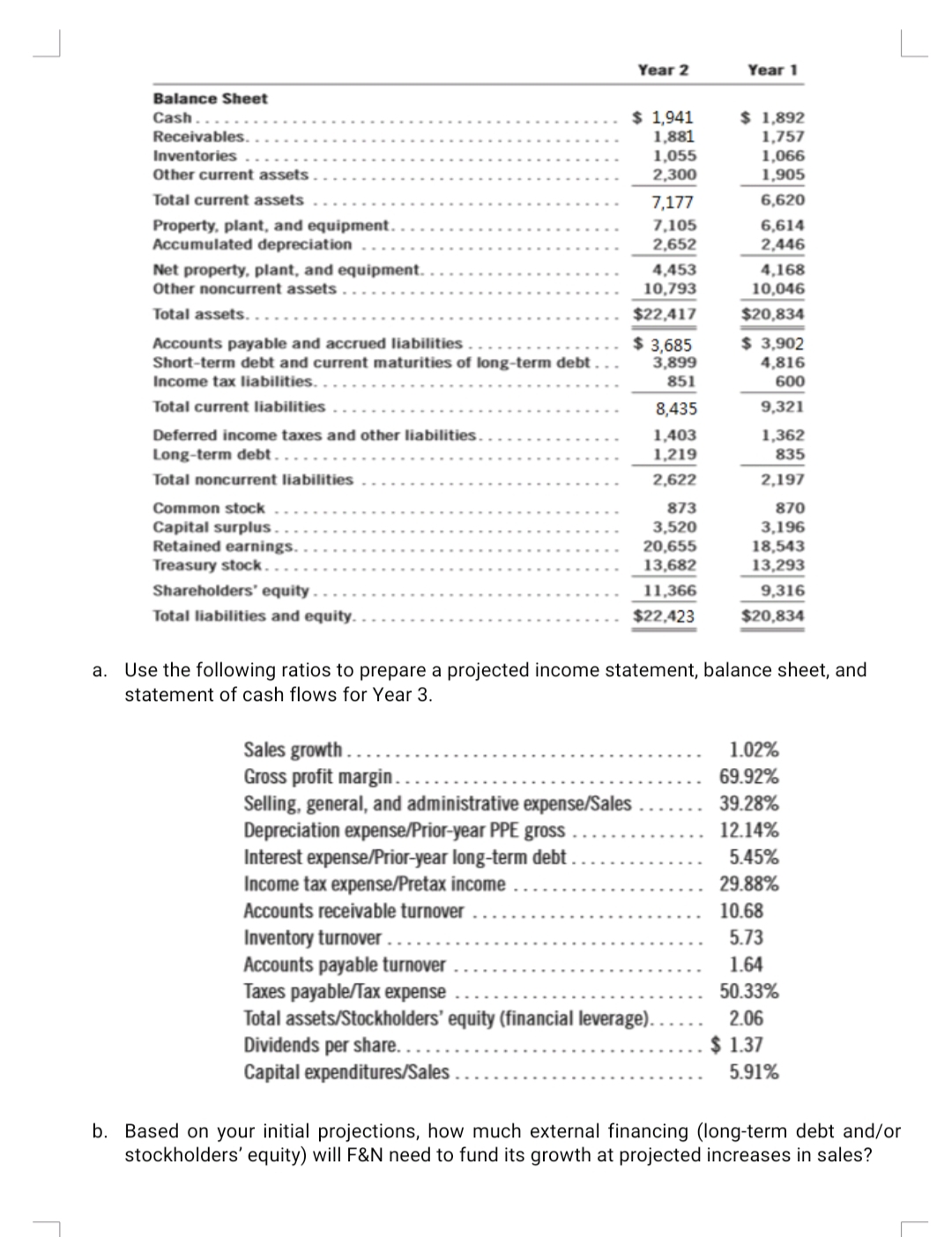

Year 2 Year 1 Balance Sheet $ 1,941 1,881 1,055 2,300 $ 1,892 1,757 1,066 1,905 Cash.. Receivables. Inventories Other current assets Total current assets 7,177 6,620 Property, plant, and equipment.. Accumulated depreciation 7,105 2,652 6,614 2,446 Net property, plant, and equipment. Other noncurrent assets. 4,453 10,793 4,168 10,046 Total assets. $22,417 $20,834 Accounts payable and accrued liabilities Short-term debt and current maturities of long-term debt . $ 3,685 3,899 851 $ 3,902 4,816 600 Income tax liabilities. . Total current liabilities 8,435 9,321 1,403 1,219 Deferred income taxes and other liabilities. 1,362 835 Long-term debt. Total noncurrent liabilities 2,622 2,197 Common stock 873 870 Capital surplus. Retained earnings. 3,520 20,655 13,682 3,196 18,543 13,293 Treasury stock. Shareholders' equity . . 11,366 9,316 Total liabilities and equity. $22,423 $20,834 a. Use the following ratios to prepare a projected income statement, balance sheet, and statement of cash flows for Year 3. Sales growth . . Gross profit margin. Selling, general, and administrative expense/Sales Depreciation expense/Prior-year PPE gross Interest expense/Prior-year long-term debt . Income tax expense/Pretax income Accounts receivable turnover . 1.02% 69.92% 39.28% 12.14% 5.45% 29.88% 10.68 Inventory turnover.. Accounts payable turnover Taxes payable/Tax expense Total assets/Stockholders' equity (financial leverage). Dividends per share. . Capital expenditures/Sales . 5.73 1.64 50.33% 2.06 $ 1.37 5.91% b. Based on your initial projections, how much external financing (long-term debt and/or stockholders' equity) will F&N need to fund its growth at projected increases in sales?

Year 2 Year 1 Balance Sheet $ 1,941 1,881 1,055 2,300 $ 1,892 1,757 1,066 1,905 Cash.. Receivables. Inventories Other current assets Total current assets 7,177 6,620 Property, plant, and equipment.. Accumulated depreciation 7,105 2,652 6,614 2,446 Net property, plant, and equipment. Other noncurrent assets. 4,453 10,793 4,168 10,046 Total assets. $22,417 $20,834 Accounts payable and accrued liabilities Short-term debt and current maturities of long-term debt . $ 3,685 3,899 851 $ 3,902 4,816 600 Income tax liabilities. . Total current liabilities 8,435 9,321 1,403 1,219 Deferred income taxes and other liabilities. 1,362 835 Long-term debt. Total noncurrent liabilities 2,622 2,197 Common stock 873 870 Capital surplus. Retained earnings. 3,520 20,655 13,682 3,196 18,543 13,293 Treasury stock. Shareholders' equity . . 11,366 9,316 Total liabilities and equity. $22,423 $20,834 a. Use the following ratios to prepare a projected income statement, balance sheet, and statement of cash flows for Year 3. Sales growth . . Gross profit margin. Selling, general, and administrative expense/Sales Depreciation expense/Prior-year PPE gross Interest expense/Prior-year long-term debt . Income tax expense/Pretax income Accounts receivable turnover . 1.02% 69.92% 39.28% 12.14% 5.45% 29.88% 10.68 Inventory turnover.. Accounts payable turnover Taxes payable/Tax expense Total assets/Stockholders' equity (financial leverage). Dividends per share. . Capital expenditures/Sales . 5.73 1.64 50.33% 2.06 $ 1.37 5.91% b. Based on your initial projections, how much external financing (long-term debt and/or stockholders' equity) will F&N need to fund its growth at projected increases in sales?

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.1E

Related questions

Question

Transcribed Image Text:Year 2

Year 1

Balance Sheet

$ 1,941

1,881

1,055

2,300

Cash.

$ 1,892

1,757

1,066

1,905

Receivables.

Inventories

Other current assets .

Total current assets

7,177

6,620

Property, plant, and equipment. .

Accumulated depreciation

7,105

2,652

6,614

2,446

Net property, plant, and equipment.

Other noncurrent assets .

4,453

10,793

4,168

10,046

Total assets..

$22,417

$20,834

Accounts payable and accrued liabilities

Short-term debt and current maturities of long-term debt .

$ 3,685

3,899

$ 3,902

4,816

Income tax liabilities.

851

600

Total current liabilities

8,435

9,321

1,403

1,219

Deferred income taxes and other liabilities.

1,362

Long-term debt .

835

Total noncurrent liabilities

2,622

2,197

870

3,196

18,543

13,293

Common stock

873

Capital surplus.

Retained earnings.

Treasury stock.

3,520

20,655

13,682

Shareholders' equity .

11,366

9,316

Total liabilities and equity.

$22,423

$20,834

a. Use the following ratios to prepare a projected income statement, balance sheet, and

statement of cash flows for Year 3.

Sales growth . .

Gross profit margin..

Selling, general, and administrative expense/Sales

Depreciation expense/Prior-year PPE gross

Interest expense/Prior-year long-term debt .

Income tax expense/Pretax income

1.02%

69.92%

39.28%

12.14%

5.45%

29.88%

Accounts receivable turnover

10.68

Inventory turnover ....

Accounts payable turnover

Taxes payable/Tax expense

Total assets/Stockholders' equity (financial leverage).

Dividends per share. . .

Capital expenditures/Sales .

5.73

1.64

50.33%

2.06

$ 1.37

5.91%

b. Based on your initial projections, how much external financing (long-term debt and/or

stockholders' equity) will F&N need to fund its growth at projected increases in sales?

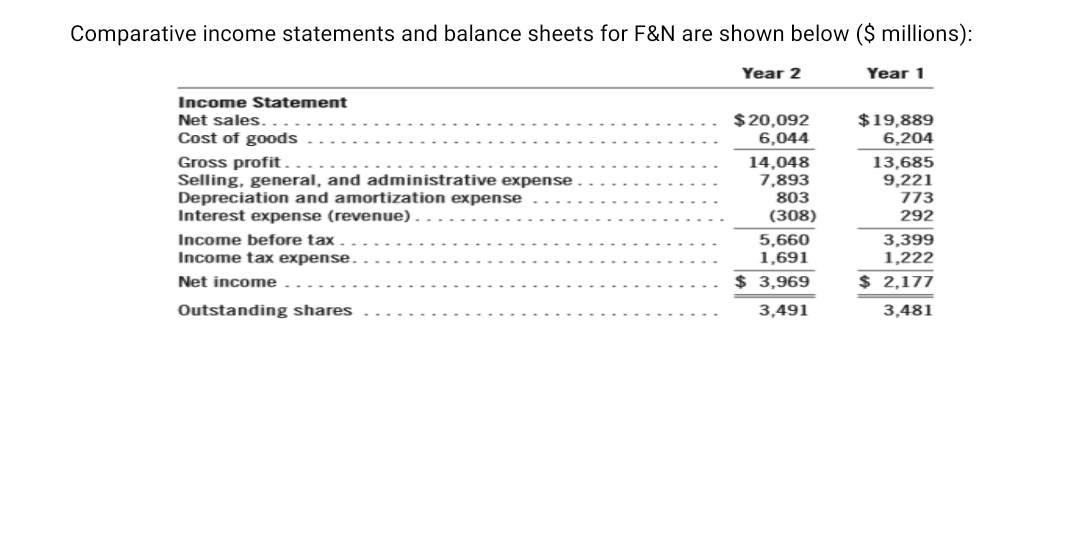

Transcribed Image Text:Comparative income statements and balance sheets for F&N are shown below ($ millions):

Year 2

Year 1

Income Statement

$19,889

6,204

Net sales.

$20,092

6,044

Cost of goods

Gross profit.

Selling, general, and administrative expense

Depreciation and amortization expense

Interest expense (revenue)

14,048

7,893

803

(308)

13,685

9,221

773

292

3,399

1,222

Income before tax

5,660

1,691

Income tax expense.

Net income

$ 3,969

$ 2,177

Outstanding shares

3,491

3,481

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning