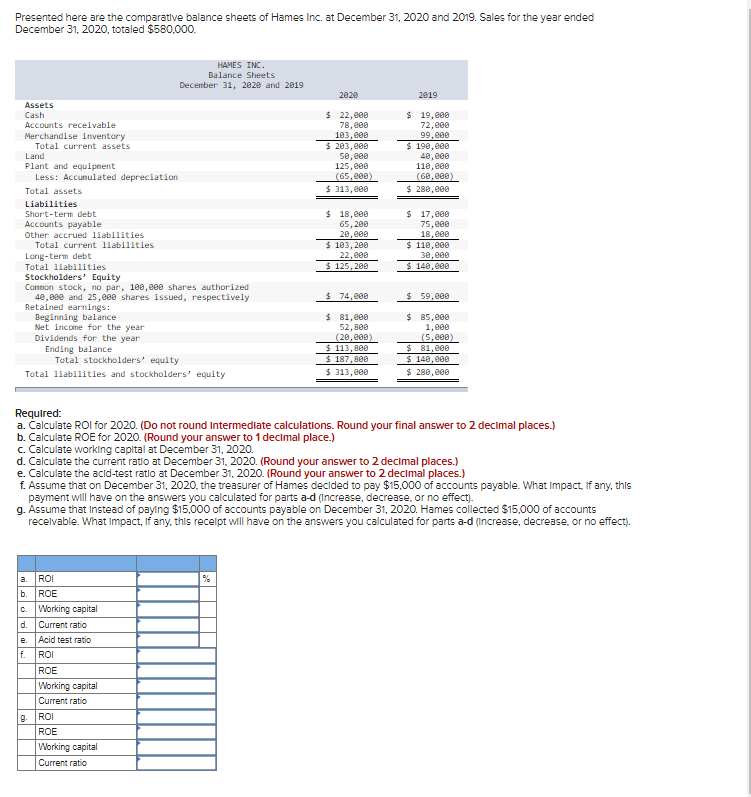

Presented here are the comparative balance sheets of Hames Inc. at December 31, 2020 and 2019. Sales for the year ended December 31, 2020, totaled $580,000. Assets Cash Accounts receivable Merchandise inventory Total current assets Land Plant and equipment Less: Accumulated depreciation Total assets Liabilities Short-term debt Accounts payable Other accrued liabilities. Total current liabilities Long-term debt Total liabilities HAMES INC. Balance Sheets December 31, 2020 and 2019 Stockholders' Equity Common stock, no par, 100,000 shares authorized 40,000 and 25,000 shares issued, respectively Retained earnings: Beginning balance Net income for the year Dividends for the year Ending balance Total stockholders' equity Total liabilities and stockholders' equity 2020 $ 22,000 78,000 103,000 $ 203,000 50,000 125,000 (65,000) $ 313,000 $ 18,000 65,200 20,000 $ 103,200 22,000 $ 125,200 $ 74,000 $ 81,000 52,800 (20,000) $ 113,800 $ 187,800 $ 313,000 2019 $ 19,000 72,000 99,000 $ 190,000 40,000 110,000 (60,000) $ 280,000 $ 17,000 75,000 18,000 $ 110,000 30,000 $ 140,000 $ 59,000 $ 85,000 1,000 (5,000) $ 81,000 $ 140,000 $ 280,000 Required: a. Calculate ROI for 2020. (Do not round Intermediate calculations. Round your final answer to 2 decimal places.) b. Calculate ROE for 2020. (Round your answer to 1 decimal place.) c. Calculate working capital at December 31, 2020.

Presented here are the comparative balance sheets of Hames Inc. at December 31, 2020 and 2019. Sales for the year ended December 31, 2020, totaled $580,000. Assets Cash Accounts receivable Merchandise inventory Total current assets Land Plant and equipment Less: Accumulated depreciation Total assets Liabilities Short-term debt Accounts payable Other accrued liabilities. Total current liabilities Long-term debt Total liabilities HAMES INC. Balance Sheets December 31, 2020 and 2019 Stockholders' Equity Common stock, no par, 100,000 shares authorized 40,000 and 25,000 shares issued, respectively Retained earnings: Beginning balance Net income for the year Dividends for the year Ending balance Total stockholders' equity Total liabilities and stockholders' equity 2020 $ 22,000 78,000 103,000 $ 203,000 50,000 125,000 (65,000) $ 313,000 $ 18,000 65,200 20,000 $ 103,200 22,000 $ 125,200 $ 74,000 $ 81,000 52,800 (20,000) $ 113,800 $ 187,800 $ 313,000 2019 $ 19,000 72,000 99,000 $ 190,000 40,000 110,000 (60,000) $ 280,000 $ 17,000 75,000 18,000 $ 110,000 30,000 $ 140,000 $ 59,000 $ 85,000 1,000 (5,000) $ 81,000 $ 140,000 $ 280,000 Required: a. Calculate ROI for 2020. (Do not round Intermediate calculations. Round your final answer to 2 decimal places.) b. Calculate ROE for 2020. (Round your answer to 1 decimal place.) c. Calculate working capital at December 31, 2020.

Chapter9: Accounting For Receivables

Section: Chapter Questions

Problem 9PA: Noren Company uses the balance sheet aging method to account for uncollectible debt on receivables....

Related questions

Question

100%

Transcribed Image Text:Presented here are the comparative balance sheets of Hames Inc. at December 31, 2020 and 2019. Sales for the year ended

December 31, 2020, totaled $580,000.

Assets

Cash

Accounts receivable

Merchandise inventory

Total current assets

Land

Plant and equipment

Less: Accumulated depreciation

Total assets

Liabilities

Short-term debt

Accounts payable

Other accrued liabilities

Total current liabilities

Long-term debt

Total liabilities

Stockholders' Equity

Common stock, no par, 100,000 shares authorized

40,000 and 25,000 shares issued, respectively

Retained earnings:

Total stockholders' equity

Total liabilities and stockholders' equity

Beginning balance

Net income for the year

Dividends for the year

Ending balance

a. ROI

b. ROE

e.

C.

d. Current ratio

f.

9.

Working capital

Acid test ratio

ROI

ROE

HAMES INC.

Balance Sheets

December 31, 2020 and 2019

Working capital

Current ratio

ROI

ROE

Working capital

Current ratio

2020

$ 22,000

78,000

103,000

$203,000

50,000

125,000

(65,000)

$ 313,000

$ 18,000

65,200

20,000

$ 103,200

22,000

$ 125,200

Required:

a. Calculate ROI for 2020. (Do not round Intermediate calculations. Round your final answer to 2 decimal places.)

b. Calculate ROE for 2020. (Round your answer to 1 decimal place.)

c. Calculate working capital at December 31, 2020.

d. Calculate the current ratio at December 31, 2020. (Round your answer to 2 decimal places.)

e. Calculate the acid-test ratio at December 31, 2020. (Round your answer to 2 decimal places.)

f. Assume that on December 31, 2020, the treasurer of Hames decided to pay $15,000 of accounts payable. What Impact, if any, this

payment will have on the answers you calculated for parts a-d (Increase, decrease, or no effect).

g. Assume that instead of paying $15,000 of accounts payable on December 31, 2020. Hames collected $15,000 of accounts

receivable. What Impact, if any, this receipt will have on the answers you calculated for parts a-d (increase, decrease, or no effect).

$ 74,000

$81,000

52,800

(20,000)

$ 113,800

$ 187,800

$313,000

2019

$ 19,000

72,000

99,000

$ 190,000

40,000

110,000

(60,000)

$ 280,000

$ 17,000

75,000

18,000

$ 110,000

30,000

$ 140,000

$ 59,000

$ 85,000

1,000

(5,000)

$ 81,000

$ 140,000

$ 280,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning