Yearly rental Lease term $3,557.25 3 years 5 years $3,000 at end of 3 years, which approximates fair value 1 year at $1,500; no penalty for nonrenewal; standard renewal clause Estimated economic life Purchase option Renewal option Fair value at inception of lease Cost of asset to lessor $10,000 $10,000 Residual value: Guaranteed -0- Unguaranteed Lessor's implicit rate (known by the lessee) Executory costs paid by: $3,000 12% Lessor; estimated to be $500 per year (included in rental equipment) $3,000 Estimated fair value at end of lease

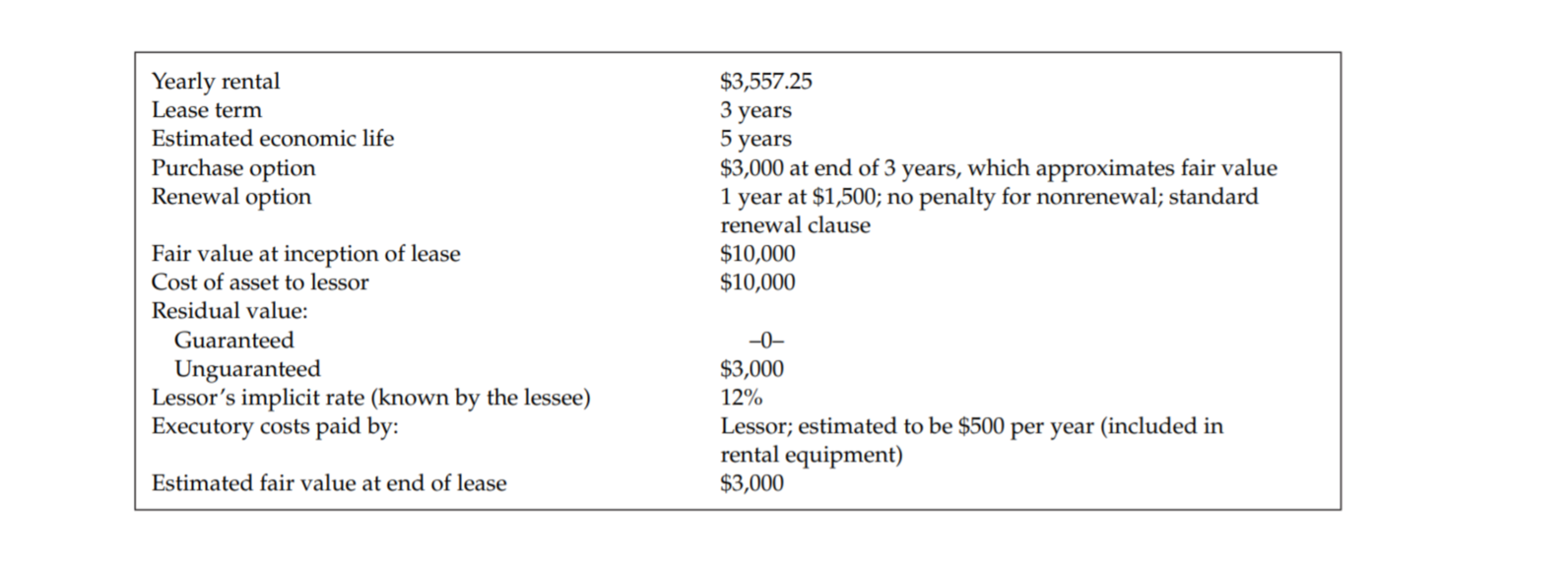

Salaur Company is evaluating a lease arrangement being offered by TSP Company for use of a computer system. The lease is noncancelable, and in no case does Salaur receive title to the computers during or at the end of the lease term. The lease starts on January 1, 2017, with the first rental payment due on January 1, 2017. Additional information related to the lease is as follows.

Check the below image for additional information

Accounting

Analyze the lease capitalization criteria for this lease for Salaur Company. Prepare the

Analysis

Briefly discuss the impact of the accounting for this lease for two common ratios: return on assets and debt to total assets.

Principles

What element of faithful representation (completeness, neutrality, free from error) is being addressed when a company like Salaur evaluates lease capitalization criteria?

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images