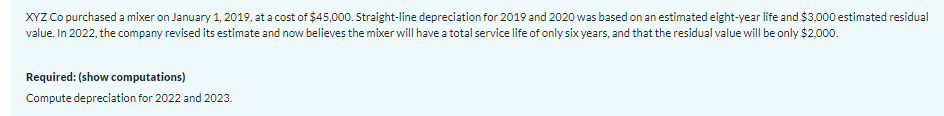

XYZ Co purchased a mixer on January 1, 2019, at a cost of $45,000. Straight-line depreciation for 2019 and 2020 was based on an estimated eight-year life and $3,000 estimated residual value. In 2022, the company revised its estimate and now believes the mixer will have a total service life of only six years, and that the residual value will be only $2,000. Required: (show computations) Compute depreciation for 2022 and 2023.

Q: On January 1, 2021, Canyon Company decided to decrease the estimated useful life of the patent from…

A: Depreciation refers to a decline in the value of a fixed asset over its useful life. A patent is an…

Q: During 2018, Wright Tool Company purchased a building site for its proposed research and development…

A: a. The items related to research and development activities should be reported on as below in the…

Q: Martinez Corporation purchased machinery on January 1, 2022, at a cost of $268,000. The estimated…

A: Depreciation is considered as an expense charge on the value of the Asset. It can be calculated by…

Q: On January 2, 2020, VSG purchased a transportation equipment costing P2,400,000. The new asset has…

A: Accumulated depreciation, December 31, 2022 = P2,400,000 x 2/8 = P600,000 Carrying value, December…

Q: . On January 1, 2019, Tarlac Company acquired a machine for P4,500,000. The machine has a useful…

A: Depreciation is a method of accounting that distributes the expense of a tangible or physical asset…

Q: On Oct. 1, 2020, Shaw Company purchased a machine for P1,260,000 that was placed in service on Nov.…

A: Depreciation: Depreciation means the reduction in the value of an asset over the life of the assets…

Q: equired:

A: These are the accounting transactions that are having a monetary impact on the financial statement…

Q: On January 1, 2018, Check Co. bought a machine for $15,000. Residual value was estimated to be…

A: The answer is as fallows

Q: Required a. Prepare the journal entry(ies) necessary to record the depreciation expense on the…

A: Depreciation: A charge on the fixed assets of the company that reduces the value of the asset is…

Q: Hotroad LLC acquired a new asphalt mixing plant for $500,000 on 1st of January 2016. The…

A: Depreciation is referred to as an amount which is charged by the business on its tangible…

Q: On January 1, 2019, Williams Company purchased a copy machine. The machine costs $160,000, its…

A: Depreciation Expenses - Depreciation Expenses are the expense incurred on the wear and tear of the…

Q: Oriole Company bought equipment for $420000 on January 1, 2021. Oriole estimated the useful life to…

A: Under Straight line depreciation method(SLM), the value of asset is depreciated evenly through out…

Q: JAY Inc. decided to revalue its machine on December 31, 2019, and determined that the current…

A: Given Information: Replacement cost on December 31,2019 $1,500,000 Purchased on January 1,2017…

Q: On January 1, 2018, Morrow Inc. purchased a spooler at a cost of $40,000. The equipment is expected…

A: Depreciation refers to the permanent/fall/decline/decrease in the value of asset pertaining to many…

Q: On January 1, 2021, SMC decided to dispose of an item of plant that is carried in its records at a…

A: Impairment loss is the difference between the carrying value of asset and the recoverable amount of…

Q: ABC, Inc. purchased a crane on January 1, 2018, for P205,500. At the time of purchase, the crane was…

A: ABC, Inc. purchased a crane on January 1, 2018, for P205,500. At the time of purchase, the crane was…

Q: On January 1, 2017, Blizzards-R-Us purchased a snow-blowing machine for $125,000. The machine was…

A: To a change in the estimate of residual value and remaining useful life of an asset, the prospective…

Q: On January 2, 2017, Bangs Company purchased equipment costing P1,500,000. The estimated useful life…

A: As per IFRS 5, at the time of initial recognition of an asset as held for sale, asset shall be…

Q: Libras Corporation purchased a machine on July 1, 2019, for P500,000. The machine was estimated to…

A: Depreciation: Depreciation means the reduction in the value of an asset over the life of the assets…

Q: UMET Co. purchased equipment on January 1, 2020, at a cost of $600,000. The equipment is expected to…

A: Hi student Since there are multiple subparts,we will answer only first three subparts.…

Q: During 2018, Sandhill Company purchased a building site for its proposed research and development…

A: Income statement is a statement prepared to calculate the net income of a company after deducting…

Q: Murgatroyd Co. purchased equipment on January 1, 2019, for $900,000, estimating a five-year useful…

A: Double declining depreciation rate = Straight line depreciation rate x 2 = (100/5 years) x 2 = 40%

Q: On July 1, 2019, Nuuty Inc., a calendar-year company, purchased a machine for a cash price of…

A: Depreciation: Depreciation means the reduction in the value of an asset over the life of the assets…

Q: On January 1, 2019, Tarlac Company acquired a machine for P4,500,000. The machine has a useful life…

A: Depreciation: Depreciation means the reduction in the value of an asset over the life of the assets…

Q: On January 1,2020 Petron Company purchased an oil tanker depot at the cost of P 7,000,000 the entity…

A: Journal in accounting and book keeping is a book of records. It is used to record every monetary…

Q: On January 1, 2020, Dan Company purchased a new machine for P4,000,000. The new machine has an…

A:

Q: On December 31, 2020, Sardines Company has an item of machinery with a cost of $4,500,000 and an…

A: Impairment of assets means reducing the book value of assets when carrying amount is more than…

Q: Ariel Company purchased a boring machine on January 1, 2020 for P8,100,000. The useful life of the…

A: Depreciation is the allocation of cost of asset over it's useful life. Units of production is a…

Q: On March 10, 2020, Waterway Limited sold equipment that it bought for $266,880 on August 21, 2013.…

A: Depreciation: It is an expense incurred in the day-to-day normal use of assets during the…

Q: During 2018, Sandhill Company purchased a building site for its proposed research and development…

A: A) Income Statement for 2020.

Q: Mercury Inc. purchased equipment in 2019 at a cost of $207,000. The equipment was expected to…

A: Units of production method is also known as units of activity and units of usage method.This is the…

Q: Dell Technologies Inc. at the beginning 2019 purchased servers at a cost of $750,000. At that time…

A: Depreciation is the amount which shows the decrease in the value of asset over a period because of…

Q: On January 1, 2019, Woodstock, Inc. purchased a machine costing $42.400. Woodstock also paid $2.200…

A: Depreciable cost=Cost+installation-Residual value=$42,400+$2,200-$6,200=$44,600-$6,200=$38,400

Q: On January 1, 2016, LLC Corporation purchased a building and equipment that have the following…

A: The declining balance method is one of the two accelerated depreciation methods, and it uses a…

Q: On January 1, 2016, LLC Corporation purchased a building and equipment that have the following…

A: The depreciation expense is charged on asset which reduces the value of fixed asset with the passage…

Q: Concord Corporation purchased a new machine for its assembly process on August 1, 2020. The cost of…

A: Depreciation is a reduction in the value of assets due to the usage of that asset. We can evaluate…

Q: Oman Cables Co. Purchased a machine for OR45,000 on January 1, 2020. The machine is expected to have…

A: Sum of Years Digit method: Under this method the depreciation is calculated at an accelerated rate.…

Q: Tristen Company purchased a five-story office building on January 1, 2019, at a cost of $6,400,000.…

A: Depreciation means the amount fixed assets written off due to normal wear and tear , normal usage ,…

Q: RS Inc. acquired a delivery truck for P2,100,000 on January 1, 2018. The delivery truck has useful…

A: 1. Sum of useful life = 5+4+3+2+1 = 15 2. Calculation of depreciation rate for each year under sum…

Q: On January 1, 2016, LLC Corporation purchased a building and equipment that have the following…

A: Since you have posted multiple question , we will do the first one for you . In order to get…

Q: On January 1, 2019, Nobel Corporation acquired machinery at a cost of P600,000. Nobel adopted the…

A: Annual Depreciation = (Cost of the assets - Salvage value) / life of the assets = (600000- 0) / 10…

Q: Tristen Company purchased a five-story office building on January 1, 2019, at a cost of $5,000,000.…

A: The depreciation expense on the building is calculated as follows: As per the straight-line method…

Q: On April 1, 2019, the KB Toy Company purchased equipment to be used in its manufacturing process.…

A: Depreciation is the non-cash expense which is reported in the books to record the regular usage of…

Q: Healthlabs Ltd. purchased lab equipment for $16,500 on January 1, 2020. At that time, management…

A: Depreciation for 2020 = (Purchase Price - Salvage Value) / Useful Life in Years Depreciation for…

Q: At the beginning of 2019, Robotics Inc. acquired a manufacturing facility for $13.9 million. $10.9…

A: Given that, Cost of the building = $109,00,000 Residual value = $2900000 Useful life of asset = 25…

Q: ABC, Inc. purchased a crane on January 1, 2018, for P205,500. At the time of purchase, the crane was…

A: Under straight line method of recording depreciation, equal amount of depreciation expense is…

Q: On January 1, 2018, Hobart Mfg. Co. purchased a drill press at a cost of $21,900. The drill press is…

A: Deprecation per unit = (Cost of drill press - Residual value)/ Expected production in units =…

Q: Tatsuo Corporation purchased farm equipment on January 1, 2019, for $287,000. In 2019 and 2020,…

A: Annual Depreciation (straight line method) = (Cost of the assets - Residual value) / Expected life…

Q: of P8,000,000 with accumulated depreciation of P3,200,000 at December 31, 2020. Annual depreciation…

A: Initially, Plant cost 8,000,000 Less: Accumulated depreciation 31.12.2020 32,000,00 Less:…

answer step by step

Step by step

Solved in 5 steps with 3 images

- Hathaway Company purchased a copying machine for 8,700 on October 1, 2019. The machines residual value was 500 and its expected service life was 5 years. Hathaway computes depreciation expense to the nearest whole month. Required: 1. Compute depredation expense (rounded to the nearest dollar) for 2019 and 2020 using the: a. straight-line method b. sum-of-the-years-digits method c. double-declining-balance method 2. Next Level Which method produces the highest book value at the end of 2020? 3. Next Level Which method produces the highest charge to income in 2020? 4. Next Level Over the life of the asset, which method produces the greatest amount of depreciation expense?On May 10, 2019, Horan Company purchased equipment for 25,000. The equipment has an estimated service life of 5 years and zero residual value. Assume that the straight-line depreciation method is used. Required: Compute the depreciation expense for 2019 for each of the following four alternatives: 1. Horan computes depreciation expense to the nearest day. (Use 12 months of 30 days each and round the daily depreciation rate to 2 decimal places.) 2. Horan computes depreciation expense to the nearest month. Assets purchased in the first half of the month are considered owned for the whole month. 3. Horan computes depreciation expense to the nearest whole year. Assets purchased in the first half of the year are considered owned for the whole year. 4. Horan records one-half years depreciation expense on all assets purchased during the year.On January 1, 2014, Klinefelter Company purchased a building for 520,000. The building had an estimated life of 20 years and an estimated residual value of 20,000. The company has been depreciating the building using straight-line depreciation. At the beginning of 2020, the following independent situations occur: a. The company estimates that the building has a remaining life of 10 years (for a total of 16 years). b. The company changes to the sum-of-the-years-digits method. c. The company discovers that it had ignored the estimated residual value in the computation of the annual depreciation each year. Required: For each of the independent situations, prepare all journal entries related to the building for 2020. Ignore income taxes.

- At the beginning of 2020, Holden Companys controller asked you to prepare correcting entries for the following three situations: 1. Machine X was purchased for 100,000 on January 1, 2015. Straight-line depreciation has been recorded for 5 years, and the Accumulated Depreciation account has a balance of 45,000. The estimated residual value remains at 10,000, but the service life is now estimated to be 1 year longer than originally estimated. 2. Machine Y was purchased for 40,000 on January 1, 2018. It had an estimated residual value of 4,000 and an estimated service life of 8 years. It has been depreciated under the sum-of-the-years-digits method for 2 years. Now, the company has decided to change to the straight-line method. 3. Machine Z was purchased for 80,000 on January 1, 2019. Double-declining-balance depreciation has been recorded for 1 year. The estimated residual value is 8,000 and the estimated service life is 5 years. The computation of the depreciation erroneously included the estimated residual value. Required: Prepare any necessary correcting journal entries for each situation. Also prepare the journal entry for each situation to record the depreciation for 2020. Ignore income taxes.Hunter Company purchased a light truck on January 2, 2019 for 18,000. The truck, which will be used for deliveries, has the following characteristics: Estimated life: 5 years Estimated residual value: 3,000 Depreciation method for financial statements: straight-line method Depreciation for income tax purposes: MACRS (3-year life) From 2019 through 2023, each year, Hunter had sales of 100,000, cost of goods sold of 60,000, and operating expenses (excluding depreciation) of 15,000. The truck was disposed of on December 31, 2023, for 2,000. Required: 1. Prepare an income statement for financial reporting through pretax accounting income for each of the 5 years, 2019 through 2023. 2. Prepare, instead, an income statement for income tax purposes through taxable income for each of the 5 years, 2019 through 2023. 3. Compare the total income for all 5 years under Requirements 1 and 2.During 2019, Ryel Companys controller asked you to prepare correcting journal entries for the following three situations: 1. Machine A was purchased for 50,000 on January 1, 2014. Straight-line depreciation has been recorded for 5 years, and the Accumulated Depreciation account has a balance of 25,000. The estimated residual value remains at 5,000, but the service life is now estimated to be 1 year longer than estimated originally. 2. Machine B was purchased for 40,000 on January 1, 2017. It had an estimated residual value of 5,000 and an estimated service life of 10 years. it has been depreciated under the double-declining-balance method for 2 years. Now, at the beginning of the third year, Ryel has decided to change to the straight-line method. 3. Machine C was purchased for 20,000 on January 1, 2018, Double-declining-balance depreciation has been recorded for 1 year. The estimated residual value of the machine is 2,000 and the estimated service life is 5 years. The computation of the depreciation erroneously included the estimated residual value. Required: Prepare any necessary correcting journal entries for each situation. Also prepare the journal entry necessary for each situation to record depreciation expense for 2019.

- On July 1, 2018, Mundo Corporation purchased factory equipment for 50,000. Residual value was estimated at 2,000. The equipment will be depreciated over 10 years using the double-declining balance method. Counting the year of acquisition as one-half year, Mundo should record 2019 depredation expense of: a. 7,680 b. 9,000 c. 9,600 d. 10,000Gray Companys financial statements showed income before income taxes of 4,030,000 for the year ended December 31, 2020, and 3,330,000 for the year ended December 31, 2019. Additional information is as follows: Capital expenditures were 2,800,000 in 2020 and 4,000,000 in 2019. Included in the 2020 capital expenditures is equipment purchased for 1,000,000 on January 1, 2020, with no salvage value. Gray used straight-line depreciation based on a 10-year estimated life in its financial statements. As a result of additional information now available, it is estimated that this equipment should have only an 8-year life. Gray made an error in its financial statements that should be regarded as material. A payment of 180,000 was made in January 2020 and charged to expense in 2020 for insurance premiums applicable to policies commencing and expiring in 2019. No liability had been recorded for this item at December 31, 2019. The allowance for doubtful accounts reflected in Grays financial statements was 7,000 at December 31, 2020, and 97,000 at December 31, 2019. During 2020, 90,000 of uncollectible receivables were written off against the allowance for doubtful accounts. In 2019, the provision for doubtful accounts was based on a percentage of net sales. The 2020 provision has not yet been recorded. Net sales were 58,500,000 for the year ended December 31, 2020, and 49,230,000 for the year ended December 31, 2019. Based on the latest available facts, the 2020 provision for doubtful accounts is estimated to be 0.2% of net sales. A review of the estimated warranty liability at December 31, 2020, which is included in other liabilities in Grays financial statements, has disclosed that this estimated liability should be increased 170,000. Gray has two large blast furnaces that it uses in its manufacturing process. These furnaces must be periodically relined. Furnace A was relined in January 2014 at a cost of 230,000 and in January 2019 at a cost of 280,000. Furnace B was relined for the first time in January 2020 at a cost of 300,000. In Grays financial statements, these costs were expensed as incurred. Since a relining will last for 5 years, Grays management feels it would be preferable to capitalize and depreciate the cost of the relining over the productive life of the relining. Gray has decided to nuke a change in accounting principle from expensing relining costs as incurred to capitalizing them and depreciating them over their productive life on a straight-line basis with a full years depreciation in the year of relining. This change meets the requirements for a change in accounting principle under GAAP. Required: 1. For the years ended December 31, 2020 and 2019, prepare a worksheet reconciling income before income taxes as given previously with income before income taxes as adjusted for the preceding additional information. Show supporting computations in good form. Ignore income taxes and deferred tax considerations in your answer. The worksheet should have the following format: 2. As of January 1, 2020, compute the retrospective adjustment of retained earnings for the change in accounting principle from expensing to capitalizing relining costs. Ignore income taxes and deferred tax considerations in your answer.Comprehensive: Acquisition, Subsequent Expenditures, and Depreciation On January 2, 2019, Lapar Corporation purchased a machine for 50,000. Lapar paid shipping expenses of 500, as well as installation costs of 1,200. The company estimated that the machine would have a useful life of 10 years and a residual value of 3,000. On January 1, 2020, Lapar made additions costing 3,600 to the machine in order to comply with pollution-control ordinances. These additions neither prolonged the life of the machine nor increased the residual value. Required: 1. If Lapar records depreciation expense under the straight-line method, how much is the depreciation expense for 2020? 2. Assume Lapar determines the machine has three significant components as shown below. If Lapar uses IFRS, what is the amount of depreciation expense that would be recorded?

- At the end of 2020, Magenta Manufacturing Company discovered that construction cost had been capitalized as a cost of the factory building in 2015 when it should have been treated as a cost of production equipment installation costs. As a result of the misclassification, the depreciation through 2018 was understated by 110,000, and depreciation for 2019 was understated by 90,000. What would be the consequences of correcting for the misclassification of the property cost? a. The taxpayer uses the FIFO inventory method, and 25% of goods produced during the period were included in the ending inventory. b. The taxpayer uses the LIFO inventory method, and no new LIFO layer was added during 2019.Bliss Company owns an asset with an estimated life of 15 years and an estimated residual value of zero. Bliss uses the straight -line method of depreciation. At the beginning of the sixth year, the assets book value is 200,000 and Bliss changes the estimate of the assets life to 25 years, so that 20 years now remain in the assets life. Explain how this change will be accounted for in Blisss financial statements, and compute the current and future annual depreciation expense.Depreciation Methods Sorter Company purchased equipment for 200,000 on January 2, 2019. The equipment has an estimated service life of 8 years and an estimated residual value of 20,000. Required: Compute the depreciation expense for 2019 under each of the following methods: 1. straight-line 2. sum-of-the-years-digits 3. double-declining-balance 4. Next Level What effect does the depreciation of the equipment have on the analysis of rate of return?