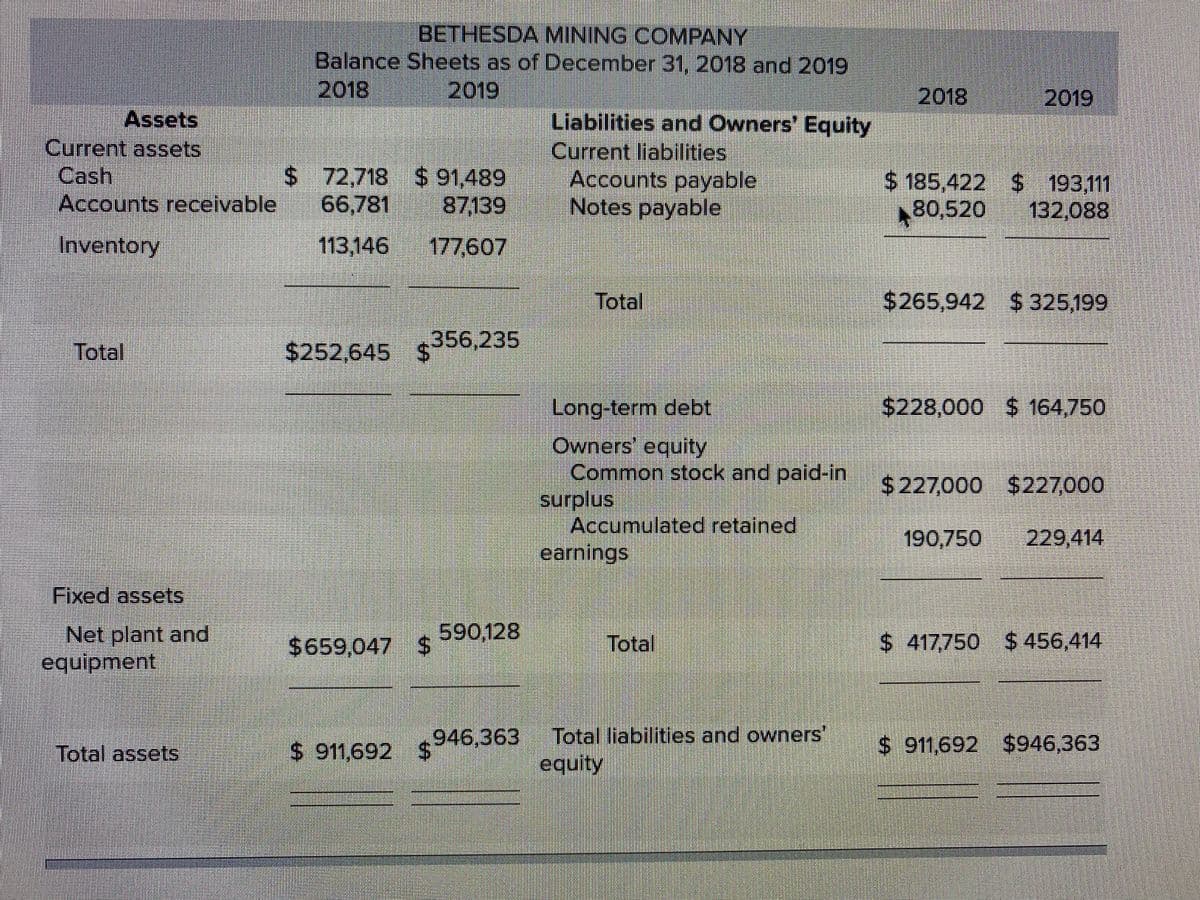

Bethesda Mining Company reports the following balance sheet information for 2018 and 2019. Calculate the following financial ratios for each year: current ratio? quick ratio? cash ratio? debt-equity ratio and equity multiplier? total debt ratio?

Q: Using the financial statements of Sultan Center in 2018, calculate the following ratios and…

A: The following computations are done for the records of Sultan Center Food Products.

Q: Given the balance sheet and income statement, calculate the ratios below. Liquidity…

A: Step 1 Accounting ratios are set of financial ratios, used to measure the efficiency and…

Q: Use the table for the question(s) below. Consider the following balance sheet: Luther…

A: Debt to capital ratio present the portion of debt employed in company out of its total capital. It…

Q: Compute the following: For fiscal 2019 and 2020: Current Ratio, Quick Ratio, Long Term Debt Ratio…

A: Hi, there, Thanks for posting the question. As per our Q&A honour code, we must answer the first…

Q: You are given the financial statements of Bersatu Berhad for the 2021 and 2020. a. Use the above…

A: Return on equity is the measure of the company’s profitability against the investment made by the…

Q: PROFITABILITY RATIOS Gross Margin= Gross Profit/Net Sales Net Profit Margin= Net Profit/ Net Sales…

A: * As per Bartleby policy, in case question have multiple subparts then answer first three only.…

Q: would represent an example of what type of analysis:

A: Financial statements: It refers to the end reports prepared by n organization to report the…

Q: Based on the attached balanced sheet and income statement, Computate the ratios and complete the…

A: (Answers of first 3 parts) Ratio analysis Liquidity Ratios 2021 2020 2019 Industry average…

Q: The below tables shows Dynamic Mattress’s year-end 2016 and 2018 balance sheets, and its income…

A: Statement of cash flows shows the flow of cash (both inflow as well as outflow) during the period.…

Q: 1. Compute for the financial health ratios of the company for 2019 C.Financial Health/ (Solvency…

A: Solvency ratios refer to those ratios which evaluate the ability of a firm to pay off its long-term…

Q: debt-to-equity ratio

A: Debt-to-equity ratio = Total noncurrent liabilities/Total shareholders' equity

Q: Calculate the financial indicators of the firms J&J for the year 2018 and fill in the spaces marked…

A: Accounting ratios are used to make analyses regarding the performance and efficiency of business…

Q: Using the information below, what is Puppy Company's debt to total assets ratio f 2019? The…

A: The question is based on the concept of ratio analysis. Ratio analysis is a quantitative method to…

Q: Bethesda Mining Company reports the following balance sheet information for 2018 and 2019. The total…

A: The debt ratio simply means the ratio of total debt to the total assets. It helps to understand the…

Q: Ratio Analysis Based on the Income Statement and Balance Sheet, complete the table below. Then…

A: The ratio analysis of company would be state the current performance of the company as compared to…

Q: Prepare a financial statement analysis in terms of liquidity, solvency, profitability and efficiency…

A: Current Ratio: the current ratio in the FY2019 is higher than FY2018 Interpretation: A higher…

Q: Southwestern Industries has the following selected data ($ in millions): Balance sheet data Total…

A: Debt to Equity Ratio: Debit and Equity both are used to provide funds to the business. The debt to…

Q: Finney Corporation has the following data as of December 31, 2018: Compute the debt to equity…

A: Assets = Liabilities + Equity Therefore , Equity = Assets - Liabilities Equity = 330,610 + 32,670 +…

Q: Using the attached balanced sheet and income statement Calculate the following ratios for the…

A: “Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: Required: Compute the ratios (according to the listed ratios as above) for 2019 and 2020. Analyse…

A: The computation of different ratios, analysis and interpretation are presented hereunder : Current…

Q: Assigning a Long-Term Debt Rating Using Financial Ratios Refer to the information below from…

A: Given : Revenue $13,601 Interest expense, gross $181 Depreciation expense 306 Dividends,…

Q: Jaffers Corporation has a current ratio (defined as current assets dividend by current liabilities)…

A: (Note: Since you have posted multiple questions, we will solve the first question for you. For the…

Q: Please do the ratios for year 2019 a. current ratio h. Debt equity ra tio b. quick ratio i. Times…

A: since there are multiple subparts to the question we will solve some of the ratios. Current Ratio…

Q: Assigning a Long-Term Debt Rating Using Financial Ratios Refer to the information below from…

A: Financial Ratios: Financial ratios are computed from the data mainly found in the financial…

Q: (A)Prepare ratio analyses (for 2019, 2018, and 2017) for both companies.You should include the…

A: Ratio analysis: This is the quantitative analysis of financial statements of a business enterprise.…

Q: Calculate the financial indicators of the firm Merck for the year 2018 and fill in the spaces marked…

A: Ratio is the tool which is used to measure the performance and growth of the company. It is also…

Q: The condensed financial statements of John Cully Company, for the years ended June 30, 2017 and…

A:

Q: A company has the following items for the fiscal year 2020: Total Equity = 15 million Total Assets =…

A: Explanation of the concept Ratio analysis is the concept where various financial ratios are…

Q: Please calculate the ratios related to North Star Maritime Company: North Star Maritime Company has…

A: Current Ratio is a liquidity measure. It shows efficiency of an entity in management of working…

Q: Using the information below, what is Puppy Company's acid-test ratio (quick ratio) for 2019? The…

A: Acid Test ratio An acid ratio test, also known as a quick ratio or liquid ratio, measures the…

Q: Based on the following information as of December 31,2020, compute the company’s debt-equity ratio.…

A: The debt to equity ratio is the leverage ratio that is calculated to determine the relationship…

Q: Given are the statements of financial position, income statements, and other pertinent data for ABC…

A: Financial ratio is an arithmetic expression used to describe the significant relationship between…

Q: a. Given the debtor's collection period, stock days on hand and creditors payment period for 2020…

A: We know the basic formula to calculate the average collection period = Number of Days in One years /…

Q: Killua Corporation’s Statement of Financial Positions at December 31, 2021, shows the following:…

A: Quick assets=Total current assets-Inventory-Prepaid expenses=P 233,000-P 120,000-P 1,000=P 112,000

Q: The following ratios have been computed for Pina Colada Company for 2022. Profit margin ratio…

A: As per authoring guidelines first three parts of the question are answered.

Q: Compute the following ratios for the comparative periods (2018 and 2019). The company used 365 days…

A: "Since you have Posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: Analyse Rara's financial statement. Include the following ratios for 2020 and discuss your findings…

A: a) Return on Assets is computed by dividing the net income by the average total assets b) Profit…

Q: Using the financial statements provided, compute the following ratios for Angostura for 2018 and…

A: Current Ratio= Current assets/ Current Liabilities For 2018- = $828,783/$85,028 = 9.75 For 2019- =…

Q: Using the fiscal year end 2019 annual report for General Mills, Inc. and the figures from the 2017…

A: "Since you have asked multiple sub part question we will solve the first three sub part question for…

Q: a) Based on the information provided, calculate the following ratios for the years ended 31 December…

A: Sl No Ratio Formula 2021 2020 Equation Ratio Equation Ratio i Gross Profit Margin Gross…

Q: Use Tableau to calculate and display the trends for the debt to equity and times interest earned…

A: Following is the answer to the given question

Q: The following ratios for The A2 Milk Limited and Synlait Limited were calculated for 2020 and 2019:…

A: Short-Term Financial Risk is the risk where company do not have sufficient funds to meet its short…

Q: Calculate the amount that would be reflected as “Working capital changes” in the Statement of Cash…

A: As per Bartleby Guidelines if multiple questions are asked and those are interlinked to each other…

Q: You are given the financial statements of a company for over the 6-year periods (2016 – 2021).…

A: Trend index The purpose of preparing the trend index is to know the actual trend which are involved…

Q: Using the financiaql statements of Top Glove Corporation Berhad for the year 2020, provide and…

A: Financial Ratios are the measures of the performance of a corporation and are used in the financial…

Q: Calculate the following ratios for Avartar Sdn. Bhd. for years ended 31 March 2019 and 31 March…

A: Ratio analysis is one of important analysis used by the stakeholders of the company to analyze the…

Q: The below tables shows Dynamic Mattress’s year-end 2016 and 2018 balance sheets, and its income…

A: Statement of Cash Flow It is a financial statement that shows the amount of cash and cash…

| Bethesda Mining Company reports the following balance sheet information for 2018 and 2019. |

Calculate the following financial ratios for each year:

current ratio?

quick ratio?

cash ratio?

debt-equity ratio and equity multiplier?

total debt ratio?

Trending now

This is a popular solution!

Step by step

Solved in 6 steps

- Leverage Cook Corporation issued financial statements at December 31, 2019, that include the following information: Balance sheet at December 31,2019 Assets $8,000,000 Liabilities $1,200,000 Stockholders' equity (300,000 shares) $6,800,000 Income statement for 2019: Income from operations $1,200,000 Less: Interest expense (100,000) Income before taxes $1,100,000 Less: Income taxes expense (0,30) (330,000) Net income $ 770,000 The levels of assets, liabilities, stockholders' equity, and operating income have been stable in recent years; however, Cook Corporation is planning a 51,800,000 expansion program that will increase income from operations by $350,000 to $1,550,000, Cook is planning to sell 8.5% notes at par to finance the expansion. Required: What earnings per share does Cook report before the expansion?Investments in Equity Securities Manson Incorporated reported investments in equity securities of 60,495 as a current asset on its December 31, 2018, balance sheet. An analysis of Mansons investments on December 31, 2018, reveals the following: During 2019, the following transactions related to Mansons investments occurred: Required: 1. Assuming Manson prepares quarterly financial statements, prepare journal entries to record the preceding information. 2. Show the items of income or loss from investment transactions that Manson reports for each quarter of 2019. 3. Show how Mansons investments are reported on the balance sheet on March 31, 2019; June 30, 2019; September 30, 2019; and December 31, 2019.BETHESDA MINING COMPANYBalance Sheets as of December 31, 2018 and 2019 2018 2019 2018 2019 Assets Liabilities and Owners’ Equity Current assets Current liabilities Cash $ 65,470 $ 82,487 Accounts payable $ 186,922 $ 194,611 Accounts receivable 65,281 85,639 Notes payable 82,020 133,588 Inventory 116,676 181,549 Total $ 268,942 $ 328,199 Total $ 247,427 $ 349,675 Long-term debt $ 231,000 $ 167,750 Owners’ equity Common stock and paid-in surplus $ 224,000 $ 224,000 Accumulated retained earnings 182,232 219,704 Fixed assets Net plant and equipment $ 658,747 $ 589,978…

- 23. Condensed financial data of Novak Company for 2020 and 2019 are presented below. NOVAK COMPANYCOMPARATIVE BALANCE SHEETAS OF DECEMBER 31, 2020 AND 2019 2020 2019 Cash $1,830 $1,180 Receivables 1,710 1,320 Inventory 1,590 1,920 Plant assets 1,890 1,710 Accumulated depreciation (1,220 ) (1,190 ) Long-term investments (held-to-maturity) 1,320 1,440 $7,120 $6,380 Accounts payable $1,190 $890 Accrued liabilities 210 260 Bonds payable 1,400 1,580 Common stock 1,940 1,660 Retained earnings 2,380 1,990 $7,120 $6,380 NOVAK COMPANYINCOME STATEMENTFOR THE YEAR ENDED DECEMBER 31, 2020 Sales revenue $6,720 Cost of goods sold 4,680 Gross margin 2,040 Selling and administrative expenses 920 Income from operations…Pharoah Corporation’s comparative balance sheet is presented below. PHAROAH CORPORATIONBalance SheetDecember 31 Assets 2021 2020 Cash $12,010 $8,980 Accounts receivable 17,810 19,660 Land 16,800 21,840 Buildings 58,800 58,800 Accumulated depreciation—buildings (12,600 ) (8,400 ) Total $92,820 $100,880 Liabilities and Shareholders’ Equity Accounts payable $10,390 $26,120 Common shares 63,000 57,960 Retained earnings 19,430 16,800 Total $92,820 $100,880 Additional information: 1. Profit was $19,010. Dividends declared and paid were $16,380. 2. No noncash investing and financing activities occurred during 2021. 3. The land was sold for cash of $4,120 resulting in a loss of $920 on the sale of the land. Prepare a cash flow statement for 2021 using the indirect method. Lu…24. Condensed financial data of Sheffield Company for 2020 and 2019 are presented below. SHEFFIELD COMPANYCOMPARATIVE BALANCE SHEETAS OF DECEMBER 31, 2020 AND 2019 2020 2019 Cash $1,800 $1,130 Receivables 1,770 1,320 Inventory 1,560 1,890 Plant assets 1,900 1,700 Accumulated depreciation (1,220 ) (1,180 ) Long-term investments (held-to-maturity) 1,300 1,430 $7,110 $6,290 Accounts payable $1,220 $890 Accrued liabilities 190 250 Bonds payable 1,410 1,520 Common stock 1,870 1,730 Retained earnings 2,420 1,900 $7,110 $6,290 SHEFFIELD COMPANYINCOME STATEMENTFOR THE YEAR ENDED DECEMBER 31, 2020 Sales revenue $6,860 Cost of goods sold 4,710 Gross margin 2,150 Selling and administrative expenses 920 Income…

- X Company collected P12350 in interest during 2019 X showed P1,850 in interest on its December 31, 2021 statement of financial position and P5,300 on December 31, 2020 How much is the Interest Revenue to be reported on X's statement of comprehensive income in 2021?Here are comparative balance sheets for Velo Company. Velo CompanyComparative Balance SheetsDecember 31 Assets 2020 2019 Cash $73,200 $32,700 Accounts receivable 85,600 70,500 Inventory 169,800 186,600 Land 74,000 100,600 Equipment 260,500 200,100 Accumulated depreciation—equipment (65,800 ) (33,700 ) Total $597,300 $556,800 Liabilities and Stockholders’ Equity Accounts payable $35,400 $47,300 Bonds payable 151,400 203,000 Common stock ($1 par) 217,500 173,200 Retained earnings 193,000 133,300 Total $597,300 $556,800 Additional information: 1. Net income for 2020 was $104,100. 2. Cash dividends of $44,400 were declared and paid. 3. Bonds payable amounting to $51,600 were redeemed for cash $51,600. 4. Common stock was issued for $44,300 cash. 5. No…Maple Group LtdComparative Balance SheetDecember 31, 2020 and 20192020 2019 Increase/(Decrease)Assets Cash and cash equivalent ? 31,500 (10,000)Accounts Receivable ? 87,500 ? Inventories 97,100 ? ? Fixed Assets, net 142,300 ? 32,000 Total Assets 302,900 323,000 (20,100)Liabilities Accounts payable 25,600 26,600 ? Accrued liabilities 24,000 ? 1,200 Long-term notes payable 58,200 ? (20,000)Stockholders' Equity: Common Stock ? 131,400 ? Retained earnings 54,800 64,000 (9,200)Total liabilities and stockholders' equity 302,900 323,000 (20,100)- - - Maple Group Ltd Income Statement Year Ended December 31,2020 Revenues and gains: Sales revenue 370,000 Interest revenue 11,800 Total revenues and gains 381,800 Expenses Cost of goods sold 205,500 Depreciation expense 15,500 Other operating expense 126,000 Interest expense 24,300 Total expenses 371,300 Income before income taxes 10,500 Income tax expense 16,300 Net Loss (5,800) Notes Acquisition of fixed asset during 2020 47,500 Sale proceed…

- Financial statements for the Genatron Manufacturing Corporation for the years 2020 and 2019 are shown. Genatron Manufacturing CorporationBalance Sheet 2020 2019 ASSETS Cash $41,847 $50,643 Accts. receivable 261,201 201,804 Inventory 504,430 450,954 Total current assets 807,478 703,401 Fixed assets, net 400,000 300,000 Total assets $1,207,478 $1,003,401 LIABILITIES AND EQUITY Accts. payable $170,208 $134,265 Bank loan 91,242 91,242 Accruals 70,000 50,000 Total current liabilities 331,450 275,507 Long-term debt, 12% 392,625 293,723 Common stock, $10 par 300,000 300,000 Capital surplus 48,173 48,173 Retained earnings 135,230 85,998 Total liabilities & equity $1,207,478 $1,003,401 Genatron Manufacturing CorporationIncome Statement 2020 2019…FILLING IN THE RATIOS .. THE LEFT SIDE IS 2019 THE RIGHT SIDE IS 2020 IN THE IMAGE. Jergan CorporationBalance SheetsDecember 31 2020 2019 2018 Cash $ 30,800 $ 17,600 $ 18,700 Accounts receivable (net) 50,500 44,200 47,100 Other current assets 89,600 94,900 63,900 Investments 55,300 71,000 45,100 Plant and equipment (net) 500,500 370,000 358,500 $726,700 $597,700 $533,300 Current liabilities $85,500 $79,800 $69,400 Long-term debt 144,300 84,100 50,300 Common stock, $10 par 348,000 316,000 304,000 Retained earnings 148,900 117,800 109,600 $726,700 $597,700 $533,300 Jergan CorporationIncome StatementFor the Years Ended December 31 2020 2019 Sales revenue $738,000 $605,500 Less: Sales returns and allowances 39,100 29,900 Net sales 698,900…Xyz tradingCondensed comparative balance sheet 2021 2020 2019Assets:Current assets 468,000. 345,600. 300,000Property and equipment 600,000. 560,400. 500,400Other assets(advances ). 72,000. 126,000. 150,000Total assets. 1,140,000. 1,032,000. 950,400Liabilities and stockholders’ equityLiabilitiesCurrent liabilities 134,400. 112,800. 100,00012 % long-term notes payable. 240,000. 300,000 350,000Total liabilities. 374,400. 412,800. 450,000Stockholders’ equity10% preferred stock 120,000. 120,000. 120,000Common stock 300,000 240,000 200,000Additional paid in capital 84,000. 48,000 40,000Retained earnings…