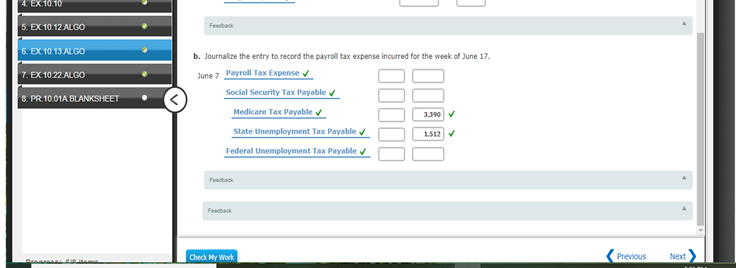

Widmer Company had gross wages of $226,000 during the week ended June 17. The amount of wages subject to social security tax was $203,400, while the amount of wages subject to federal and state unemployment taxes was $28,000. Tax rates are as follows: Social security 6.0% Medicare 1.5% State unemployment 5.4% Federal unemployment 0.8% The total amount withheld from employee wages for federal taxes was $45,200. If an amount box does not require an entry, leave it blank. If required, round answers to two decimal places. a. Journalize the entry to record the payroll for the week of June 17. June 7 Wages Expense Social Security Tax Payable v 226.000 Medicare Tax Payable v 3.390 V Employees Federal Income Tax Payable v 45.200 Wages Payable v

Widmer Company had gross wages of $226,000 during the week ended June 17. The amount of wages subject to social security tax was $203,400, while the amount of wages subject to federal and state unemployment taxes was $28,000. Tax rates are as follows: Social security 6.0% Medicare 1.5% State unemployment 5.4% Federal unemployment 0.8% The total amount withheld from employee wages for federal taxes was $45,200. If an amount box does not require an entry, leave it blank. If required, round answers to two decimal places. a. Journalize the entry to record the payroll for the week of June 17. June 7 Wages Expense Social Security Tax Payable v 226.000 Medicare Tax Payable v 3.390 V Employees Federal Income Tax Payable v 45.200 Wages Payable v

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter10: Liabilities: Current, Installment Notes, And Contingencies

Section: Chapter Questions

Problem 10.13EX

Related questions

Question

100%

Anyone know the rest?

Transcribed Image Text:EX 10.10

5. EX 10.12 ALGO

Feedack

6. EX 10.13 ALGO

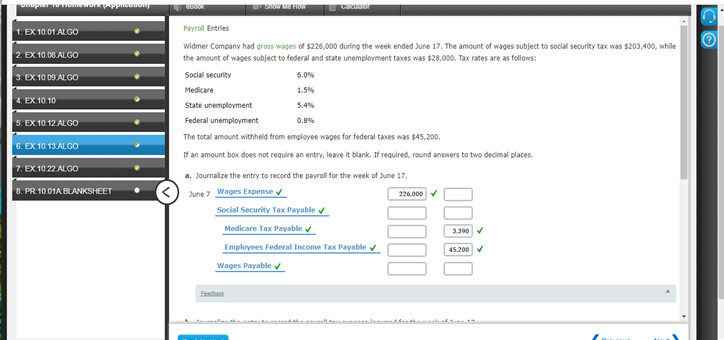

b. Journalize the entry to record the payroll tax expense incurred for the week of June 17.

7. EX 10.22 ALGO

June 7 Payroll Tax Expense

Social Security Tax Payable v

8. PR.10.01A BLANKSHEET

Medicare Tax Payable v

3,390V

State Unemployment Tax Payable v

1.512

Federal Unemployment Tax Payable v

Feedack

Feedback

Check My Work

Previous

Next

Transcribed Image Text:L RRR

Catr

Payroll Entries

1. EX 10.01 ALGO

Widmer Company had gross wages of $226,000 during the week ended June 17. The amount of wages subject to social security tax was $203,400, while

2. EX 10.08 ALGO

the amount of wages subject to federal and state unemployment taxes was $28,000. Tax rates are as follows:

3. EX 10.09 ALGO

Social security

6.0%

Medicare

1.5%

4. EX 10.10

State unemployment

5.4%

5. EX 10.12 ALGO

Federal unemployment

0.8%

The total amount withheld from employee wages for federal taxes was $45,200.

6. EX 10.13 ALGO

If an amount box does not require an entry, leave it blank. If required, round answers to two decimal places.

7. EX 10.22 ALGO

a. Journalize the entry to record the payroll for the week of June 17.

8. PR.10.01A BLANKSHEET

June 7 Wages Expensev

226.000

Social Security Tax Payable v

Medicare Tax Payable v

3.390 V

Employees Federal Income Tax Payable v

45.200V

Wages Payable v

Eenstask

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,