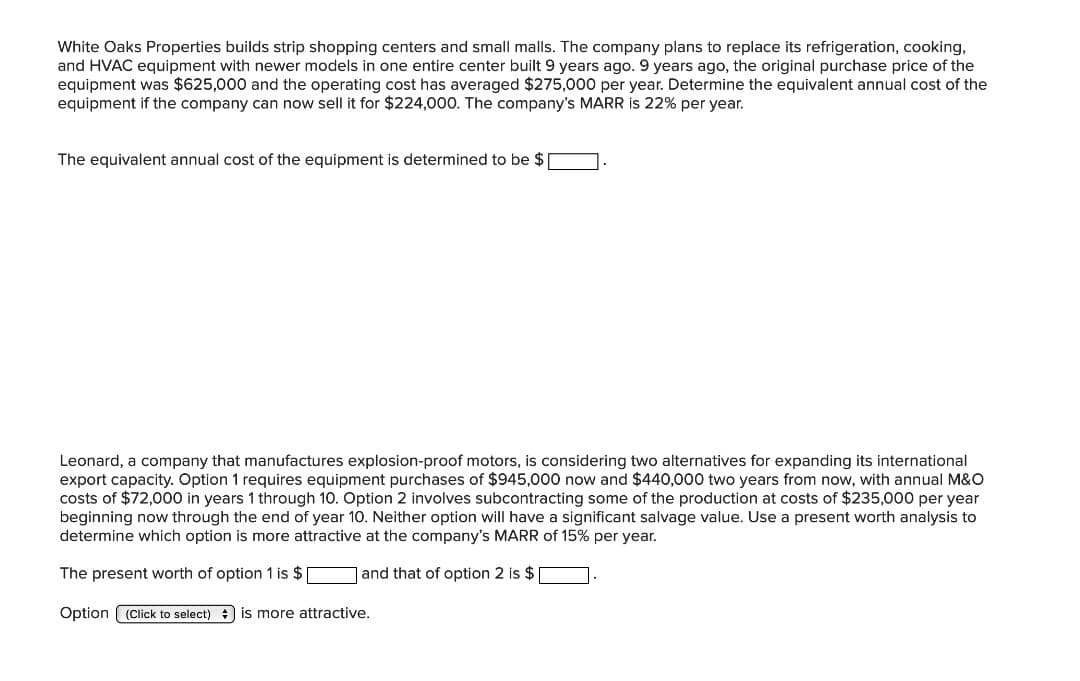

White Oaks Properties builds strip shopping centers and small malls. The company plans to replace its refrigeration, cooking, and HVAC equipment with newer models in one entire center built 9 years ago. 9 years ago, the original purchase price of the equipment was $625,000 and the operating cost has averaged $275,000 per year. Determine the equivalent annual cost of the equipment if the company can now sell it for $224,000. The company's MARR is 22% per year. The equivalent annual cost of the equipment is determined to be $

White Oaks Properties builds strip shopping centers and small malls. The company plans to replace its refrigeration, cooking, and HVAC equipment with newer models in one entire center built 9 years ago. 9 years ago, the original purchase price of the equipment was $625,000 and the operating cost has averaged $275,000 per year. Determine the equivalent annual cost of the equipment if the company can now sell it for $224,000. The company's MARR is 22% per year. The equivalent annual cost of the equipment is determined to be $

Chapter1: Making Economics Decisions

Section: Chapter Questions

Problem 1QTC

Related questions

Question

Transcribed Image Text:White Oaks Properties builds strip shopping centers and small malls. The company plans to replace its refrigeration, cooking,

and HVAC equipment with newer models in one entire center built 9 years ago. 9 years ago, the original purchase price of the

equipment was $625,000 and the operating cost has averaged $275,000 per year. Determine the equivalent annual cost of the

equipment if the company can now sell it for $224,000. The company's MARR is 22% per year.

The equivalent annual cost of the equipment is determined to be $1

Leonard, a company that manufactures explosion-proof motors, is considering two alternatives for expanding its international

export capacity. Option 1 requires equipment purchases of $945,000 now and $440,000 two years from now, with annual M&O

costs of $72,000 in years 1 through 10. Option 2 involves subcontracting some of the production at costs of $235,000 per year

beginning now through the end of year 10. Neither option will have a significant salvage value. Use a present worth analysis to

determine which option is more attractive at the company's MARR of 15% per year.

The present worth of option 1 is $

|and that of option 2 is $

Option (Click to select) + is more attractive,

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

A delivery car had a first cost of $36,000, an annual operating cost of $16,000, and an estimated $3500 salvage value after its 6-year life. Due to an economic slowdown, the car will be retained for only 3 years and must be sold now as a used vehicle. At an interest rate of 14% per year, what must the market value of the used vehicle be in order for its AW value to be the same as the AW if it had been kept for its full life cycle?

The market value of the used vehicle is determined to be $ .

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics (12th Edition)

Economics

ISBN:

9780134078779

Author:

Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:

PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:

9780134870069

Author:

William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:

PEARSON

Principles of Economics (12th Edition)

Economics

ISBN:

9780134078779

Author:

Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:

PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:

9780134870069

Author:

William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:

PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-…

Economics

ISBN:

9781259290619

Author:

Michael Baye, Jeff Prince

Publisher:

McGraw-Hill Education