[Question 1] Saturn Company Comparative Balance Sheet 2018 2017 Assets Cash Accounts Recelvable Prepaid Insurance Inventory Land Plant Assets $ 47,500 21,500 2,500 48,000 20.000 230,000 (85,500) $284.000 S 24,300 26,000 1,800 45,500 10,000 190,000 (71,100) $226,500 Accumulated Depreciation Total Assets Llabilities and Equity Liabilities: Accounts Payable Salaries Payable Notes Payable $ 17,200 1,900 85.000 S 19,000 1,500 75,000 95,500 Total Liabiltes. 104.100 Equity Common Stock Retained Earnings Total Equity Total Liabilities and Equity 115.000 64.900 70,000 61,000 131,000 $226,500 179.900 $4284.000

[Question 1] Saturn Company Comparative Balance Sheet 2018 2017 Assets Cash Accounts Recelvable Prepaid Insurance Inventory Land Plant Assets $ 47,500 21,500 2,500 48,000 20.000 230,000 (85,500) $284.000 S 24,300 26,000 1,800 45,500 10,000 190,000 (71,100) $226,500 Accumulated Depreciation Total Assets Llabilities and Equity Liabilities: Accounts Payable Salaries Payable Notes Payable $ 17,200 1,900 85.000 S 19,000 1,500 75,000 95,500 Total Liabiltes. 104.100 Equity Common Stock Retained Earnings Total Equity Total Liabilities and Equity 115.000 64.900 70,000 61,000 131,000 $226,500 179.900 $4284.000

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.23E: Unusual income statement items Assume that the amount of each of the following items is material to...

Related questions

Question

![[Question 1]

Saturn Company

Comparative Balance Sheet

2018

2017

Assets

Cash

Accounts Recelvable

Prepaid Insurance

Inventory

Land

Plant Assets

$ 47,500

21,500

2,500

48,000

20,000

230,000

(85,500)

$284,000

$ 24,300

26,000

1,800

45,500

10,000

190,000

(71,100)

Accumulated Depreciation

Total AssetsS

$226,500

Llabilities and Equity

Labilities

Accounts Payable

Salaries Payable

Notes Payable

Total Llabilities

S 19,000

1,500

75.000

$ 17,200

85.000

104.100

95.500

315.000

64.900

Common Stock

Retained Earnings

Tota Equity

Total Liabilities and Equity

61,000

379.900

131.000

$284.000

$226,500](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2Fcc8b4e33-200f-4136-a5a9-8c4b487db8eb%2Fe247c304-2398-4228-9884-cc35544433bb%2Fbly9ln8_processed.jpeg&w=3840&q=75)

Transcribed Image Text:[Question 1]

Saturn Company

Comparative Balance Sheet

2018

2017

Assets

Cash

Accounts Recelvable

Prepaid Insurance

Inventory

Land

Plant Assets

$ 47,500

21,500

2,500

48,000

20,000

230,000

(85,500)

$284,000

$ 24,300

26,000

1,800

45,500

10,000

190,000

(71,100)

Accumulated Depreciation

Total AssetsS

$226,500

Llabilities and Equity

Labilities

Accounts Payable

Salaries Payable

Notes Payable

Total Llabilities

S 19,000

1,500

75.000

$ 17,200

85.000

104.100

95.500

315.000

64.900

Common Stock

Retained Earnings

Tota Equity

Total Liabilities and Equity

61,000

379.900

131.000

$284.000

$226,500

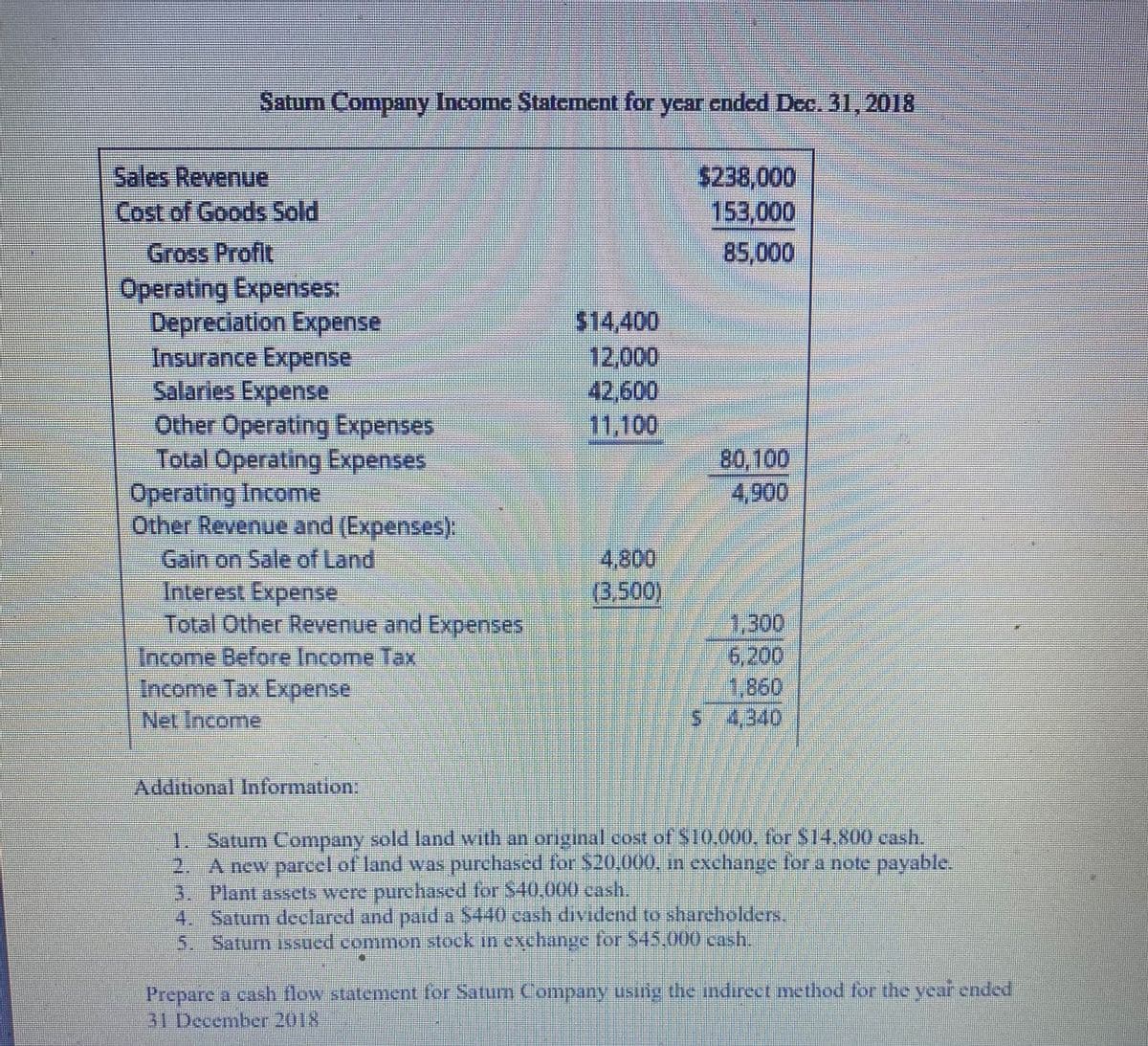

Transcribed Image Text:Satum Company Income Statement for year ended Dec. 31, 2018

Sales Revenue

Cost of Goods Sold

$238,000

153,000

85,000

Gross Profit

Operating Expenses:

Depreciation Expense

Insurance Expense

Salaries Expense

Other Operating Expenses

Total Operating Expenses

Operating Income

Other Revenue and (Expenses):

Gain on Sale of Land

Interest Expense

Total Other Revenue and Expenses

Income Before Income Tax

Income Tax Expense

Net Income

$14,400

12,000

42,600

11,100

80,100

4,900

4,800

(3,500)

1,300

6,200

1,860

5 4,340

Additional Information:

1. Saturn Company sold land with an original cost of S10,000, for S14.800 cash.

2. A new parcel of land was purchased for $20,000, in exchange for a note payable.

3. Plant assets were purchased for $40,000 cash,

4. Satum declared.and paid a $440 cash dividend to shareholders.

5.

Saturn issued common stock in exchange for $45.000 cash.

Prepare a cash flow statement for Saturn Company usinig the indireet method for the year ended

31 December 2018

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning