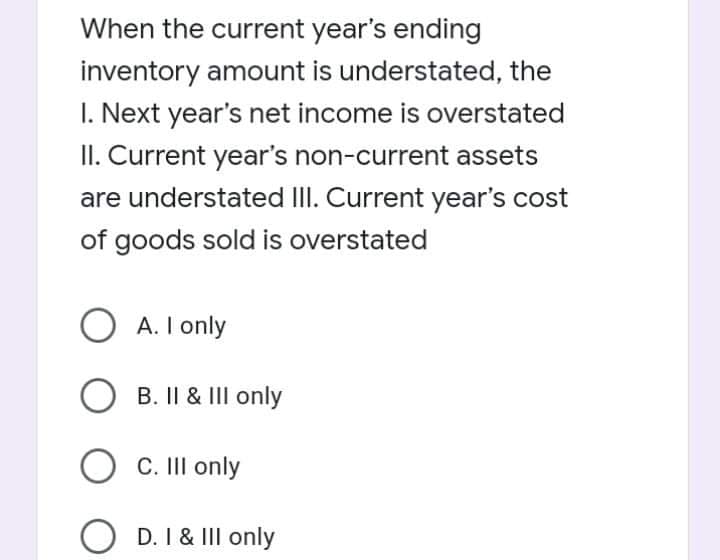

When the current year's ending inventory amount is understated, the I. Next year's net income is overstated II. Current year's non-current assets are understated III. Current year's cost of goods sold is overstated O A. I only B. II & III only O C. II only D. I & III only

Q: If ending inventory is understated in the current fiscal year, what effect will this have on net…

A: “Since you have asked multiple question, we will solve the first question for you. If you want any…

Q: (A) Assume that the company uses the FIFO method. What is the value of the ending inventory at…

A: 1. FIFO method: Under this method and periodic inventory system is used, the ending inventory stock…

Q: on-recording of purchases during the current and the non-inclusion of the goods purchased in ending…

A: Errors in accounting are the mistakes conducted while entering the accounting transactions in the…

Q: Home Furnishings reports inventory using the lower of cost and net realizable value (NRV). Below is…

A: Total cost recorded cost of ending inventory before any adjustments = (200 x $85) + (50 x $400) =…

Q: receivable from the customer in transaction b. . Following the taking of a physical inventory at…

A: Income statement is a statement which records the revenue and expenses of an undertaking for a…

Q: An error in the physical count of goods on hand at the end of a period resulted in a $10200…

A: Cost of goods sold (COGS) refers to the cost including the costs which are directly related to the…

Q: Non-recording of purchases during the current and the non-inclusion of the goods purchased in ending…

A: Purchases refers to process of acquiring required materials or trading goods by an entity which…

Q: Presented below are the components in determining cost of goods sold. Determine the missing amounts.…

A: Formula: Cost of goods available for sale = Beginning Inventory + Purchases

Q: If ending Inventory is overstated at the end of the year, profit will be: O Ovestated b) Understated…

A: Inventory valuation includes different methods that are used by companies to find out the value of…

Q: Below are the components in determining cost of goods sold. Determine the missing amounts.…

A: Cost of Goods Available for Sale = Beginning Inventory + Purchases Cost of Goods Sold = Cost of…

Q: 1. Determine the costs that should be assligned to the ending Inventory and to goods sold under the…

A: FIFO Perpetual: Purchase Cost of goods sold Balance Date Quantity Rate…

Q: 1. In the year-end statement of financial position, what amount should be reported in inventory? a.…

A: 1. Inventory should report the following. Duplication of computer software and training materials…

Q: Supply the missing dollar amounts for each of the following independent cases: Sales Revenue…

A: Beginning inventory +Purchases =Cost of goods available for saleCost of goods -Ending inventory…

Q: If beginning inventory is understated by $980O, the effect of this error in the current period is…

A: The COGS is determined based on beginning inventory, inventory purchase, and closing inventory. COGS…

Q: Margo Company uses the periodic inventory method and had the following inventory information…

A: Inventory valuation is the process of determining the cost of inventory at the end of the reporting…

Q: Using FIFO (a) Compute the cost of ending inventory. (b) Compute the cost of goods sold for the…

A:

Q: In the income statement restated to current cost, what the inventory sold for the current year? 3.…

A: Dear student, as per bartleby guidelines we are supposed to answer only first 3 subparts. Kindly…

Q: 2. What accounting term is used for the cost of goods unsold at the end of the accounting period? A.…

A: Hi student Since there are multiple questions, we will answer only first question. If you want…

Q: A company reports inventory using the lower of cost and net realizable value. Below is information…

A: In the balance sheet, we record inventory at cost or NRV whichever is lower. we should record…

Q: The current period's ending inventory is: Multiple Choice The next period's beginning inventory. The…

A: Cost of goods sold = Beginning inventory + Net purchases - Ending inventory

Q: Vaughn Co. decides at the beginning of 2020 to adopt the FIFO method of inventory valuation. Vaughn…

A: a. VAUGHN CO. Income Statement For the Year Ended December 31 LIFO 2018 2019 2020…

Q: 8. Under a perpetual inventory system, the adjusting entry to account for inventory shrinkage would…

A: Introduction: Journal: Recording of a business transactions in a chronological order. First step in…

Q: Required information [The following information applies to the questions displayed below.] A company…

A: The cost of inventory shall be computed by using lower of cost and NRV. It can be calculated Cost…

Q: Which of the following accounts should be closed to Income Summary at the end of the fiscal year?…

A: A temporary account in which all the incomes and outlays from the income statement are transferred…

Q: Net income at year end will be understated if Group of answer choices A. Inventory at year end is…

A: A. Inventory at year end is overstated Net income will be overstated B. Sales revenue during the…

Q: .Which of the following inventory items is/are included in the year end inventory of an entity's…

A: Concept Freight paid on goods sold are freight outward and treated as selling expense Goods in the…

Q: he economic order quantity is not affected by the a. cost of purchase-order forms. b. safety stock…

A: The economic order quantity (EOQ) is a company's optimal order quantity for minimizing its total…

Q: Distinguish between FOB Shipping Point and FOB Destination. Identify the freight terms that will…

A:

Q: The ending merchandise inventory is overstated by $3,000. The effect on net income for the current…

A: Inventory value can be calculated by deducting the cost of goods sold from sales. Cost of goods sold…

Q: Required: 1. Compute the number and total cost of the units available for sale during the year. 2.…

A: Methods of Valuation of Closing Inventory 1. First In First Out (FIFO): Under this method, inventory…

Q: Net income at year end will be overstated if a. Prepaid expense is not recognized b. Accrued…

A: a. Prepaid expense is not recognized No effect on net income b. Accrued income is not recognized…

Q: 4. The purchase of inventory items on account using the perpetual inventory method a. Has no…

A: Solution 4: The purchase of inventory items on account using the perpetual inventory method "Has no…

Q: For each of the independent events listed below, analyze the impact on the indicated items at the…

A: Business Events: A financial transaction that takes place between two or more parties and includes…

Q: If beginning inventory is understated by $15,000, the effect of this error in the current period is…

A: Inventory error cab effect both Balance Sheet and Income Statement.

Q: If a company has goods in transit at the end of the year that were shipped FOB shipping point, how…

A: The goods in transit are those goods that have left the seller's place but are yet to reach the…

Q: es the periodic inventory method and the beginning inventory is overstated by $9,000 because the…

A:

Q: Match the term on the left to the appropriate description on the right. v Cost of goods available…

A: Cost of goods available for sale is used for calculating cost of goods sold, COGS=COGAS-Ending…

Q: What is the relationship of inventory at the beginning of year 2022 to net income for the year 2022?…

A: Inventory at the end of one accounting period becomes Opening inventory for the next accounting…

Q: An entity uses periodic inventory system and neglected to record a purchase of merchandise on…

A: The periodic inventory system records the purchase of inventory of inventory on account as debit…

Q: The amount of any inventory writedown of inventory to met realizable value is A. Recognized as…

A: The balance sheet shows the financial position of the company that involves the assets, liabilities,…

Q: The amount found in the Income Statement debit column on the worksheet for Income Summary is the:…

A: Income statement helps stakeholder to analyse the revenue earned by the entity during the year and…

Q: If ending inventory in Period 1 is overstated, gross profit in Period 2 is

A: The correct answer is Understated.

Q: Net income at year end will be overstated if Group of answer choices a. Accrued income is not…

A: Prepaid expenses are those expenses which occur during the commencement of a business and are…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Net income at year end will be overstated if a. Prepaid expense is not recognized b. Accrued income is not recognized c. Inventory at year end is understated d. Purchases during the year are understatedNet income at year end will be understated if a. Insurance expense is not recognized b. Accrued income is not recognized c. Inventory at year end is overstated d. Sales revenue during the year is overstatedNet income at year end will be overstated if Group of answer choices a. Accrued income is not recognized b. Prepaid expense is not recognized c. Purchases during the year are understated d. Inventory at year end is understated

- a. Determine the adjustment to the allowance for overvaluation account. b. Compute the consolidated inventory at the end of the year.What are the effects (UNDERSTATED, OVERSTATED, NO EFFECT AT ALL) of these inventory errors on (a) the current year's ASSET, LIABILITY, OWNERS EQUITY, COST OF GOODS SOLD, NET INCOME, and (b) the subsequent year's ASSET, LIABILITY, OWNERS EQUITY, COST OF GOODS SOLD, NET INCOME? Error 1. Understatement of ending inventory and understatement of purchases, but the purchase was recorded the next year. Current Year: ASSET - LIABILITY - OWNERS EQUITY - COST OF GOODS SOLD - NET INCOME - Subsequent Year: ASSET - LIABILITY - OWNERS EQUITY - COST OF GOODS SOLD - NET INCOME - Error 2. Sales of the current year recorded in the following year (corresponding goods were properly excluded from ending inventory of the current year) Current Year: ASSET - LIABILITY - OWNERS EQUITY - COST OF GOODS SOLD - NET INCOME - Subsequent Year: ASSET - LIABILITY - OWNERS EQUITY - COST OF GOODS SOLD - NET INCOME - Include some simple explanations. Thank you.1. In the statement of financial statement restated to current cost, what amount should be reported as inventory on December 31? a. 1080000 b. 2880000 c.975000 d. 870000 2. What amount should be reported as unrealized holding gain on inventory for the current year? a. 210000 b. 135000 c. 560000 d. 0 3. In the income statement restated to current cost, what amount should be reported as cost of goods sold for the current year? a. 2320000 b. 2880000 c. 2600000 d. 2375000 4. In the income statement restated to current cost, what amount should be reported as realized holding gain from the inventory sold for the current year? a. 225000 b. 135000 c. 350000 d. 505000

- Show how the following independent errors will affect net income on 2021. Choose if its overstated, understated and no effect Ending inventory in 2020 overstated Failed to accrue 2020 interest revenue A capital expenditure for factory equipment (useful life, 5 years) was erroneously charged to maintenance expense in 2020 Failed to count office supplies on hand at 12/31/20. Cash expenditures have been charged to an office supplies expense account during the year 2020 Failed to accrue 2020 wages Ending inventory in 2020 understated Overstated 2020 depreciation expense; 2021 expense correctGross profit is equal to Select one: a. revenues - expenses b. sales - cost of goods sold c. profits plus depreciation d. earnings before taxes minus taxes payableShow how the following independent errors will affect net income on 2020. Choose if its overstated, understated and no effect Ending inventory in 2020 overstated Failed to accrue 2020 interest revenue Failed to count office supplies on hand at 12/31/20. Cash expenditures have been charged to an office supplies expense account during the year 2020 Ending inventory in 2020 understated Overstated 2020 depreciation expense; 2021 expense correct Ending inventory in 2020 overstated Failed to accrue 2020 interest revenue A capital expenditure for factory equipment (useful life, 5 years) was erroneously charged to maintenance expense in 2020 Failed to count office supplies on hand at 12/31/20. Cash expenditures have been charged to an office supplies expense account during the year 2020. Row Failed to accrue 2020 wages Ending inventory in 2020 understated Overstated 2020 depreciation expense; 2021 expense correct

- Please prepare a cost by nature/expense by nature income statement for the following points. In particular please explain whether point a) (first point) should be included in the income statement. In point a), Is there sufficient information for write-off expenses to be recorded in the income statement and should write-off of assets be included in the income statement? a) Write off (in minus) of short-term financial assets 9 000b) Other costs by nature 4 000c) Change in inventories of traded goods + 2 000d) Revenue from sale of building 50 000e) Income tax 10%f) Revenue from sale of traded goods 12 000g) Retained profits from previous years 10 000h) Accumulated depreciation of building 49 000i) Historical cost of building 102 000State how each of the following items is reflected in thefinancial statements.(a) Change from FIFO to LIFO method for inventoryvaluation purposes.(b) Charge for failure to record depreciation in a previousperiod.(c) Litigation won in current year, related to prior period.(d) Change in the realizability of certain receivables.(e) Write-off of receivables.(f) Change from the percentage-of-completion to thecompleted-contract method for reporting net income.State the effect of the following errors if OVERSTATED, UNDERSTATED, or NO EFFECT. NO. ERRORS EFFECT IN 1. Omission of accrued expense in year 2021 Retained Earnings, 12/31/2022 2. Omission of prepaid expense in year 2021 Net income of 2022 3. Omission of accrued income in year 2021 Asset, 12/31/2022 4. Omission of unearned income in year 2021 Income of 2022 5. Sales of 2021 recorded as sales of 2022 Retained Earnings, 12/31/2022 6. Purchases of 2021 recorded as purchases of 2022 Retained Earnings, 12/31/2022 7. Inventory, 12/31/2021 is overstated Net income of 2022 8. Inventory, 1/1/2021 is understated Net income of 2022 9. Depreciation of 2021 is understated Net income of 2022 10. Interest income is recorded as Rent Income Net income