WSM Corporation is considering offering an air shuttle service between Sao Paulo and Rio de Janeiro. It plans to offer four flights every day (excluding certain holidays) for a total of 1,400 flights per year (= 350 days × 4 flights per day). WSM has hired a consultant to determine activity-based costs for this operation. The consultant's report shows the following. Activity Measure (cost driver) Number of flights Number of passengers Number of promotions Unit Cost(cost per unit of activity) $ 2,400 per fiight Ss per passenger $59,000 per promotion Activity Flying and maintaining aireraft Serving passengers Advertining and marketing WSM estimates the following annual information. With 21 advertising promotions, it will be able to generate demand for 40 passengers per flight at a fare of $330. The lease of the 60-seat aircraft will cost $4,350,000. Other equipment costs will be $2,900,000. Administrative and other marketing costs will be $1,600,000. Required: a. What annual operating income can WSM expect from this new service? b-1. WSM is considering selling tickets over the Internet to save on commissions and other costs. It is estimated that the cost driver rate for flights would decrease by $50 as a result of Internet sales. Administrative and other marketing costs would increase by $1 million. WSM estimates that the added convenience would generate a 5 percent increase in demand. All other costs and fares would remain the same. What annual operating income can WSM expect from adopting Internet ticket sales? b-2. Would you recommend that WSM adopt Internet ticket sales? C. Assume that WSM management decides not to adopt the Internet strategy, regardless of your answer to requirement (b). Instead,i is now considering a plan to sell tickets at two prices. An unrestricted ticket (good for travel at any time on any day) would sell for $ 355. A discount ticket, good for reservations made in advance, would sell for $180. Management estimates that it can sell 35,000 tickets (25 per flight) at the unrestricted airfare of $355. All other data remain the same. Ignoring the information in requirement (b), how many discounted tickets would WSM have to sell annually to earn an operating income of $4,800,000? Assume that the annual number of flights remains at 1,400 and that the discounted tickets would be evenly divided across the 1,400 flights. Complete this question by entering your answers in the tabs below. Reg A Reg B1 Reg B2 Req c WSM is considering selling tickets over the Internet to save on commissions and other costs. It is estimated that the cost driver rate for flights would decrease by $50 as a result of Internet sales. Administrative and other marketing costs would increase by $1 million. WSM estimates that the added convenience would generate a 5 percent increase in demand. All other costs and fares would remain the same. What annual operating income can WSM expect from adopting Internet ticket sales? (Enter your answer in thousands of dollars.) Show lessa Operating income < Req A Req B2 >

WSM Corporation is considering offering an air shuttle service between Sao Paulo and Rio de Janeiro. It plans to offer four flights every day (excluding certain holidays) for a total of 1,400 flights per year (= 350 days × 4 flights per day). WSM has hired a consultant to determine activity-based costs for this operation. The consultant's report shows the following. Activity Measure (cost driver) Number of flights Number of passengers Number of promotions Unit Cost(cost per unit of activity) $ 2,400 per fiight Ss per passenger $59,000 per promotion Activity Flying and maintaining aireraft Serving passengers Advertining and marketing WSM estimates the following annual information. With 21 advertising promotions, it will be able to generate demand for 40 passengers per flight at a fare of $330. The lease of the 60-seat aircraft will cost $4,350,000. Other equipment costs will be $2,900,000. Administrative and other marketing costs will be $1,600,000. Required: a. What annual operating income can WSM expect from this new service? b-1. WSM is considering selling tickets over the Internet to save on commissions and other costs. It is estimated that the cost driver rate for flights would decrease by $50 as a result of Internet sales. Administrative and other marketing costs would increase by $1 million. WSM estimates that the added convenience would generate a 5 percent increase in demand. All other costs and fares would remain the same. What annual operating income can WSM expect from adopting Internet ticket sales? b-2. Would you recommend that WSM adopt Internet ticket sales? C. Assume that WSM management decides not to adopt the Internet strategy, regardless of your answer to requirement (b). Instead,i is now considering a plan to sell tickets at two prices. An unrestricted ticket (good for travel at any time on any day) would sell for $ 355. A discount ticket, good for reservations made in advance, would sell for $180. Management estimates that it can sell 35,000 tickets (25 per flight) at the unrestricted airfare of $355. All other data remain the same. Ignoring the information in requirement (b), how many discounted tickets would WSM have to sell annually to earn an operating income of $4,800,000? Assume that the annual number of flights remains at 1,400 and that the discounted tickets would be evenly divided across the 1,400 flights. Complete this question by entering your answers in the tabs below. Reg A Reg B1 Reg B2 Req c WSM is considering selling tickets over the Internet to save on commissions and other costs. It is estimated that the cost driver rate for flights would decrease by $50 as a result of Internet sales. Administrative and other marketing costs would increase by $1 million. WSM estimates that the added convenience would generate a 5 percent increase in demand. All other costs and fares would remain the same. What annual operating income can WSM expect from adopting Internet ticket sales? (Enter your answer in thousands of dollars.) Show lessa Operating income < Req A Req B2 >

Essentials of Business Analytics (MindTap Course List)

2nd Edition

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Chapter15: Decision Analysis

Section: Chapter Questions

Problem 5P: Hudson Corporation is considering three options for managing its data warehouse: continuing with its...

Related questions

Topic Video

Question

I need help with this accounting problem

Transcribed Image Text:WSM Corporation is considering offering an air shuttle service between Sao Paulo and Rio de Janeiro. It plans to offer four flights every

day (excluding certain holidays) for a total of 1,400 flights per year (= 350 days x 4 flights per day). WSM has hired a consultant to

determine activity-based costs for this operation. The consultant's report shows the following.

Activity Measure

(cost driver)

Number of flights

Number of pansengers

Number of promotions

Unit Cost (cost per unit

of activity)

$ 2,400 per flight

5 per passenger

$59,000 per promotion

Activity

Flying and maintaining aircraft

Serving passengers

Advertising and marketing

WSM estimates the following annual information. With 21 advertising promotions, it will be able to generate demand for 40 passengers

per flight at a fare of $330. The lease of the 60-seat aircraft will cost $4,350,000. Other equipment costs will be $2,900,000.

Administrative and other marketing costs will be $1,600,000.

Required:

a. What annual operating income can WSM expect from this new service?

b-1. WSM is considering selling tickets over the Internet to save on commissions and other costs. It is estimated that the cost driver

rate for flights would decrease by $50 as a result of Internet sales. Administrative and other marketing costs would increase by $1

million. WSM estimates that the added convenience would generate a 5 percent increase in demand. All other costs and fares would

remain the same. What annual operating income can WSM expect from adopting Internet ticket sales?

b-2. Would you recommend that WSM adopt Internet ticket sales?

c. Assume that WSM management decides not to adopt the Internet strategy, regardless of your answer to requirement (b). Instead, it

is now considering a plan to sell tickets at two prices. An unrestricted ticket (good for travel at any time on any day) would sell for $

355. A discount ticket, good for reservations made in advance, would sell for $180. Management estimates that it can sell 35,000

tickets (25 per flight) at the unrestricted airfare of $355. All other data remain the same.

Ignoring the information in requirement (b), how many discounted tickets would WSM have to sell annually to earn an operating

income of $4,800,000? Assume that the annual number of flights remains at 1,400 and that the discounted tickets would be evenly

divided across the 1,400 flights.

Complete this question by entering your answers in the tabs below.

Req A

Req B1

Req B2

Req C

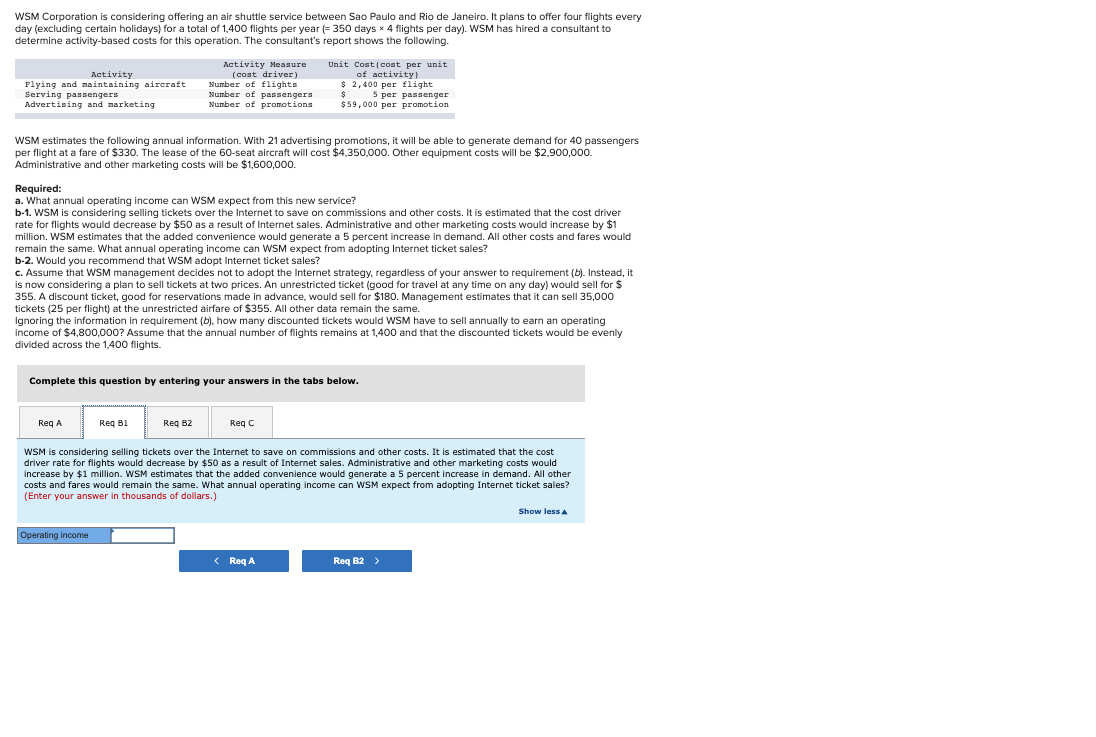

WSM is considering selling tickets over the Internet to save on commissions and other costs. It is estimated that the cost

driver rate for flights would decrease by $50 as a result of Internet sales. Administrative and other marketing costs would

increase by $1 million. WSM estimates that the added convenience would generate a 5 percent increase in demand. All other

costs and fares would remain the same. What annual operating income can WSM expect from adopting Internet ticket sales?

(Enter your answer in thousands of dollars.)

Show less A

Operating income

< Req A

Req B2 >

Transcribed Image Text:WSM Corporation is considering offering an air shuttle service between Sao Paulo and Rio de Janeiro. It plans to offer four flights every

day (excluding certain holidays) for a total of 1,400 flights per year (= 350 days x 4 flights per day). WSM has hired a consultant to

determine activity-based costs for this operation. The consultant's report shows the following.

Activity Measure

(cost driver)

Number of flights

Number of pansengers

Number of promotions

Unit Cost (cost per unit

of activity)

$ 2,400 per flight

$5 per passenger

$59,000 per promotion

Activity

Flying and maintaining aircraft

Serving passengers

Advertising and marketing

WSM estimates the following annual information. With 21 advertising promotions, it will be able to generate demand for 40 passengers

per flight at a fare of $330. The lease of the 60-seat aircraft will cost $4,350,000. Other equipment costs will be $2,900,000.

Administrative and other marketing costs will be $1,600,000.

Required:

a. What annual operating income can WSM expect from this new service?

b-1. WSM is considering selling tickets over the Internet to save on commissions and other costs. It is estimated that the cost driver

rate for flights would decrease by $50 as a result of Internet sales. Administrative and other marketing costs would increase by $1

million. WSM estimates that the added convenience would generate a 5 percent increase in demand. All other costs and fares would

remain the same. What annual operating income can WSM expect from adopting Internet ticket sales?

b-2. Would you recommend that WSM adopt Internet ticket sales?

c. Assume that WSM management decides not to adopt the Internet strategy, regardless of your answer to requirement (b). Instead, it

is now considering a plan to sell tickets at two prices. An unrestricted ticket (good for travel at any time on any day) would sell for $

355. A discount ticket, good for reservations made in advance, would sell for $180. Management estimates that it can sell 35,000

tickets (25 per flight) at the unrestricted airfare of $355. All other data remain the same.

