1. Calculate the following ratios for each year (Round ratios and percentages to one decimal place.) Marriott Hyatt a. Return on total assets 5.2 x % 2.7 X %

1. Calculate the following ratios for each year (Round ratios and percentages to one decimal place.) Marriott Hyatt a. Return on total assets 5.2 x % 2.7 X %

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter16: Financial Statement Analysis

Section: Chapter Questions

Problem 4MAD: Marriott International, Inc. (MAR), and Hyatt Hotels Corporation (H) are two major owners and...

Related questions

Question

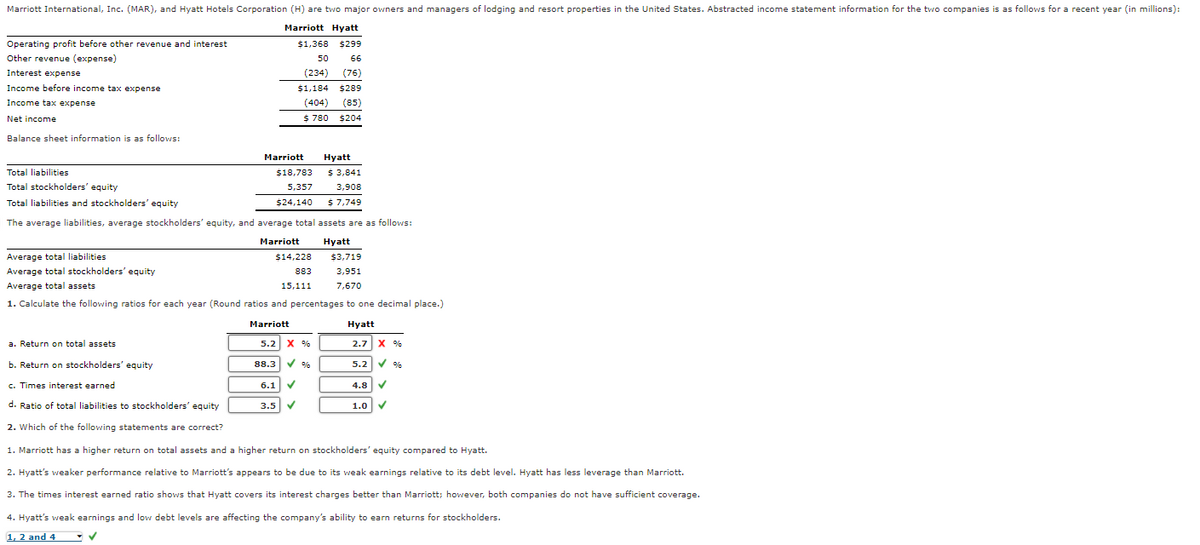

Transcribed Image Text:Marriott International, Inc. (MAR), and Hyatt Hotels Corporation (H) are two major owners and managers of lodging and resort properties in the United States. Abstracted income statement information for the two companies is as follows for a recent year (in millions):

Marriott Hyatt

Operating profit before other revenue and interest

$1,368 $299

Other revenue (expense)

50

66

Interest expense

(234) (76)

Income before income tax expense

$1,184

$289

Income tax expense

(404) (85)

Net income

$ 780 $204

Balance sheet information is as follows:

Marriott

Нyatt

Total liabilities

$18,783

$ 3,841

Total stockholders' equity

5,357

3,908

Total liabilities and stockholders' equity

$24,140

$ 7,749

| The average liabilities, average stockholders' equity, and average total assets are as follows:

Marriott

Hyatt

Average total liabilities

$14,228

$3,719

Average total stockholders' equity

883

3,951

Average total assets

15,111

7,670

1. Calculate the following ratios for each year (Round ratios and percentages to one decimal place.)

Marriott

Hyatt

a. Return on total assets

5.2 X %

2.7 X %

b. Return on stockholders' equity

88.3

%

5.2

%

c. Times interest earned

6.1 V

4.8 V

d. Ratio of total liabilities to stockholders' equity

3.5

1.0

2. Which of the following statements are correct?

1. Marriott has a higher return on total assets and a higher return on stockholders' equity compared to Hyatt.

2. Hyatt's weaker performance relative to Marriott's appears to be due to its weak earnings relative to its debt level. Hyatt has less leverage than Marriott.

3. The times interest earned ratio shows that Hyatt covers its interest charges better than Marriott; however, both companies do not have sufficient coverage.

4. Hyatt's weak earnings and low debt levels are affecting the company's ability to earn returns for stockholders.

1, 2 and 4

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning