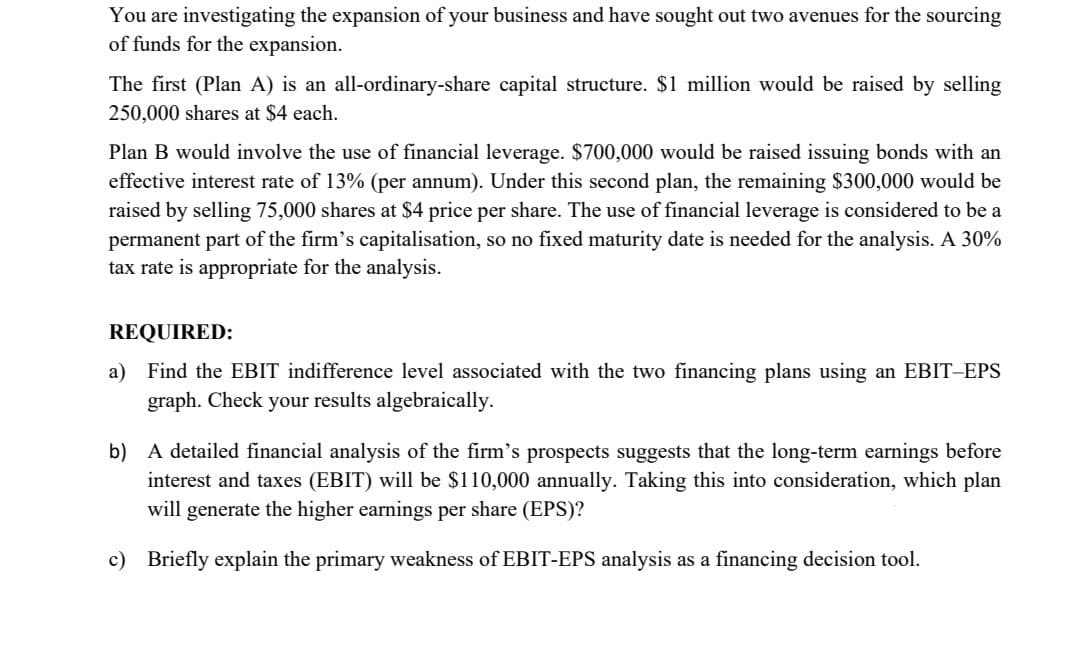

You are investigating the expansion of your business and have sought out two avenues for the sourcing of funds for the expansion. The first (Plan A) is an all-ordinary-share capital structure. $1 million would be raised by selling 250,000 shares at $4 each. Plan B would involve the use of financial leverage. $700,000 would be raised issuing bonds with an effective interest rate of 13% (per annum). Under this second plan, the remaining $300,000 would be raised by selling 75,000 shares at $4 price per share. The use of financial leverage is considered to be a permanent part of the firm's capitalisation, so no fixed maturity date is needed for the analysis. A 30% tax rate is appropriate for the analysis.

You are investigating the expansion of your business and have sought out two avenues for the sourcing of funds for the expansion. The first (Plan A) is an all-ordinary-share capital structure. $1 million would be raised by selling 250,000 shares at $4 each. Plan B would involve the use of financial leverage. $700,000 would be raised issuing bonds with an effective interest rate of 13% (per annum). Under this second plan, the remaining $300,000 would be raised by selling 75,000 shares at $4 price per share. The use of financial leverage is considered to be a permanent part of the firm's capitalisation, so no fixed maturity date is needed for the analysis. A 30% tax rate is appropriate for the analysis.

Chapter14: Capital Structure Management In Practice

Section: Chapter Questions

Problem 22P

Related questions

Concept explainers

Question

Transcribed Image Text:You are investigating the expansion of your business and have sought out two avenues for the sourcing

of funds for the expansion.

The first (Plan A) is an all-ordinary-share capital structure. $1 million would be raised by selling

250,000 shares at $4 each.

Plan B would involve the use of financial leverage. $700,000 would be raised issuing bonds with an

effective interest rate of 13% (per annum). Under this second plan, the remaining $300,000 would be

raised by selling 75,000 shares at $4 price per share. The use of financial leverage is considered to be a

permanent part of the firm's capitalisation, so no fixed maturity date is needed for the analysis. A 30%

tax rate is appropriate for the analysis.

REQUIRED:

a) Find the EBIT indifference level associated with the two financing plans using an EBIT-EPS

graph. Check your results algebraically.

b) A detailed financial analysis of the firm's prospects suggests that the long-term earnings before

interest and taxes (EBIT) will be $110,000 annually. Taking this into consideration, which plan

will generate the higher earnings per share (EPS)?

c) Briefly explain the primary weakness of EBIT-EPS analysis as a financing decision tool.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning