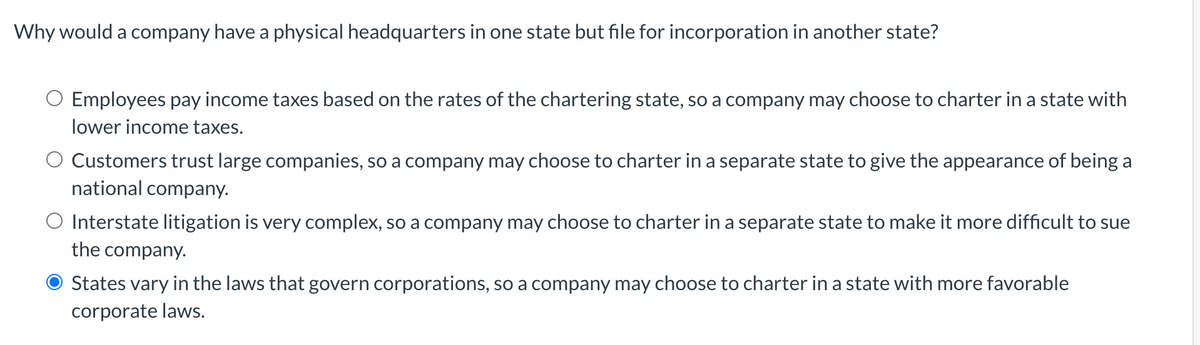

Why would a company have a physical headquarters in one state but file for incorporation in another state? O Employees pay income taxes based on the rates of the chartering state, so a company may choose to charter in a state with lower income taxes. O Customers trust large companies, so a company may choose to charter in a separate state to give the appearance of being a national company. O Interstate litigation is very complex, so a company may choose to charter in a separate state to make it more difficult to sue the company. O States vary in the laws that govern corporations, so a company may choose to charter in a state with more favorable corporate laws.

Why would a company have a physical headquarters in one state but file for incorporation in another state? O Employees pay income taxes based on the rates of the chartering state, so a company may choose to charter in a state with lower income taxes. O Customers trust large companies, so a company may choose to charter in a separate state to give the appearance of being a national company. O Interstate litigation is very complex, so a company may choose to charter in a separate state to make it more difficult to sue the company. O States vary in the laws that govern corporations, so a company may choose to charter in a state with more favorable corporate laws.

Chapter24: Multistate Corporate Taxation

Section: Chapter Questions

Problem 2BCRQ

Related questions

Question

Transcribed Image Text:Why would a company have a physical headquarters in one state but file for incorporation in another state?

O Employees pay income taxes based on the rates of the chartering state, so a company may choose to charter in a state with

lower income taxes.

O Customers trust large companies, so a company may choose to charter in a separate state to give the appearance of being a

national company.

O Interstate litigation is very complex, so a company may choose to charter in a separate state to make it more difficult to sue

the company.

States vary in the laws that govern corporations, so a company may choose to charter in a state with more favorable

corporate laws.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you