Which of the following is NOT a piece of evidence for the investor underreaction? OA The stock market index excess returns are positively autocorrelated at the monthly frequency. O B. Stocks with higher returns in the last six months tend to ean higher returns in the future. OC The stock market index excess returns are negatively autocorrelated at the three to five year horizons. O D. Stocks with higher standardized unexpected earnings tend to earn higher returns in the future.

Which of the following is NOT a piece of evidence for the investor underreaction? OA The stock market index excess returns are positively autocorrelated at the monthly frequency. O B. Stocks with higher returns in the last six months tend to ean higher returns in the future. OC The stock market index excess returns are negatively autocorrelated at the three to five year horizons. O D. Stocks with higher standardized unexpected earnings tend to earn higher returns in the future.

Chapter8: Analysis Of Risk And Return

Section: Chapter Questions

Problem 19P

Related questions

Question

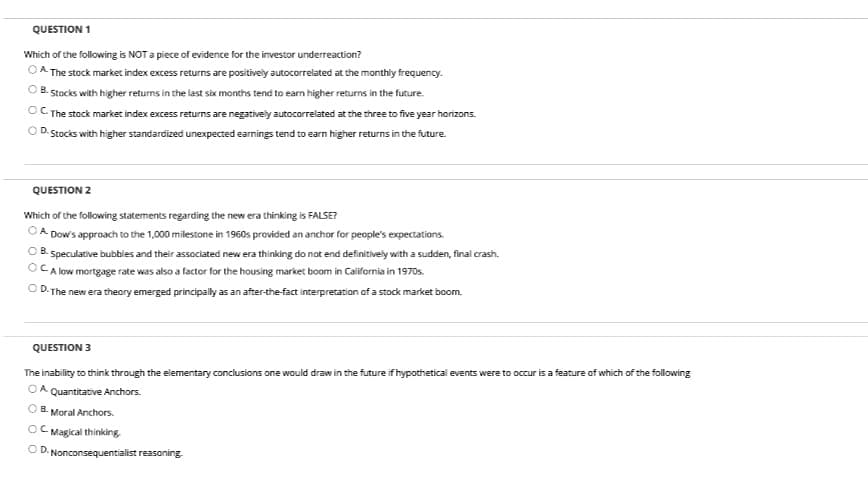

Transcribed Image Text:QUESTION 1

Which of the following is NOT a piece of evidence for the investor underreaction?

OA The stock market index excess returns are positively autocorrelated at the monthly frequency.

O B. Stocks with higher returns in the last six months tend to earn higher returns in the future.

OCThe stock market index excess returns are negatively autocorrelated at the three to five year horizons.

O D. Stocks with higher standardized unexpected earnings tend to earn higher returns in the future.

QUESTION 2

Which of the following statements regarding the new era thinking is FALSE?

OA Dow's approach to the 1,000 milestone in 1960s provided an anchor for people's expectations.

O B. Speculative bubbles and their associated new era thinking do not end definitively with a sudden, final crash.

OCA low mortgage rate was also a factor for the housing market boom in California in 1970s.

O D. The new era theory emerged principally as an after-the-fact interpretation of a stock market boom.

QUESTION 3

The inability to think through the elementary conclusions one would draw in the future if hypothetical events were to occur is a feature of which of the following

OA Quantitative Anchors.

OB Moral Anchors.

OC.

Magical thinking.

OD.

Nonconsequentialist reasoning.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning