What is the total deferred tax liability at December 31, 20x6? 2. What is the total deferred tax asset at December 31, 20x6? 3. What is the current income tax expense for the year ended December 31, 20x6? 4. What is the total income tax expense for 20x6?

What is the total deferred tax liability at December 31, 20x6? 2. What is the total deferred tax asset at December 31, 20x6? 3. What is the current income tax expense for the year ended December 31, 20x6? 4. What is the total income tax expense for 20x6?

Chapter26: Tax Practice And Ethics

Section: Chapter Questions

Problem 32P

Related questions

Question

1. What is the total

2. What is the total

3. What is the current income tax expense for the year ended December 31, 20x6?

4. What is the total income tax expense for 20x6?

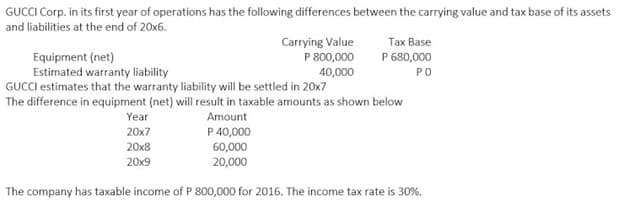

Transcribed Image Text:GUCCI Corp. in its first year of operations has the following differences between the carrying value and tax base of its assets

and liabilities at the end of 20x6.

Carrying Value

Тax Base

Equipment (net)

Estimated warranty liability

GUCCI estimates that the warranty liability will be settled in 20x7

The difference in equipment (net) will result in taxable amounts as shown below

P 800,000

40,000

P 680,000

PO

Year

Amount

P 40,000

60,000

20,000

20x7

20x8

20x9

The company has taxable income of P 800,000 for 2016. The income tax rate is 30%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning