You are given the financial statements of a company for over the 6-year periods (2016 – 2021). Considering 2016 as the base year, compute the trend index for the following items: a. Revenue, cost of goods sold, total expenses and net earnings. Comment on the trends of each of the items. b. Total assets, total liabilities and shareholders’ equity. Comment on the trends of each of the items. c. Cash flow from operation, cash flow from investing, cash flow from financing and closing cash balances. Comment on the trends of each of the items.

You are given the financial statements of a company for over the 6-year periods (2016 – 2021). Considering 2016 as the base year, compute the trend index for the following items: a. Revenue, cost of goods sold, total expenses and net earnings. Comment on the trends of each of the items. b. Total assets, total liabilities and shareholders’ equity. Comment on the trends of each of the items. c. Cash flow from operation, cash flow from investing, cash flow from financing and closing cash balances. Comment on the trends of each of the items.

Fundamentals of Financial Management (MindTap Course List)

15th Edition

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter4: Analysis Of Financial Statements

Section: Chapter Questions

Problem 24P: Income Statement for Year Ended December 31, 2018 (Millions of Dollars) Net sales 795.0 Cost of...

Related questions

Question

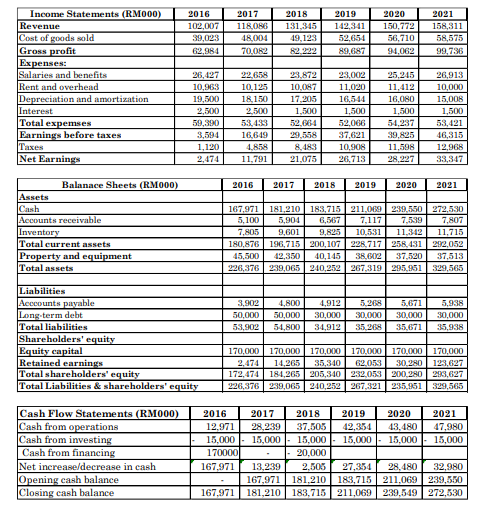

You are given the financial statements of a company for over the 6-year periods (2016 –

2021).

Considering 2016 as the base year, compute the trend index for the following items:

a. Revenue, cost of goods sold, total expenses and net earnings. Comment on the

trends of each of the items.

b. Total assets, total liabilities and shareholders’ equity. Comment on the trends of

each of the items.

c. Cash flow from operation, cash flow from investing, cash flow from financing and

closing cash balances. Comment on the trends of each of the items.

Transcribed Image Text:Income Statements (RM000)

Revenue

Cost of goods sold

Gross profit

Expenses:

Salaries and benefits

Rent and overhead

Depreciation and amortization

Interest

Total expemses

Earnings before taxes

Taxes

Net Earnings

2016

2017

2018

2019

2020

2021

102,007

118086

131,345

142,341

150,772

158,311

39,023

48,004

49,123

52,654

56,710

58,575

62,984

70,082

82.222

89,687

94.062

99,736

23.872

23,002

11.020

26,427

22,658

25,245

26,913

10.963

10,125

10.087

11,412

10.000

19,500

18,150

17,205

16,544

16,080

15.008

1,500

54,237

2,500

2,500

1,500

1,500

1,500

59,390

53,433

52,664

52,066

53,421

3,594

16,649

29,558

37,621

39,825

46.315

8,483

21,075

10,908

1,120

2,474

12,968

33,347

4,858

11,598

11,791

26,713

28,227

Balanace Sheets (RM000)

2016

2019

2017

2018

2020

2021

Assets

Cash

Accounts receivable

181,210 | 183,715 | 211,069

239,550 272,530

7,807

167,971

5,100

5,904

6,567

7,117

7,539

Inventory

Total eurrent assets

7,805

9.601

9,825

10,531

11,342

11,715

180,876

196,715 | 200,107 | 228,717 | 258,431 | 292,052

37,520

Property and equipment

Total assets

45,500

42,350

40,145

38,602

37,513

226,376 | 239,065 | 240,252 267,319 295,951| 329,565

Liabilities

Acccounts payable

3,902

4,800

4,912

5,268

5,671

5,938

Long-term debt

Total liabilities

50,000

50,000

30,000

30,000

30,000

30,000

53,902

54,800

34,912

35,268

35,671

35,938

Shareholders' equity

Equity capital

Retained earnings

Total shareholders' equity

Total Liabilities & shareholders' equity

170,000

170,000 170,000

170,000

170,000| 170,000

30,280| 123,627

35,340

172,474 184,265 | 205,340 232,053 200,280

239,065 | 240,252 | 267,321 235,951

2,474

14,265

62,053

293,627

226,376

329,565

Cash Flow Statements (RMO00)

Cash from operations

Cash from investing

Cash from financing

2016

2017

28,239

15,000

2018

37,505

2019

2020

2021

42,354

15,000

12,971

43,480

47,980

15,000

170000

167.971

15,000

20,000

15,000

15,000

Net increase/decrease in cash

Opening cash balance

Closing cash balance

13,239

167,971

167,971| 181,210

27,354

28,480

181,210 183,715 211,069 239,550

2,505

32,980

183,715| 211,069

239,549 272,530

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning