Chapter4: Time Value Of Money

Section: Chapter Questions

Problem 1Q

Related questions

Question

See chart on page 97. Explain to me why the policy cash values go up faster for policies with a shorter premium paying period.

Transcribed Image Text:represented by the ordinary life insurance policy, for which the premiums are pay-

policies, whereas a LP85 policy or beyond is, for practical purposes, an ordinary

life policy. Other things being the same, as the number of premium payments

CHAPTER 4: PERSONAL LIFE INSURANCE PRODUCTS: II

increases, the annual premium and, consequently, the rate of growth of cash val-

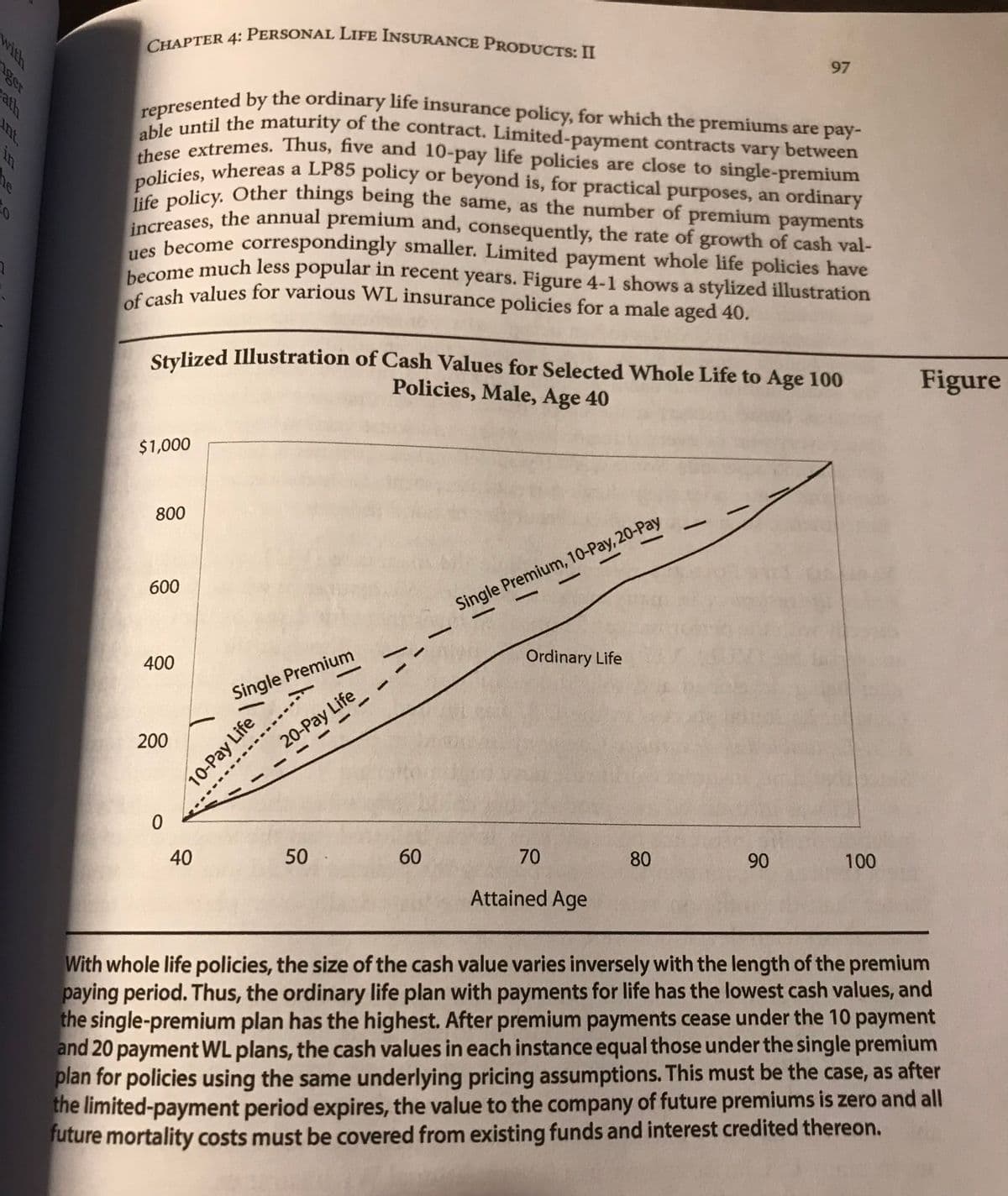

become much less popular in recent years. Figure 4-1 shows a stylized illustration

of cash values for various WL insurance policies for a male aged 40.

97

esented by the ordinary life insurance policy, for which the premiums are pay-

reprentil the maturity of the contract. Limited-payment contracts vary between

abie extremes. Thus, five and 10-pay life policies are close to single-premium

thcies, whereas a LP85 policy or beyond is, for practical purposes, an ordinary

ife policy. Other things being the same, as the number of

me Peses, the annual premium and, consequently, the rate of growth of cash val-

premium payments

ues

hecome correspondingly smaller. Limited payment whole life policies have

dome much less popular in recent years. Figure 4-1 shows a stylized illustration

Decoch values for various WL insurance policies for a male aged 40.

Stylized Illustration of Cash Values for Selected Whole Life to Age 100

Policies, Male, Age 40

Figure

$1,000

800

600

Single Premium, 10-Pay, 20-Pay

400

Ordinary Life

Single Premium

200

20-Pay Life

|

40

50

60

70

80

90

100

Attained Age

With whole life policies, the size of the cash value varies inversely with the length of the premium

paying period. Thus, the ordinary life plan with payments for life has the lowest cash values, and

the single-premium plan has the highest. After premium payments cease under the 10 payment

and 20 payment WL plans, the cash values in each instance equal those under the single premium

plan for policies using the same underlying pricing assumptions. This must be the case, as after

the limited-payment period expires, the value to the company of future premiums is zero and all

future mortality costs must be covered from existing funds and interest credited thereon.

with

ath

ఎరి

nt.

in

10-Pay Life

Expert Solution

Step 1

Cash value is a part of your policy that provide interest and available to you for the purpose of withdrawing or available for borrowing in case of emergency. Permanent life insurance policies includes cash value features. Permanent life insurance includes

a. whole life insurance

b. universal life insurance

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT