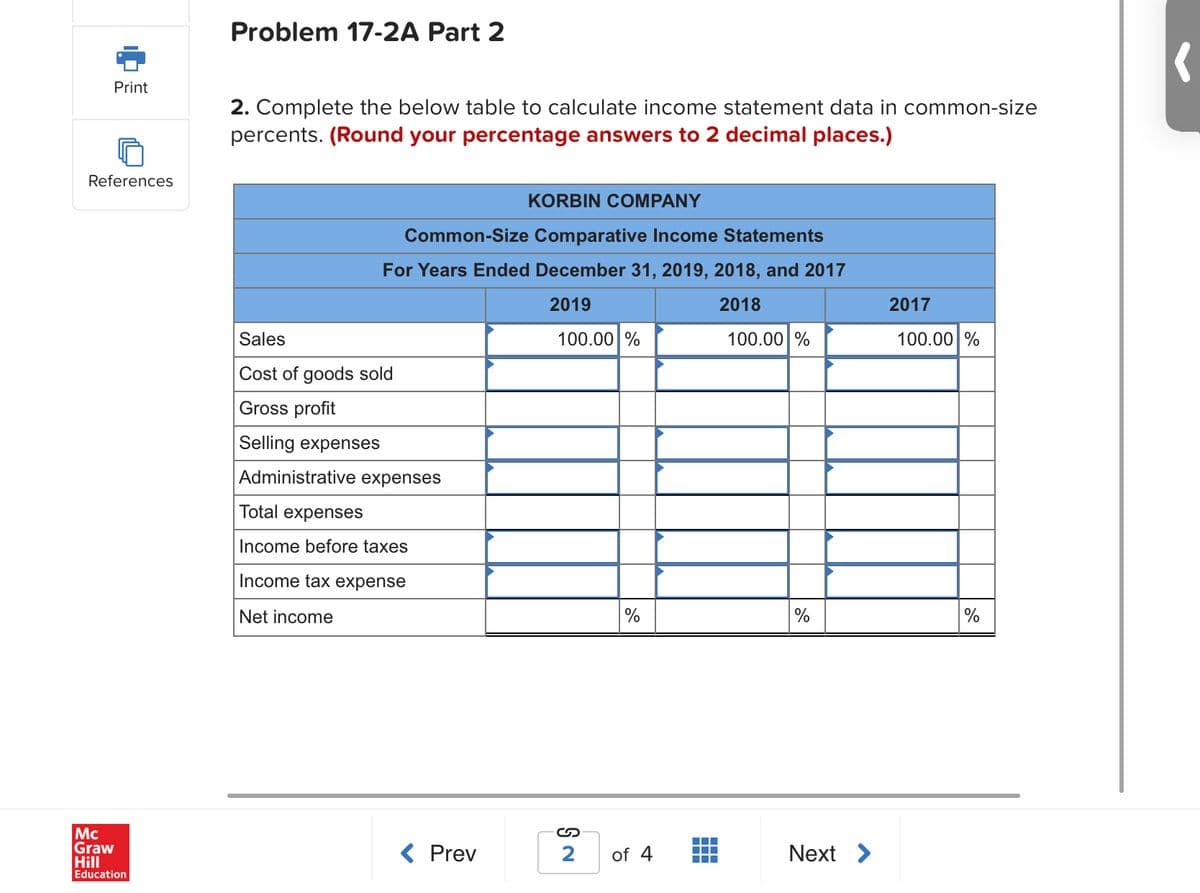

Transcribed Image Text:Problem 17-2A Part 2

Print

2. Complete the below table to calculate income statement data in common-size

percents. (Round your percentage answers to 2 decimal places.)

References

KORBIN COMPANY

Common-Size Comparative Income Statements

For Years Ended December 31, 2019, 2018, and 2017

2019

2018

2017

Sales

100.00 %

100.00 %

100.00 %

Cost of goods sold

Gross profit

Selling expenses

Administrative expenses

Total expenses

Income before taxes

Income tax expense

Net income

%

Mc

Graw

Hill

Education

< Prev

2

of 4

Next >

![PM Sat Mar 6

Done <

>

AA

A ezto.mheducation.com

Ch 17 - Connect Assignment i

Saved

Help

Save & Exit

Submit

Check my work

1

Required information

Problem 17-2A Ratios, common-size statements, and trend

Part 1 of 2

percents LO P1, P2, P3

[The following information applies to the questions displayed below.]

25

Selected comparative financial statements of Korbin Company follow.

points

KORBIN COMPANY

Comparative Income Statements

For Years Ended December 31, 2019, 2018, and 2017

2019

2018

2017

еВook

$ 401,594 $307,654

192,899

114,755

42,456

27,074

69,530

45,225

9,271

Sales

$213,500

241,760

159,834

Cost of goods sold

Gross profit

Selling expenses

Administrative expenses

136,640

76,860

28,182

57,026

36,143

93,169

66,665

12,400

Ask

17,721

45,903

30,957

6,284

Total expenses

Income before taxes

Print

Income tax expense

Net income

$ 54,265

$ 35,954 $ 24,673

References

KORBIN COMPANY

Comparative Balance Sheets

December 31, 2019, 2018, and 2017

2019

2018

2017

Assets

$ 59,658

$ 39,929

$ 53,376

3,870

62,458

Current assets

Long-term investments

Plant assets, net

900

114, 272

$ 173,930

103,654

$ 144,483

Total assets

$119,704

Liabilities and Equity

$ 25,394

73,000

9,125

66,411

$ 21,528

73,000

9,125

40,830

$ 20,948

55,000

6,11

37,645

Current liabilities

Common stock

Other paid-in capital

Retained earnings

Total liabilities and equity

$ 173,930

$ 144,483

$119,704

Problem 17-2A Part 1

Required:

1. Complete the below table to calculate each year's current ratio.

Mc

Graw

Hill

< Prev

1

of 4

Next >

Education](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2Fc04a68db-c5db-40bc-94cf-7f74c56f8506%2F464f06ef-60db-4ca1-851d-0ccc33bd1c0a%2Fgdcqh2u_processed.jpeg&w=3840&q=75)

Transcribed Image Text:PM Sat Mar 6

Done <

>

AA

A ezto.mheducation.com

Ch 17 - Connect Assignment i

Saved

Help

Save & Exit

Submit

Check my work

1

Required information

Problem 17-2A Ratios, common-size statements, and trend

Part 1 of 2

percents LO P1, P2, P3

[The following information applies to the questions displayed below.]

25

Selected comparative financial statements of Korbin Company follow.

points

KORBIN COMPANY

Comparative Income Statements

For Years Ended December 31, 2019, 2018, and 2017

2019

2018

2017

еВook

$ 401,594 $307,654

192,899

114,755

42,456

27,074

69,530

45,225

9,271

Sales

$213,500

241,760

159,834

Cost of goods sold

Gross profit

Selling expenses

Administrative expenses

136,640

76,860

28,182

57,026

36,143

93,169

66,665

12,400

Ask

17,721

45,903

30,957

6,284

Total expenses

Income before taxes

Print

Income tax expense

Net income

$ 54,265

$ 35,954 $ 24,673

References

KORBIN COMPANY

Comparative Balance Sheets

December 31, 2019, 2018, and 2017

2019

2018

2017

Assets

$ 59,658

$ 39,929

$ 53,376

3,870

62,458

Current assets

Long-term investments

Plant assets, net

900

114, 272

$ 173,930

103,654

$ 144,483

Total assets

$119,704

Liabilities and Equity

$ 25,394

73,000

9,125

66,411

$ 21,528

73,000

9,125

40,830

$ 20,948

55,000

6,11

37,645

Current liabilities

Common stock

Other paid-in capital

Retained earnings

Total liabilities and equity

$ 173,930

$ 144,483

$119,704

Problem 17-2A Part 1

Required:

1. Complete the below table to calculate each year's current ratio.

Mc

Graw

Hill

< Prev

1

of 4

Next >

Education

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning