yeal, $1,600,000 worth of computer components. ABC's costs are labour, $700,000; interest on debt, $100,000; and taxes, $50,000. ABC sells all its output to XYZ Supercomputer. Using ABC's components, XYZ builds four supercomputers at a cost of $750,000 each ($400,000 worth of components, $250,000 in labour costs, and $100,000 in taxes per computer). XYZ has a $30,000,000 factory. XYZ sells three of the supercomputers for $1,200,000 each; at year's end, it has not sold the fourth. The unsold computer is carried on XYZ's books as a $750,000 increase in inventory. Assume that ABC and XYZ are incorporated companies, and that XYZ sells to companies. a. Calculate the contributions to GDP of these transactions, showing that all three approaches give the same answer. Using the product approach, the value added by ABC is $ 1,600,000', the value added by XYZ is $ 2,750,000', and the total contribution to GDP of these transactions is $ 4,350,000'. Using the expenditure approach, private consumption expenditure is $ government purchases of goods and services are $ , net exports are $ , and GDP is $ investment is $

yeal, $1,600,000 worth of computer components. ABC's costs are labour, $700,000; interest on debt, $100,000; and taxes, $50,000. ABC sells all its output to XYZ Supercomputer. Using ABC's components, XYZ builds four supercomputers at a cost of $750,000 each ($400,000 worth of components, $250,000 in labour costs, and $100,000 in taxes per computer). XYZ has a $30,000,000 factory. XYZ sells three of the supercomputers for $1,200,000 each; at year's end, it has not sold the fourth. The unsold computer is carried on XYZ's books as a $750,000 increase in inventory. Assume that ABC and XYZ are incorporated companies, and that XYZ sells to companies. a. Calculate the contributions to GDP of these transactions, showing that all three approaches give the same answer. Using the product approach, the value added by ABC is $ 1,600,000', the value added by XYZ is $ 2,750,000', and the total contribution to GDP of these transactions is $ 4,350,000'. Using the expenditure approach, private consumption expenditure is $ government purchases of goods and services are $ , net exports are $ , and GDP is $ investment is $

Economics: Private and Public Choice (MindTap Course List)

16th Edition

ISBN:9781305506725

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Chapter7: Taking The Nation's Economic Pulse

Section: Chapter Questions

Problem 1CQ

Related questions

Question

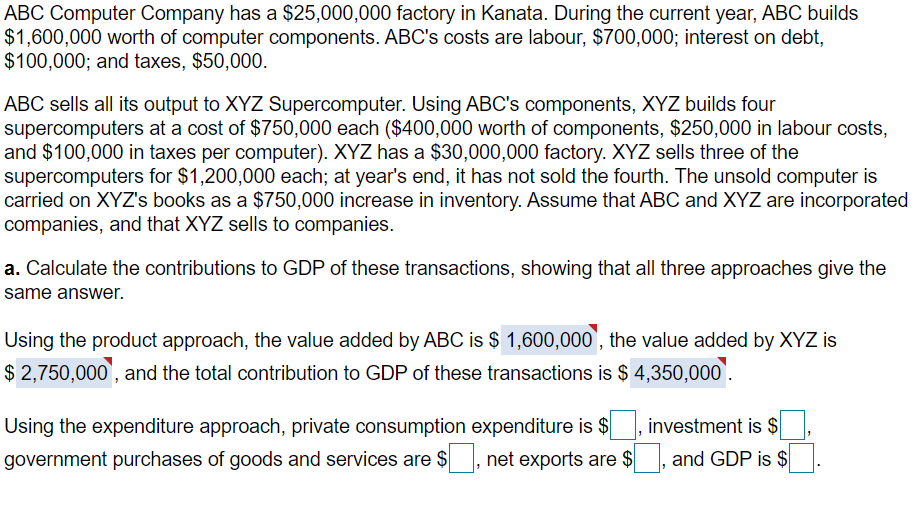

Transcribed Image Text:ABC Computer Company has a $25,000,000 factory in Kanata. During the current year, ABC builds

$1,600,000 worth of computer components. ABC's costs are labour, $700,000; interest on debt,

$100,000; and taxes, $50,000.

ABC sells all its output to XYZ Supercomputer. Using ABC's components, XYZ builds four

supercomputers at a cost of $750,000 each ($400,000 worth of components, $250,000 in labour costs,

and $100,000 in taxes per computer). XYZ has a $30,000,000 factory. XYZ sells three of the

supercomputers for $1,200,000 each; at year's end, it has not sold the fourth. The unsold computer is

carried on XYZ's books as a $750,000 increase in inventory. Assume that ABC and XYZ are incorporated

companies, and that XYZ sells to companies.

a. Calculate the contributions to GDP of these transactions, showing that all three approaches give the

same answer.

Using the product approach, the value added by ABC is $ 1,600,000', the value added by XYZ is

$ 2,750,000', and the total contribution to GDP of these transactions is $ 4,350,000'.

investment is $

Using the expenditure approach, private consumption expenditure is $

government purchases of goods and services are $, net exports are $|

and GDP is $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Macroeconomics: Principles and Policy (MindTap Co…

Economics

ISBN:

9781305280601

Author:

William J. Baumol, Alan S. Blinder

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Macroeconomics: Principles and Policy (MindTap Co…

Economics

ISBN:

9781305280601

Author:

William J. Baumol, Alan S. Blinder

Publisher:

Cengage Learning

Survey of Economics (MindTap Course List)

Economics

ISBN:

9781305260948

Author:

Irvin B. Tucker

Publisher:

Cengage Learning