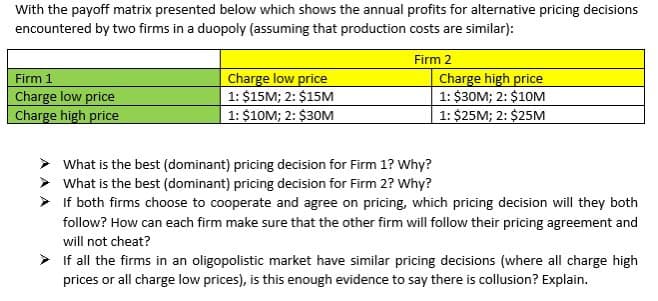

With the payoff matrix presented below which shows the annual profits for alternative pricing decisions encountered by two firms in a duopoly (assuming that production costs are similar): Firm 2 Firm 1 Charge low price 1: $15M; 2: $15M Charge low price Charge high price 1: $30M; 2: $10M 1: $25M; 2: $25M Charge high price 1: $10M; 2: $30M ➤What is the best (dominant) pricing decision for Firm 1? Why? What is the best (dominant) pricing decision for Firm 2? Why? If both firms choose to cooperate and agree on pricing, which pricing decision will they both follow? How can each firm make sure that the other firm will follow their pricing agreement and

With the payoff matrix presented below which shows the annual profits for alternative pricing decisions encountered by two firms in a duopoly (assuming that production costs are similar): Firm 2 Firm 1 Charge low price 1: $15M; 2: $15M Charge low price Charge high price 1: $30M; 2: $10M 1: $25M; 2: $25M Charge high price 1: $10M; 2: $30M ➤What is the best (dominant) pricing decision for Firm 1? Why? What is the best (dominant) pricing decision for Firm 2? Why? If both firms choose to cooperate and agree on pricing, which pricing decision will they both follow? How can each firm make sure that the other firm will follow their pricing agreement and

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter12: Price And Output Determination: Oligopoly

Section: Chapter Questions

Problem 1E

Related questions

Question

I need answer ASAP.Thank you!

Transcribed Image Text:With the payoff matrix presented below which shows the annual profits for alternative pricing decisions

encountered by two firms in a duopoly (assuming that production costs are similar):

Firm 2

Firm 1

Charge low price

1: $15M; 2: $15M

Charge low price

Charge high price

1: $30M; 2: $10M

1: $25M; 2: $25M

Charge high price

1: $10M; 2: $30M

What is the best (dominant) pricing decision for Firm 1? Why?

What is the best (dominant) pricing decision for Firm 2? Why?

If both firms choose to cooperate and agree on pricing, which pricing decision will they both

follow? How can each firm make sure that the other firm will follow their pricing agreement and

will not cheat?

If all the firms in an oligopolistic market have similar pricing decisions (where all charge high

prices or all charge low prices), is this enough evidence to say there is collusion? Explain.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning