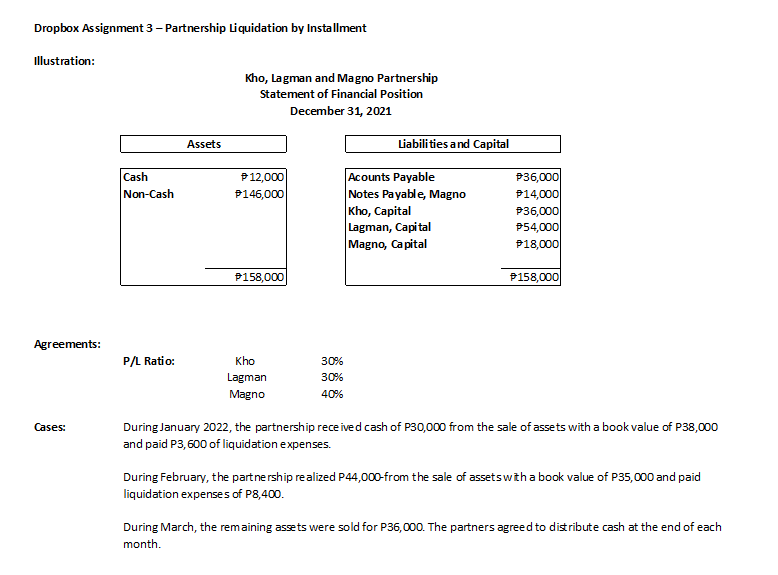

What will i do for the liquidation expense stated in the problem related to parnership liquidation installment - cash priority program? Problem: On January 1, 2022, partners Kho, Lagman and Magno decided to liquidate their partnership. Prior to the liquidation, the partnersip had cash of P12,000, non-cash assets of P146,000, liabilities to outsiders of P36,000 and a note payable to Partner Magno of P14,000. The capital balances of the partners were: Kho - P36,000; Lagman-P54,000; Magno-P18,000. The partners share profits and losses in the ratio of 3:3:4,respectively. During January 2022, the partnership received cash of P30,000 from the sale of assets with a book value of P38,000 and paid P3,600 of liquidation expenses. During February, the partnership realized P44,000-from the sale of assets with a book value of P35,000 and paid liquidation expenses of P8,400. During March, the remaining assets were sold for P36,000. The partners agreed to distribute cash at the end of each month.

What will i do for the liquidation expense stated in the problem related to parnership liquidation installment - cash priority program?

Problem:

On January 1, 2022, partners Kho, Lagman and Magno decided to liquidate their

During January 2022, the partnership received cash of P30,000 from the sale of assets with a book value of P38,000 and paid P3,600 of liquidation expenses. During February, the partnership realized P44,000-from the sale of assets with a book value of P35,000 and paid liquidation expenses of P8,400. During March, the remaining assets were sold for P36,000. The partners agreed to distribute cash at the end of each month.

Instructions:

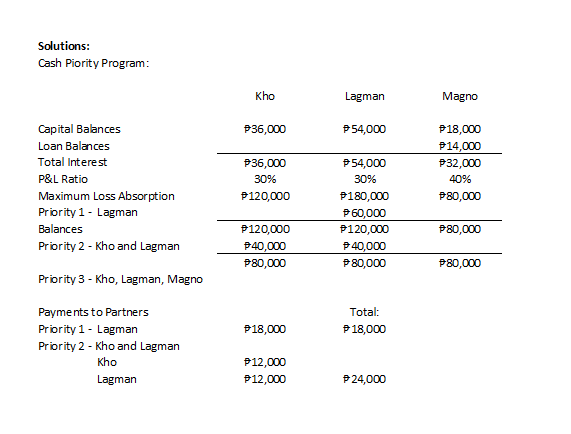

1. Prepare a Cash priority program.

2. Prepare a Statement of Liquidation.

3. Prepare the necessary

Pictures proivded are my in progress work.

Thank you

Step by step

Solved in 2 steps