Ignoring the information in requirement (b), how many discounted tickets would WSM have to sell annually to earn an operating

income of $4,800,000? Assume that the annual number of flights remains at 1,400 and that the discounted tickets would be evenly

divided across the 1,400 flights.

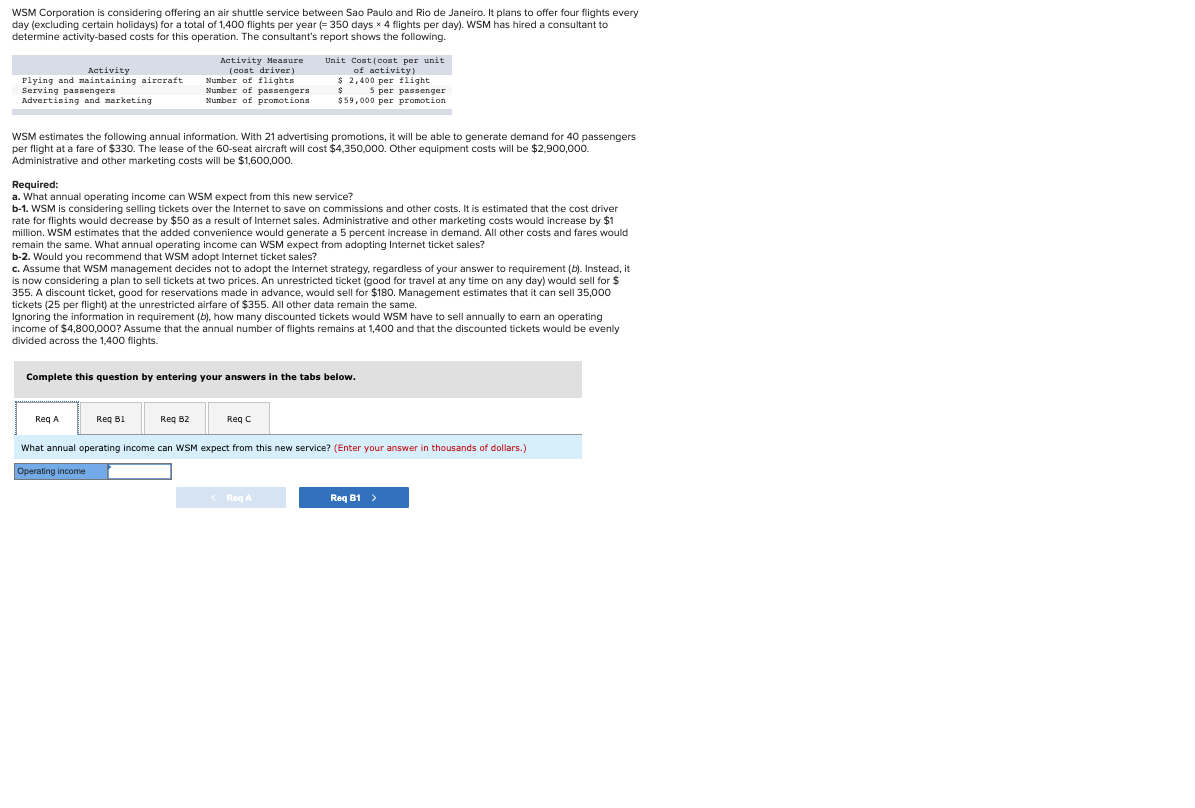

Complete this question by entering your answers in the tabs below.

Req A

Req B1

Reg B2

Req C

What annual operating income can WSM expect from this new service? (Enter your answer in thousands of dollars.)

Operating income

< Req A

Req B1 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning