What provision of federal law makes employer-based health insurance even more attractive to most EMPLOYEES who receive it than just the value of the premium? O Insured employees can take a tax deduction for the entire amount paid to doctors for the employee's treatment even if much of the cost was paid by insurance. Employer-based health insurance offers much better coverage than other types of insurance Employer-based health insurance offers lower copays and deductibles than other types of insurance The value of health insurance paid by an employer is not taxable income for the employee

What provision of federal law makes employer-based health insurance even more attractive to most EMPLOYEES who receive it than just the value of the premium? O Insured employees can take a tax deduction for the entire amount paid to doctors for the employee's treatment even if much of the cost was paid by insurance. Employer-based health insurance offers much better coverage than other types of insurance Employer-based health insurance offers lower copays and deductibles than other types of insurance The value of health insurance paid by an employer is not taxable income for the employee

Chapter15: Medical Care Reform In The United States

Section: Chapter Questions

Problem 2QAP

Related questions

Question

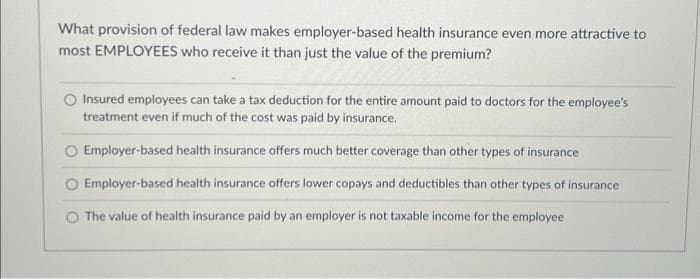

What provision of federal law makes employer-based health insurance even more attractive to most EMPLOYEES who receive it than just the value of the premium?

O Insured employees can take a tax deduction for the entire amount paid to doctors for the employee's treatment even if much of the cost was paid by insurance.

Employer-based health insurance offers much better coverage than other types of insurance

Employer-based health insurance offers lower copays and deductibles than other types of insurance

The value of health insurance paid by an employer is not taxable income for the employee

Transcribed Image Text:What provision of federal law makes employer-based health insurance even more attractive to

most EMPLOYEES who receive it than just the value of the premium?

O Insured employees can take a tax deduction for the entire amount paid to doctors for the employee's

treatment even if much of the cost was paid by insurance.

Employer-based health insurance offers much better coverage than other types of insurance

Employer-based health insurance offers lower copays and deductibles than other types of insurance

The value of health insurance paid by an employer is not taxable income for the employee

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc