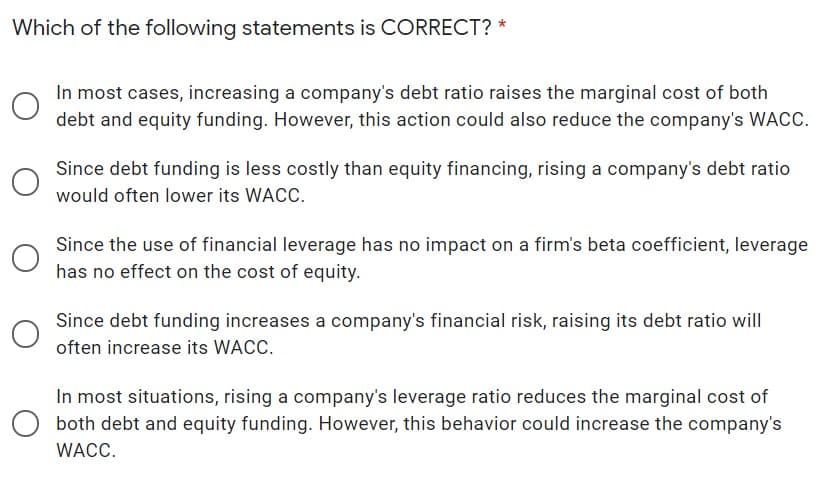

Which of the following statements is CORRECT? * In most cases, increasing a company's debt ratio raises the marginal cost of both debt and equity funding. However, this action could also reduce the company's WACC. Since debt funding is less costly than equity financing, rising a company's debt ratio would often lower its WACC. Since the use of financial leverage has no impact on a firm's beta coefficient, leverage has no effect on the cost of equity. Since debt funding increases a company's financial risk, raising its debt ratio will often increase its WACC. In most situations, rising a company's leverage ratio reduces the marginal cost of both debt and equity funding. However, this behavior could increase the company's WACC.

Which of the following statements is CORRECT? * In most cases, increasing a company's debt ratio raises the marginal cost of both debt and equity funding. However, this action could also reduce the company's WACC. Since debt funding is less costly than equity financing, rising a company's debt ratio would often lower its WACC. Since the use of financial leverage has no impact on a firm's beta coefficient, leverage has no effect on the cost of equity. Since debt funding increases a company's financial risk, raising its debt ratio will often increase its WACC. In most situations, rising a company's leverage ratio reduces the marginal cost of both debt and equity funding. However, this behavior could increase the company's WACC.

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter5: Risk Analysis

Section: Chapter Questions

Problem 2QE

Related questions

Question

Transcribed Image Text:Which of the following statements is CORRECT? *

In most cases, increasing a company's debt ratio raises the marginal cost of both

debt and equity funding. However, this action could also reduce the company's WACC.

Since debt funding is less costly than equity financing, rising a company's debt ratio

would often lower its WACC.

Since the use of financial leverage has no impact on a firm's beta coefficient, leverage

has no effect on the cost of equity.

Since debt funding increases a company's financial risk, raising its debt ratio will

often increase its WACC.

In most situations, rising a company's leverage ratio reduces the marginal cost of

both debt and equity funding. However, this behavior could increase the company's

WACC.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning