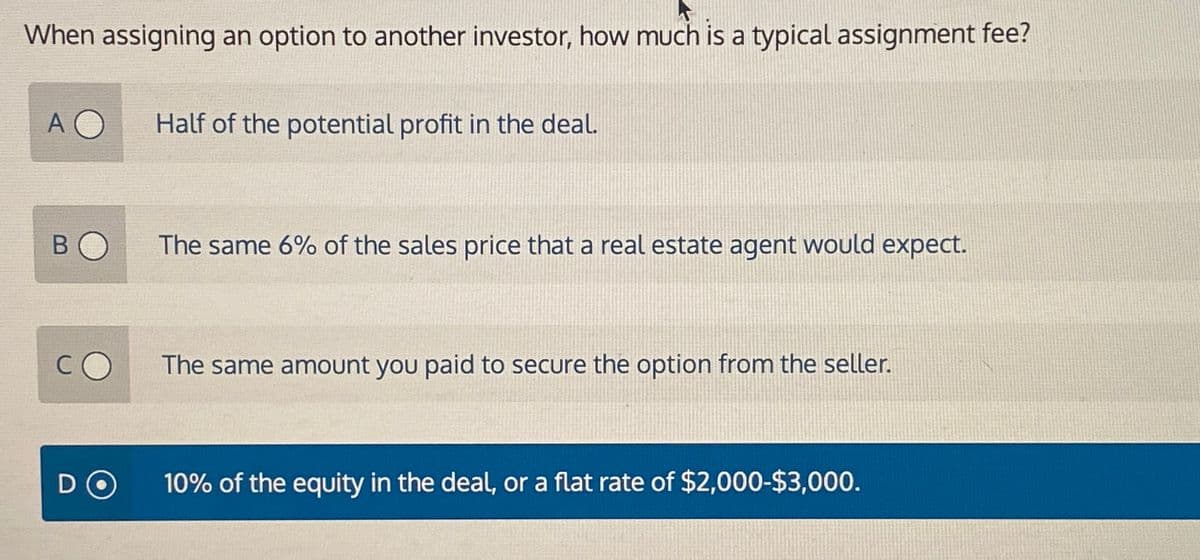

When assigning an option to another investor, how much is a typical assignment fee? A B Half of the potential profit in the deal. The same 6% of the sales price that a real estate agent would expect. The same amount you paid to secure the option from the seller. 10% of the equity in the deal or a flat rate of $2.000-$3.000.

Q: Discuss the six types of diversity found in organizations and how organizations should approach HR…

A: An organization is a structured entity, formal or informal, with defined objectives and coordinated…

Q: describe briefly, what are the characteristics of a healthy organizational culture?

A: Organizational culture signifies the collective principles, convictions, mores, and actions that…

Q: How can organizations measure and evaluate the effectiveness of their organizational norms in…

A: Organizational norms are guidelines or standards that control how members of a group conduct and…

Q: What strategies can organizations implement to support employees during the different stages of the…

A: The employee life cycle refers to the series of stages an individual progresses through during their…

Q: Aflaţi numerele x, y,z, invers proporţionale cu numerele 3,4,5, suma lor find 5648

A: inverse proportion is a part of mathematics that shows if one variable is increasing and the second…

Q: Marla Opper currently earns $53,000 a year and is offered a job in another city for $66,700. The…

A: The objective of the question is to determine the minimum salary Marla should require before…

Q: discuss, what are the potential effects of job specialization on employee relationships and social…

A: Job specialization delineates the fragmentation of labor within an entity, wherein distinct…

Q: What do you think can be done to improve the situation in the common Amazon SWP (strategic workforce…

A: Improving the situation in the Amazon SWP (Supply Chain Workers Program) is a multifaceted challenge…

Q: Please provide response to the following questions.. Can you describe any bargaining situation you…

A: In the realm of negotiations, individuals often find themselves in situations where their desired…

Q: eXplain ,How does a hybrid structure balance centralized decision-making with decentralized…

A: A hybrid structure refers to a mix of different organizational structures within a single reality.…

Q: Discuss the role of change management in an organisation building of culture

A: Organizations, teams, and individuals can move from their current states to desired future ones with…

Q: lz discuss How can organizations address unethical behavior among employees?

A: About unethical behaviour among employees:-Unethical behaviour among workers refers to conduct that…

Q: Describe transformational leadership. What are the four types of leadership behaviors that are…

A: Transformational leadership is a style of leadership where a leader works with subordinates to…

Q: Goal: To work as a Corporate Economist using your understanding of the Laws of Supply and Demand and…

A: To address each scenario, we'll analyze the potential impact on demand for your company's product…

Q: Quiz: Legal Environment Quiz: Legal Environment

A: Preserving the established fundamental right and liberties of its citizens is a substantial factor…

Q: Ethical codes are foundational frameworks that guide individuals or groups in making moral decisions…

A: Ethical codes, also known as codes of ethics or codes of conduct, are sets of principles or rules…

Q: Please can I get the references for these please or the website to find the information?

A: Here's the information for cricket bat:Material and Manufacturing: Bats usually made of willow wood…

Q: Live Nation operates music venues, provides management services to music artists, and promotes more…

A: Introduction:Live Nation, a global entertainment company, has strategically utilized horizontal…

Q: How to complete an email with information below? As Communications Director for Blackthorn…

A: Business Communication is an aspect of the organization that deals with the sharing of information…

Q: Section 1: Scenario: Briefly describe the scenario you have been given, expanding on the situation…

A: In the heart of an ancient and mysterious forest, a group of friends embarks on an adventurous…

Q: Coordination is the process of harmonizing activities and efforts within an organization to achieve…

A: The objective of the question is to understand the strategies that organizations can employ to…

Q: How can managers ensure that feedback is received positively by employees?

A: Human Resource Management (HRM) is the strategic management of an organization's workforce,…

Q: enumerate, the importance of planning for work activities in achieving organizational goals?

A: Planning is an intrinsic procedure entailing the formulation of objectives, identification of…

Q: Enumerate, how has globalization influenced the evolution of management?

A: Globalization refers to the ongoing process of increasing interconnectedness and interdependence…

Q: Tech Products Inc. is one of the world's leading technology companies known for its innovative…

A: Organizations function in a dynamic business environment which keeps on changing. It is important to…

Q: What role does HR play in designing and implementing talent development strategies?

A: In the dynamic landscape of today's workplace, the strategic role of Human Resources (HR) in shaping…

Q: Explain how task allocation helps in balancing workloads among team members.

A: Task allocation is the systematic assignment of specific responsibilities to team members. It…

Q: Change management is a critical aspect of organizational management that deals with the process of…

A: Change management refers to the structured approach and methodical process of managing the…

Q: Please identify and discuss any two diversity management issues in the workplace. The discussion…

A: In an increasingly globalized world, the workplace has become a melting pot of cultures, identities,…

Q: How global warming is framed by an ethical framework? provide examples

A: In addressing the complex challenge of global warming, ethical considerations play a pivotal role in…

Q: Bibi's is a catering shop that caters to its retirement population by selling over 10000 doughnuts…

A: Three alternative methods of acquiring flour for Bibi's catering shop could be: 1. Direct Purchase…

Q: Purell Magazine Construction Fraud The Purell Magazine Construction Fraud case involves James…

A: The question outlines the case of fraud perpetrated by James Small, a facilities supervisor at…

Q: Review the selected article (Human Resource Systems). Manroop, L., Singh, P., & Ezzedeen, S. (2014).…

A: Business ethics is the aspects of business that define the standards or directives that assist in…

Q: Effective communication is the cornerstone of a successful workplace, fostering collaboration,…

A: Navigating communication challenges in diverse workplaces requires a thoughtful and inclusive…

Q: Purell Magazine Construction Fraud The Purell Magazine Construction Fraud case involves James…

A: The Purell Magazine Construction Fraud case illuminates a troubling incident that occurred within…

Q: The following memo is from an exasperated manager to her staff. Obviously, this manager does not…

A: The memo from Albertina Sindaha displays a tone of frustration, annoyance, and exasperation. This is…

Q: Discuss the impact of ethical decisions in global warming?

A: Global warming refers to the long-term increase in Earth's average temperature. It is mainly caused…

Q: write a preliminary report on a fraud examination scenario. Determine the types of fraud committed…

A: Examination refers to a systematic and thorough inspection or evaluation of something, often…

Q: Investigate.. what are the benefits of job rotation programs for skill development of employees?

A: Job rotation is a strategic human resource management practice wherein employees are systematically…

Q: explain how can task allocation strategies be adapted to accommodate the diverse skills and…

A: In order to guarantee effective resource utilization and peak performance, tasks and…

Q: dont use chatgpt answer

A: The objective of the question is to determine the probability of rejecting a lot in a…

Q: b. What are the effects of a values-driven culture on employee retention and turnover rates?

A: Employee retention refers to the ability of an organization to keep its employees engaged,…

Q: The rise of remote work has brought about numerous benefits, such as increased flexibility and…

A: In the dynamic realm of virtual work configurations, employees seamlessly carry out their…

Q: give meaning for the terms: Multi-domestic Strategy, transnational business strategy and global…

A: A business strategy clearly describes the long-term concept and focus of a company, leading its…

Q: When assessing buyer power using Porter's five forces, which of the following is not consistent with…

A: Porter's Five Forces is a framework developed by Michael Porter, a renowned professor at Harvard…

Q: How does employee satisfaction impact organizational performance and productivity?

A: Employee fulfillment refers to the level of satisfaction, happiness, and achievement experienced by…

Q: Explain, How do extrinsic motivators contribute to organizational performance and goal achievement?

A: Motivation originating from outside of oneself is known as extrinsic motivation. Obtaining money,…

Q: I need help creating an executive summary for my product

A: Promotion refers to the activities, methodologies, and procedures utilized by organizations or…

Q: Explains what the structural models of multinational companies are.

A: The objective of this question is to understand the different structural models that multinational…

Q: Globalization refers to the interconnectedness and interdependence of economies, cultures, and…

A: Globalization refers to the process of adding interconnectedness and interdependence among…

Step by step

Solved in 3 steps

- Which of the following scenarios accurately reflects the meaning of the profit leverage effect? Group of answer choices With a 7.6% profit margin, decreasing your cost of goods sold (COGS) by $10,000 increases your pre-tax profits by $10,000, but increasing your sales by $10,000 only increases your pre-tax profits by $760. When operating with a 7.6% profit margin, your cost of goods sold will be $10,000 as long as your sales exceed $10,000. With a 7.6% profit margin, every additional $10,000 in sales increases your pre-tax profits by $10,000, while every $10,000 saved in purchasing increases your pre-tax profits by just $760. If your profit margin is 7.6%, every $10,000 saved in purchasing lowers your COGS sold by $760.ABC Corporation has recently given out a nine-month contract to a construction subcontractor. At the end of the first month, it becomes obvious that the subcontractor is not reporting costs according to an appropriate WBS level. ABC Corporation asks the subcontractor to change its cost reporting procedures. The subcontractor states that this cannot be done without additional funding. This problem has occurred with other subcontractors as well. What can ABC Corporation do about this?A group of doctors is considering the construction of a private clinic. IF the medical demand is high (favorable market for the clinic), the physicians could realize a profit of P1,000,000. If the market is not favorable, they could lose P400,000. If they don’t proceed at all, there is no cost. In the absence of any market research, the best the physician can guess is that there is a 50-50 chance the clinic will be successful. Required: Construct a decision tree to help analyze this problem. What should the doctors do?

- 21) It is the core executive team, CEO, COO, and CTO, that makes decisions on strategy. True or False? True False“Multisource feedback is a tool used to obtain feedback from individuals at various levels of the organization. Frequently, the target employee (the one receiving the feedback) selects the individuals who will provide feedback. What are some potential drawbacks of allowing the target employee to select his or her raters? Should the target employee’s supervisor be responsible for selecting raters? How else could raters be determined? How might we incorporate technology into this process?”A hiring manager told a candidate that if they joined the company , they would be promoted within 6 months , would be given an office , and would be given a substantial raise . The candidate took the job based on this information . After the 6 month period , the employer did not come through with these promises and stated the reason was financial constraints . 1. What is this an example of ? 2. Discuss how employees can protect themselves from these types of situations ?

- An elevator company has redesigned their product to be 50% moreenergy efficient than hydraulic designs. Two designs are beingconsidered for implementation in a new building.(a) Given an interest rate of 20% which bid should be accepted?Alternatives A BInstalled cost $45,000 $54,000Annual cost 2700 2850Salvage value 3000 4500Life, in years 10 152 true or false If the decision doesn’t involve risk and uncertainty, utility is the numerical score to measure the attractiveness of a course of action.You are entrusted with deciding whether to make or buy software. The make decision has a setup cost of $15,000 and a monthly maintenance cost of $1,200. A vendor will sell the software for an initial cost of $11,400 and a monthly cost of $3,000. For how many months must the company use this software to support a make decision?

- Linda is upset: she has to make another trip to the dry cleaners because they did not get a stain out of her new jacket as they had promised. This is an example of A.performance risk B.financial risk C.time-loss risk D.opportunity riskwhat is the design option that involves embracing or conceding to the situation with minor modifications and awareness about the nature and level of risk/reward compliance associated with the opportunity,obstacle, or obligation? a. avoid b. share c. control d.accept what is the term used to describe the positive impact on the organiztion? a.profit b.reward c.risk d.benefitThe owners of a small manufacturing concern have hired a vice president to run the company with the expectation that he will buy the company after five years. Compensation of the new vice president is a flat salary plus 75% of the first $150,000 profit, and then 10% of profit over $150,000. Purchase price for the company is set at 4.5 times earnings (profit), computed as average annual profitability over the next five years. a.Plot the annual compensation of the vice president as a function of annual profit. b.Assume the company will be worth $10 million in five years. Plot the profit of buying the company as a function of annual profit. c.Does this contract align the incentives of the new vice president with the profitability goals of the owners?