The financial statements for the year ended June 30, 2011, are given below for Morgan Construction Company. The firm’s sales are projected to grow at a rate of 26percent next year, and all financial statement accounts will vary directly with sales. Morgan Construction Company Balance Sheet for Year Ended June 30, 2011 Assets: Liabilities and Stockholders’ Equity: Cash $3,349,239 Accounts payable $9,041,679 Accounts receivables 5,830,754 Notes payable 4,857,496 Inventories 22,267,674 Total current assets $31,447,667 Total current liabilities $13,899,175 Net fixed assets 43,362,482 Long-term debt 29,731,406 Other assets 1,748,906 Common stock 19,987,500 Retained earnings 12,940,974 Total assets $76,559,055 Total liabilities & equity $76,559,055 Morgan Construction Company Income Statement Year Ended June 30, 2011 Revenues $193,212,500 Costs 145,265,625 EBITDA $47,946,875 Depreciation 23,318,750 EBIT $24,628,125 Interest 11,935,869 EBT $12,692,256 Taxes (35%) 4,442,290 Net income $8,249,966 Based on that projection, develop a pro forma balance sheet and an income statement for the 2012 fiscal year. (Round answers to the nearest whole dollar, e.g. 5,275.)

The financial statements for the year ended June 30, 2011, are given below for Morgan Construction Company. The firm’s sales are projected to grow at a rate of 26percent next year, and all financial statement accounts will vary directly with sales.

|

Morgan Construction Company |

|||

|

Assets: |

Liabilities and |

||

|

Cash |

$3,349,239 |

Accounts payable |

$9,041,679 |

|

|

5,830,754 |

Notes payable |

4,857,496 |

|

Inventories |

22,267,674 |

||

|

Total current assets |

$31,447,667 |

Total current liabilities |

$13,899,175 |

|

Net fixed assets |

43,362,482 |

Long-term debt |

29,731,406 |

|

Other assets |

1,748,906 |

Common stock |

19,987,500 |

|

|

12,940,974 |

||

|

Total assets |

$76,559,055 |

Total liabilities & equity |

$76,559,055 |

|

Morgan Construction Company |

|

|

Revenues |

$193,212,500 |

|

Costs |

145,265,625 |

|

EBITDA |

$47,946,875 |

|

|

23,318,750 |

|

EBIT |

$24,628,125 |

|

Interest |

11,935,869 |

|

EBT |

$12,692,256 |

|

Taxes (35%) |

4,442,290 |

|

Net income |

$8,249,966 |

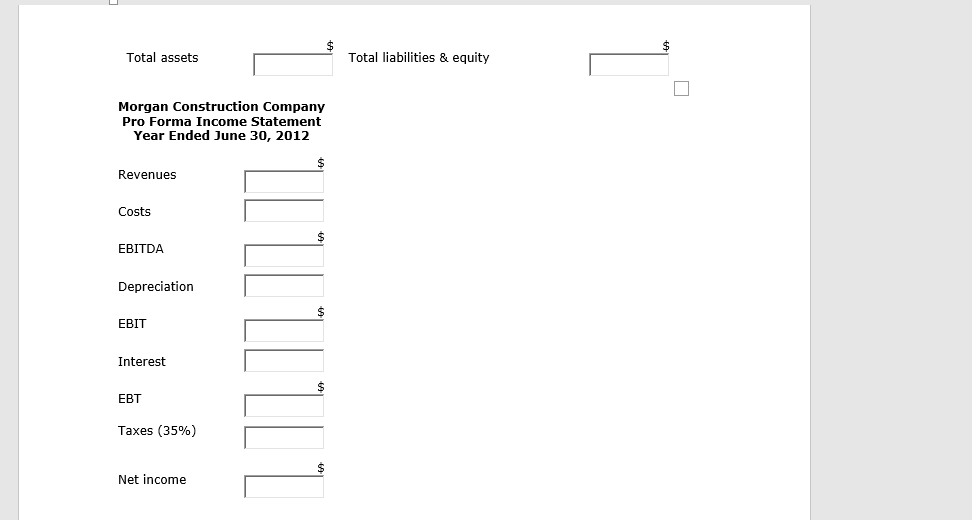

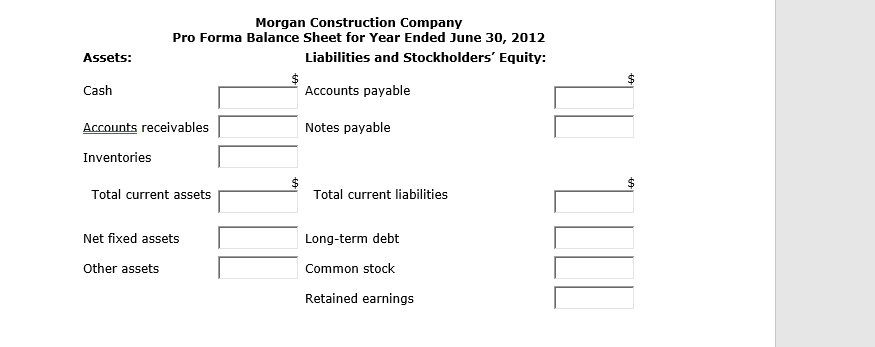

Based on that projection, develop a pro forma balance sheet and an income statement for the 2012 fiscal year. (Round answers to the nearest whole dollar, e.g. 5,275.)

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images