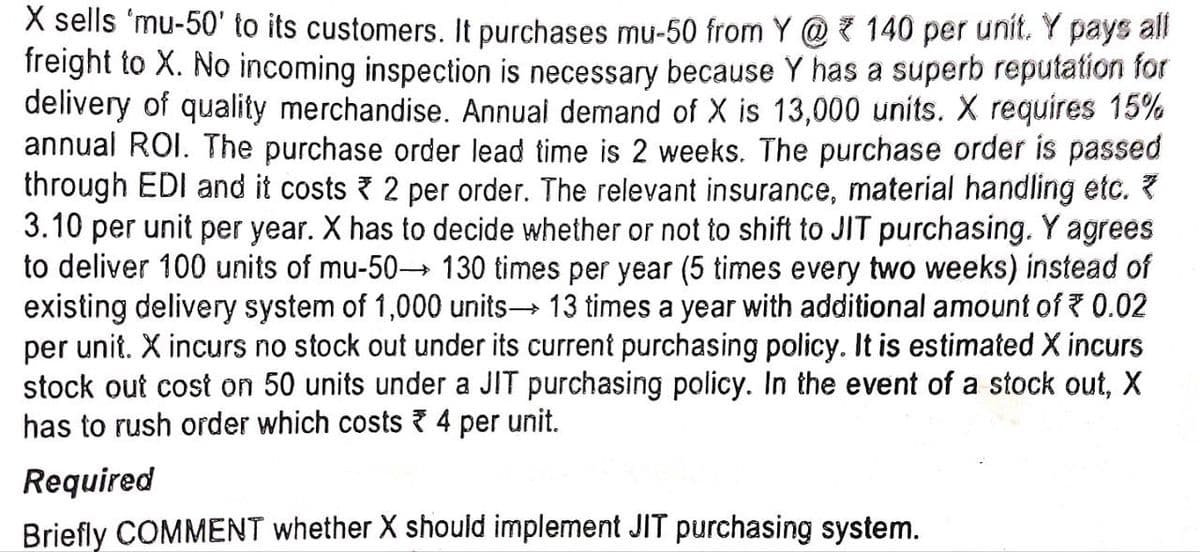

X sells 'mu-50' to its customers. It purchases mu-50 from Y @ 140 per unit. Y pays all freight to X. No incoming inspection is necessary because Y has a superb reputation for delivery of quality merchandise. Annual demand of X is 13,000 units. X requires 15% annual ROI. The purchase order lead time is 2 weeks. The purchase order is passed through EDI and it costs 2 per order. The relevant insurance, material handling etc. * 3.10 per unit per year. X has to decide whether or not to shift to JIT purchasing. Y agrees to deliver 100 units of mu-50-130 times per year (5 times every two weeks) instead of existing delivery system of 1,000 units→ 13 times a year with additional amount of * 0.02 per unit. X incurs no stock out under its current purchasing policy. It is estimated X incurs stock out cost on 50 units under a JIT purchasing policy. In the event of a stock out, X has to rush order which costs 4 per unit.

X sells 'mu-50' to its customers. It purchases mu-50 from Y @ 140 per unit. Y pays all freight to X. No incoming inspection is necessary because Y has a superb reputation for delivery of quality merchandise. Annual demand of X is 13,000 units. X requires 15% annual ROI. The purchase order lead time is 2 weeks. The purchase order is passed through EDI and it costs 2 per order. The relevant insurance, material handling etc. * 3.10 per unit per year. X has to decide whether or not to shift to JIT purchasing. Y agrees to deliver 100 units of mu-50-130 times per year (5 times every two weeks) instead of existing delivery system of 1,000 units→ 13 times a year with additional amount of * 0.02 per unit. X incurs no stock out under its current purchasing policy. It is estimated X incurs stock out cost on 50 units under a JIT purchasing policy. In the event of a stock out, X has to rush order which costs 4 per unit.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter20: Inventory Management: Economic Order Quantity, Jit, And The Theory Of Constraints

Section: Chapter Questions

Problem 2CE: Sterling Corporation has an EOQ of 5,000 units. The company uses an average of 500 units per day. An...

Related questions

Question

Transcribed Image Text:X sells 'mu-50' to its customers. It purchases mu-50 from Y@ 140 per unit. Y pays all

freight to X. No incoming inspection is necessary because Y has a superb reputation for

delivery of quality merchandise. Annual demand of X is 13,000 units. X requires 15%

annual ROI. The purchase order lead time is 2 weeks. The purchase order is passed

through EDI and it costs 2 per order. The relevant insurance, material handling etc. *

3.10 per unit per year. X has to decide whether or not to shift to JIT purchasing. Y agrees

to deliver 100 units of mu-50→ 130 times per year (5 times every two weeks) instead of

existing delivery system of 1,000 units→ 13 times a year with additional amount of ₹ 0.02

per unit. X incurs no stock out under its current purchasing policy. It is estimated X incurs

stock out cost on 50 units under a JIT purchasing policy. In the event of a stock out, X

has to rush order which costs 4 per unit.

Required

Briefly COMMENT whether X should implement JIT purchasing system.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning