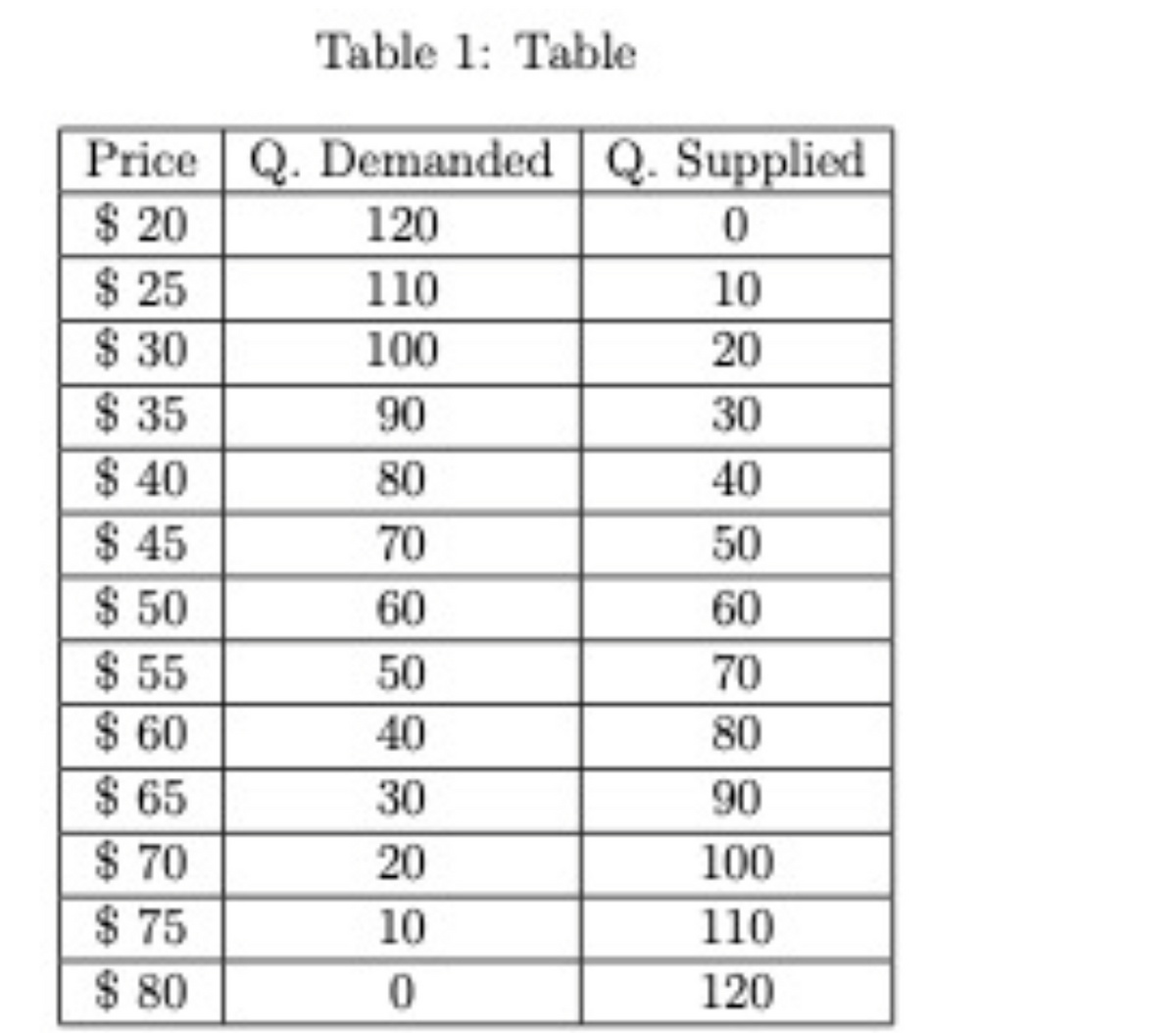

Who bears the greater economic burden of the tax on yellow bell peppers? a. Government b. Consumer c. Producer d. Consumer and producer, equally

Q: Assume that you have been hired by an International Organization to be consulted on various issues…

A: It can be defined as the process by which an economy can achieve stability in the country in the…

Q: How do changes in consumer spending patterns impact the accuracy of short-term economic forecasting…

A: Consumer spending, often considered the backbone of many economies, reflects the total amount of…

Q: The table shows the quantities of the goods Suzie bought and the prices she paid during two…

A: CPI:CPI refers to the total expenditure made in a particular year by the consumers of the economy.It…

Q: The following graph represents the demand and supply for blinkies (an imaginary product). The black…

A: Government intervention occurs when the government intervenes in the marketplace with the intent of…

Q: Government-imposed taxes cause reductions in the activity that is being taxed, which has important…

A: Taxes are imposed by the government on certain which they expect to be consumed at a larger amount.…

Q: 8. Each firm belonging to a competitive industry has the following long-run cost function 9² q³ 2 16…

A: "As per our policy, we can provide you with the solution to the first three sub-parts. Kindly raise…

Q: Instead, suppose the government taxes bucket hats. The following graph shows the annual supply and…

A: An excise tax when collected from sellers shifts the supply curve upward by the amount of the tax.…

Q: With the Firm Y response function Qy=600-1/2Qx and the Firm X response function Qx=600-1/2Qy…

A: In economics, the game of Stackelberg, two players with the leading and trailing firms function in…

Q: The discount rate should be chosen when analyzing an investment project using Net Present Value…

A: The discount rate is a financial idea that's utilized to decide the present value of future cash…

Q: 2. Ten countries are considering fighting global warming by entering into an agreement. Under the…

A: Ten nations are contemplating combatting global warming through a collective pact.Within this…

Q: The following graph plots the weekly market supply curve (orange line) for quiche in a hypothetical…

A: Producer surplus is difference between price seller is receiving and the price which he is willing…

Q: Which of the following scenarios best illustrates the concept of "Moral Hazard" in the context of…

A: Moral hazard can be defined by the risk that the concerned party hasn't mentioned in the contract in…

Q: Role of Economics in Shaping Public Policy - Analyze how economics plays a vital role in shaping…

A: Since the second part of the question is subjective, according to the guidelines, only the first…

Q: In 1990, the town of Ham Harbour had a more-or-less free market in taxi services. Any respectable…

A: The concept of a competitive equilibrium pricing is an important intersection between supply and…

Q: 6. At the local high school, one-fourth of the students are freshman, one-eighth are sopho- mores,…

A: Let, total number of students be xFreshman = 1x/4Sophomores = 1x/8Juniors = 153Seniors = 2x/5

Q: A car rental company has collected data on demand for luxury cars over the past 25 days. Because…

A: Available cars=9

Q: Silicon is an important input in the production of computer chips. If the price of silicon…

A: To determine the expected outcome when the price of silicon decreases concerning the supply of…

Q: What are some of the primary factors that produce illicit activities in the global political…

A: Illicit activities refer to actions, transactions, or behaviors that are illegal, prohibited, or not…

Q: A firm has the following demand function P=200-2Q and the average cost of AC=100/Q+3Q-20 a. Find…

A: Our goal is to determine the profit-maximizing production level, calculate the associated profit,…

Q: Consider a market where the inverse demand function is P = 400 – 20Q, where Q is the aggregate…

A: The bertrand competition is form of oligopoly where the prevailing firms compete on prices. In this…

Q: We talked in class about practice performance being a poor predictor of learning. Some types of…

A: Learning is a cognitive process through which individuals acquire new knowledge, skills, behaviors,…

Q: Draw the demand curve in the market for medical care. (Include the horizontal axis should represent…

A: Consider how health insurance affects the quantity of healthcare services performed. Suppose that…

Q: Statutory Conditions in an insurance policy are established for the protection of both the person…

A: Statutory Conditions in an insurance policy are legal requirements or provisions that are mandated…

Q: Figure: A Profit-Maximizing Monopoly Firm Price, marginal revenue, marginal cost, average total cost…

A: Profit maximization refers to the strategy employed by a company to create the highest possible…

Q: In the binary voting model with two alternatives, dictatorship of voter 1 (D1) is a rule that makes…

A: Neutrality:Neutrality is a fairness criterion in voting theory that states that the voting rule…

Q: An industry has two firms, a leader and a follower. The demand curve for the industry's output is…

A: This industry has two firms, between which one is a leader and the other is the follower. The leader…

Q: Unit Costs 0 Q1 Q2 Q3 Quantity Only from Q3 to Q4 Refer to the above graph. There are constant…

A: The change in output that results from a proportional change in all inputs used in the production…

Q: A firm produces a product which it sells in a perfectly competitive market. The price of the product…

A: Profit, difference of TR over TC, is highest at the unit of output where marginal cost matches the…

Q: Refer to the diagram. Assume that nominal wages initially are set based on the price level P2 and…

A: Aggregate supply refers to the total quantity of goods and services that producers in an economy are…

Q: The real exchange rate is:

A: The real exchange rate is the rate at which a person can trade the goods and services of one country…

Q: What impact would a price increase have on the demand for ibuprofen and on consumer surplus given…

A: In this case, we have to discuss the term elasticity of demand. That means there is a change in the…

Q: Using Microsoft Excel, create an investment cash-flow diagram that will have a present worth of zero…

A: Investment cash flow and present value analysis are essential techniques for determining the…

Q: Evaluate the size of the insurance and pensions sectors in Zambia in terms of the number of market…

A: Insurance refers to a settlement among an individual or entity (the policyholder) and an coverage…

Q: Given that the consumption function is: C = 10 + .9Y, at the level of Y = 200, we should expect the…

A: As given:

Q: JayZee is the new sensation in the fashion industry, his cloth line is being appreciated and liked…

A: In case of production theory, there are three stages of production. In the first stage, there is…

Q: Complete the following table, given the information presented on the graph. Result Per-unit tax…

A: It can be defined as the extra profit a producer can get by selling the commodity to the consumer.…

Q: Given the following: Budget Deficit = 20; Trade Deficit = 30; and Investment…

A: Saving is the portion of earnings that isn't spent on current . In other words, it refers to the…

Q: Which one of the following statements is correct? a) Under monopolistic competition, marginal revenu…

A: Monopolistic competition is a market structure in which there are many firms selling products that…

Q: Suppose robotic technology improves the results of abdominal surgery-less time to perform the…

A: Demand refers to the quantity of a particular good or service that consumers are willing and able to…

Q: 35. Suppose the government opens the border to free trade in widgets and foreign suppliers have a…

A: Market equilibrium is a situation where the price at which quantities demanded and supplied are…

Q: Question 3: Assume all workers are casual and cost $100 per day Firm has a ten year lease @ $200 per…

A: Total cost is the sum of fixed costs and variable costs.Fixed costs are the total obligations of the…

Q: Which one (1) of the following amounts must be established when there is a co-insurance clause in a…

A: DISCLAIMER “Since you have asked multiple questions, we will solve the first question for you. If…

Q: A. Explain the Keynesian transmission mechanism, and use graphs to illustrate B. Suppose that…

A: The Keynesian transmission mechanism is a model of what monetary policy means for the economy. In…

Q: To support its network, Leroy Merlin prefers to build and run its own distribution facilities where…

A: ***Since the student ha sposted multiple subparts, the expert has solved the first three…

Q: 8. All-Leather is a tanning company located on Lake Michigan in Chicago. Its total cost function is…

A: "As client instructed, solution to d,e and f are provided." The private marginal cost refers to the…

Q: PRICE (Dollars per slice) 9.00 8.25 7.50 6.75 6.00 5.25 4.50 3.75 3.00 2.25 1.50 + 0.75 + 0 Price…

A: Producer surplus is difference between price seller is receiving and the price which he is willing…

Q: In a completely randomized experimental design, 11 experimental units were used for each of the 3…

A: ANOVA : Analysis of Variance is a statistical formula used to compare variances across the means (or…

Q: We are looking at a consumer who should choose how many hours she wants to work, and thus how much…

A: a) The consumer's decision on how many hours to work (l) and how much free time to have (f) can be…

Q: Of all the points in the diagram,. Good X is highest. a) Point A represents a situation where the…

A: The Production Possibility Frontier is a graphical representation that illustrates the various…

Who bears the greater economic burden of the tax on yellow bell peppers?

Who bears the greater economic burden of the tax on yellow bell peppers?

a. Government

b. Consumer

c. Producer

d. Consumer and producer, equally.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

- 10.2 Note:- Please refrain from offering handwritten solutions. Please ensure that your response maintains accuracy and quality to avoid receiving a downvote. Take care of plagiarism. Answer completely. You will get up vote for sure.I NEED IT BY NOW! plsss Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.TIME Qd Price 1 44 10 2 40 9 3 42 11 4 46 12 5 48 11 6 52 12 7 54 13 8 58 13 9 56 14 10 60 15 Estimate demand as a function of price and shoew the line of best fit What would happen to the demand if price is Taka 20?

- ABC Company negotiates a 1% credit card discount. If a customer charges $1,000 on his VISA credit card, how much money will ABC receive? ABC Company sold $10,000 of merchandise to a customer on September 1. The terms were 2/10, n/30. How much money will ABC Company is paid by September 8? Group of answer choices $9,000 $10,000 $9,800 $7,000Only typed answer and please don't use chatgpt otherwise I downvote the answer Q = 12S1/2P-2. Q is number of newspapers sold and S is number of inches of news printed. The cost of reporting S units is $10S. The cost of printing one copy of the newspaper is $0.08, so the total cost of Q = $10S + .08Q. How many copies will be sold at the profit maximizing price when S = 100? Round (up) to the nearest newspaper.Given: QS = 140,000 + 36p QD = 200,000 – 24p 1. Compute the price if there is a shortage of 10,000 units.

- a.choose a correct answer b.choose a second best answer and explain why Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.7) Manager B Effort Level Chance of success Cost of effort High Effort 0.6 100,000 Routine Effort 0.5 60,000 What is the minimum bonus that will entice high effort? 1. 40,000 2. 260,000 3. 300,000 4. 400,000 5. 520,000 6. 60,000 7. 100,000 8. 0 6) Manager A Effort Level Chance of success Cost of effort High Effort 0.6 300,000 Routine Effort 0.5 260,000 What is the minimum bonus that will entice high effort? 1. 40,000 2. 260,000 3. 300,000 4. 400,000 5. 520,000 6. 60,000 7. 100,000 8. 0 5) ABC Instrument, a manufacturer of precise scientific instruments, relies heavily on the efforts of its local salespeople. Selling an instrument requires either luck, high effort, or some combination of the two. A salesperson who chooses to work hard has a 40 percent chance of selling an instrument in a given year while a salesperson who chooses…Please work these out both parts do not understand

- Please explaint both correct and incorrect Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism.Answer completely.You will get up vote for sure.Please solve 15, 16, 17. Thank you!. 15. You have two types of buyers for your product. Forty percent of buyers value your product at $10 and the remainder of the buyers value it at $6. What price maximizes your expected revenue? Group of answer choices a. $7 b. $6 c. $8 d. $10 16. Skip, the manager of a local senior living facility, has been under a lot of pressure from his regional manager because the occupancy rate at his facility is 80%. Given his fixed costs, if he wants his average per patient costs to equal his company’s average per patient cost (which is lower than Skip’s), he needs to increase his occupancy rate to 90%. When he does this, he will be taking advantage of Group of answer choices a. Economies of scale b. Marginal analysis c. Opportunity costs d. Economies of scope 17. When Sabrina reduced the price of her hourly accounting rates, her clients asked her to devote more hours to the financial aspects of their businesses. Her clients’…What is the correct answer? Note:- Please refrain from offering handwritten solutions. Please ensure that your response maintains accuracy and quality to avoid receiving a downvote. Take care of plagiarism. Answer completely. You will get up vote for sure.