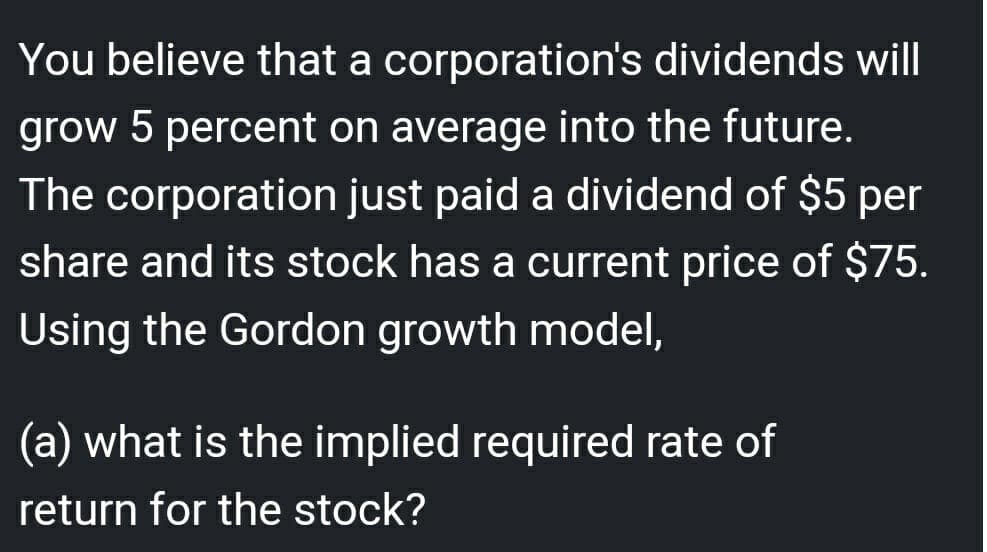

You believe that a corporation's dividends will grow 5 percent on average into the future. The corporation just paid a dividend of $5 per share and its stock has a current price of $75. Using the Gordon growth model, (a) what is the implied required rate of return for the stock?

Q: Analytical problems 12 Faustian health economics. Consider Figure 11.10, which shows the locus of fe...

A: Dear Student, as you have posted multiple sub-parts in a question but according to our policies and ...

Q: The following diagram shows supply and demand in the market for laptops. Use the black point (plus s...

A: The markets are the place where the buyers of the products tend to interact with the sellers of thes...

Q: The first cost of an equipment is 65000 and a salvage value of 3000 at the end of its 6 year life. f...

A: Given First cost of equipment (FC)=65000 Salvage value SV=3000 Useful life (n) =6 year We have to f...

Q: Assume an economy in which only broccoli and cauliflower are produced. In year 1, 500 million pounds...

A: GDP deflator and CPI are both measures of inflation. GDP deflator measures changes in price keeping ...

Q: How does SAT performance influence occupational andeconomic achievement?

A: SAT scores have a positive relationship with economic achievement. A higher SAT scores means a high...

Q: The market for drones is perfectly competitive. Assume for simplicity that fractions of everything, ...

A: Perfectly competitive market is a market structure where all seller sell identical products, firm ar...

Q: Firm w fillonwing production function 3/4 wil r=3 1 Derive Cost functin if wil 8 re3 run Supply if R...

A: Given Production function: q(L,K)=L1/4K3/4 ... (1) Price of labor w=1 Price of capit...

Q: 1 2 Quantity of Books Suppose the solid line in the graph above illustrates Michael's budget line. W...

A: (Since you have asked many questions, we will solve the first one for you. If you want any specific ...

Q: Marginal cost-benefit analysis and the goal of the firm Wendy Winter needs to determine whether the ...

A: Calculating Wendy's decision:

Q: Country A produces GDP according to the following equation: GDP = 5VK. The country has a depreciatio...

A: Let savings rate be represented by s. In steady-state: s×steady state level of GDP=Depreciation rate...

Q: The market for drones is perfectly competitive. Labor is the only variable input. The fixed cost is ...

A: Marginal Product of Labor (MPL): - it is the change in total production due to the employment of an ...

Q: Refer to the information provided in Table Table Aggregate Output Aggregate Consumption Planned Inve...

A: The portion of each of the additional extra income of a household that is being spent or consumed is...

Q: In the short run, a rise in the federal funds rate shifts the a. AD curve leftward. b. SAS curve...

A: When product or any kind of service is manufactured, cost takes place and process of business follo...

Q: Suppose the demand functions facing the wireless telephone monopolist in Worked-Out Problem 18.4 (pa...

A: Given; Low-demand consumer; QLd=50-100P High- demand consumer;QHd=120-100P Marginal cost per minute=...

Q: The rational expectations theory suggests that as the public learns more about the effects of fiscal...

A: Rational expectation theory suggests the economic agents have full information about the economy, th...

Q: What contributions are community colleges making tohigher education?

A: The institution providing higher education which provides a curriculum of two years that could lead ...

Q: Consider a production firm whose production function has the isoquant shown in the following graph. ...

A: Given is the graph of the production firm's isoquant. The isoquant is a downward sloping curve in th...

Q: hat is a basket of goods? Explain how it is selected.

A: The "shopping baskets" of items utilized in aggregating the various measures of consumer price infla...

Q: Refer to the information provided in Figure below to answer the question that follow. AS 110 AD 600 ...

A: Oil embargo depicts a situation where oil supply is decreasing. In economy most of the production is...

Q: The market for drones is perfectly competitive. Assume for simplicity that fractions of everything, ...

A: Perfectly competitive market: - it is a market condition where there are many buyers and many seller...

Q: Identify the NonPrice determinants of supply in the dentistry field. (per factor)

A: The supply curve shows the direct relationship between two variables that are price and quantity sup...

Q: 12. If _____ is rising, it likely means that the economy is shrinking. A. consumer spending B. nomin...

A: GDP is the value of final goods and services produced in the economy within a given period of time

Q: 1 Draw the disadvantages of each policy choice? Policy 1: Exchange stability combined with capital m...

A: There is monetary trilemma involved when it comes to international trade that is we cannot have all ...

Q: You own a zero-coupon bond that will pay 10,000 in two years. The interest rate from 2021 to 2022 is...

A:

Q: 50 45 Profit or Loss 40 35 ATC 15 AVC 10 MC 5 4 10 12 14 16 18 20 QUANTITY (Thousands of sweaters) I...

A: In perfect competition, eqm quantity is found by the intersection of MC(marginal cost) and P(price) ...

Q: 16.) Suppose that a demand curve passes through the points (4,$4.00) and (8,$2.00). What is the pric...

A: Since you have asked multiple question, we will solve the first question for you. If you want any sp...

Q: The current national unemployment rate in the United States as of January 2022 falls within the boun...

A: The unemployment rate in January 2022 in USA was 4%. The Fed's estimate of natural rate of unemploym...

Q: • Assuming that there is no government spending or trade, an economy's GDP is the sum of domestic co...

A: Answer -

Q: Rich's Opportunities. Rich has no nonlabor income, and suppose the price of consumption is $1 per un...

A: A change in the wage or salary will result in a shift in the amount of labour demanded. If the wage ...

Q: 20. Which of the following statements is true regarding international unemployment? A. Higher unempl...

A: Unemployment is a global issue and it represents a negative state of the economy that indicates the ...

Q: Suppose that at a rural gas station in Toby Acres, there are only two customers, Johnny (who drives ...

A: There are only two consumers, i.e., Johnny and Olivia who demand gasoline. ----------------------- ...

Q: Note : please answer both the question. I will give instant upvote. For the "No, markets fail ...

A: Answer: (1). A negative demand shock leads to a decrease in the aggregate demand in the economy. As...

Q: 40 36 Demand 32 28 24 20 16 12 4. 2 3 4 5 6 10 QUANTITY (Thousands of large boxes) In the following ...

A: Output (Q) Price (P) Total Revenue (P*Q) Marginal Revenue (TRn - TRn-1) Average Revenue (TR/Q) 0 2...

Q: 3. Suppose that the nominal exchange rate of the dollar in terms of yen is ¥175/$. The price level i...

A: To solve above question let us consider two period (1& 2 ). In period 1 : Nominal Exchange rate ...

Q: How are public colleges and universities respondingto budget cuts?

A: Meaning of Government Debt: The term government debt refers to the situation under which the gover...

Q: How many years will it take to triple your investment of $5,000 if it has an interest rate of 10% co...

A: Information given to us is:- Investment = $5000 Interest rate = 10% compounded annually We have to c...

Q: Refer to the data in the table given below. Suppose that the present equilibrium price level and lev...

A: We have been given that dataset C is the relevant aggregate supply schedule. We can see that the pri...

Q: 10) Suppose that the utility function of an individual can be described as U(X,Y) = 4X + 2Y. For thi...

A: Marginal rate of substitution refers to the slope of an indifference curve. Indifference curve shows...

Q: Which of the following is (are) CORRECT? O a. Unanticipated inflation benefits borrowers O b. The NA...

A: In US , The NAIRU or natural rate of unemployment is the lowest unemployment rate that can be sustai...

Q: A binomial probability experiment is conducted with the given parameters. Compute the probability of...

A: a frequency distribution of the number of successful results that can be achieved in a specified num...

Q: Using the 3-equation model provide a detailed period by period description of the adjustment proces...

A:

Q: If the budget line rotates from blue to red. Consumption Next Year B Consumption Today The interest ...

A: since you have asked multiple questions and according to policy we can solve only 1 question and for...

Q: In Plant Design, one is required to compute for one time-independent and one time-dependent market i...

A: Answer -

Q: unexpected inflation is better for whom and why? O If you are a lender, because it reduces the value...

A: Inflation is the increase in average price level of goods and services produced in the economy.

Q: Suppose a workers' union managed to sign a new wage contract with the employer for a 5% nominal wage...

A: Here, it is given that the workers' union signed a contract with employer to have a 5% increase in n...

Q: Collective rights is a concept that prioritizes the welfare of society over: Group of answer cho...

A: Collective rights is held by a group of people rather than the individuals of the group. So it prio...

Q: Consider the following hypothesis test. Ho: Hs 50 Hiu > 50 A sample of 60 is used and the population...

A: (a) X = Sample Mean = 52.5n = Sample Size = 60 μ =Population Mean = 50σ = Population Standard Deviat...

Q: Price £/unit E B. 'D3 D1 D2 Quantity Figure 4 Supply and demand curves for a normal good Figure 4 sh...

A: Macroeconomics and microeconomics are the two important branches of economics and both are important...

Q: Some economists say that profit earner is a kind of

A: To find : What is profit earner type

Q: QUESTION 4 Suppose the real GDP in a fictional economy currently equals to 160 million USD, the pote...

A: According to the above mentioned question we have:- Equilibrium level of GDP = 160 million Potential...

Step by step

Solved in 2 steps

- Over the next three years, the expected path of 1-year interst rates is 4,1, and 1 percent. Today you buy $1 of one-year bond and when it matures you plan to use the money you receive to reinvest in one-year bond again. Then your expected rate of return for this $1 investment is _____% (round to the nearest integer). If the expectations theory of the term structure is true, then your expected rate of return for buying a two-year bond today is ____%, which implies that the current interest rate on 2-year bond must be ____%Show graphically how the capital stock will respond to(i) a permanent increase in output price;(ii) a temporary investment tax credit scheme that rebates a fraction r of the value ofinvestment.Assume that the real risk-free rate is r* = 2% and the average expected inflation rate is 3% for each future year. The DRP and LP for Bond X are each 1%, and the applicable MRP is 2%. What is Bond X’s interest rate? Is Bond X (1) a Treasury bond or a corporate bond and (2) more likely to have a 3-month or a 20-year maturity? SHOW WORK AND USE FINANCIAL CALCULATOR

- Over the next three years, the expected path of 1 year interest rates is 1, 2, and 1 percent, and the 1-year, 2-year, and 3- year term premia are 0, 0.2. and 0.5 percent, respectively. Using the information, if the expectations theory of the term structure is true, then your expected rate of return for buying a two-year bond today over the next two-year is ____% (round to the nearest integer).Suppose that conditions in the economy are such that the after-tax expected real interest rate is described by the equationRa = a X gWhere a is a number that depends on how people value their consumption in one period compared with another period, and g is the growth rate of the economy. The a equals 1 when people prefer consumption to be balanced, with the same amount of consumption each period; a may be bigger than the one when people prefer consumption today over consumption in the future, with a being larger and larger the more impatient people are:A - Suppose that a = 2, g = 0.02, the inflation rate is expected to be steady at pi = 0.03, and the tax rate is .40. What are the values of the equilibrium nominal interest rate and the before-tax expected real interest rate?B - Beginning with the situation in part a, if the growth rate of the economy increases to .04, what are the new values of the equilibrium nominal interest rate and the before-tax expected real interest rate?C -…Suppose that conditions in the economy are such that the after-tax expected real interest rate is described by the equationRa = a X gWhere a is a number that depends on how people value their consumption in one period compared with another period, and g is the growth rate of the economy. The a equals 1 when people prefer consumption to be balanced, with the same amount of consumption each period; a may be bigger than the one when people prefer consumption today over consumption in the future, with a being larger and larger the more impatient people are:D - Beginning with the situation in part a, if the expected inflation rate declings to 0.01, what are the new values of the equilibrium nominal interest rate and the before tax expected real interest rate?E - From these results, what general conclusions can you draw about the relationship between the nominal interest rate and the rate of economic growth, the tax rate, and the inflation rate? what about the relationship between the before…

- Suppose that a firm begins at time t=1 with a capital stock of K(1)= 200,000 and, in addition to replacing any depreciated capital, is planning to invest in new capital at the rate I(t)=50,000t*-3/2 for the forseeable future. Find the planned level of capital stock T years from now. Will this firm’s capital stock grow without bound as T -> ∞ ? Explain using a graph.Consider the market for loanable funds. Suppose the demand for loans is given by i= 40-Q+π, and the supply of loans is given by i= -30+Q+π, where π represents inflation. In the case of π=5, what is the equilbrium quantity of loans and what is the corresponsing interest rate? Q*=70, i*=45 Q*=10, i*=35 Q*=35, i*=10 Q*=45, i*=70(FINANCIAL MARKET AND EXPECTATION) a. Name three independent variables that affect stock prices and explain how these independent variables affect stock prices. b. If the Government is conducting an expansionary monetary policy, how will it affect stock prices? Draw the IS LM curve. c. The number of online video viewers increases dramatically during this pandemic time. How would this tendency affect the stock price of online video companies? What variable of the stock price determination will be affected in this case?

- If Im looking at an infinite period model and im told my dividend is always 0 at every period, would my nominal stock price always be zero?suppose that we have identified three important systematic risk factors given by exports, inflation, and industrial production, in the beginning of the year, growth in these three factors is estimated at -1%, 2.5%. and 3 5% respectively. However, actual growth in these factors turn out to be 1%.-2% ,and 2%. the factor betas are given by bex= 1.8, b1=0.7, and bip=1.0. 1. lf the expected return on the stock is 6%, and no unexpected news concerning the stock surfaces calculate the stock's total return 2. calculate the stock's total return if the company announces that they had ab accident and the operating facilities will be closed down for some time thus resulting in a loss by the company of 7% in return. 3. what would the stock total return be if the actual growth in each of the facts was equal to growth expected? assume no unexpected news on the company.Over the next three years, the expected path of 1-year interest rate is 4, 1, and 1 percent. Today if you buy $1 of one-year bond and when it matures you use the money you receive to buy another one-year bond, then your expected rate of return for this $1 investment is ____% (round to the nearest integer). If the expectations theory of the term structure is true, then it implies that the current interest rate on 2-year bond must be ____% (round to one decimal place x.x)