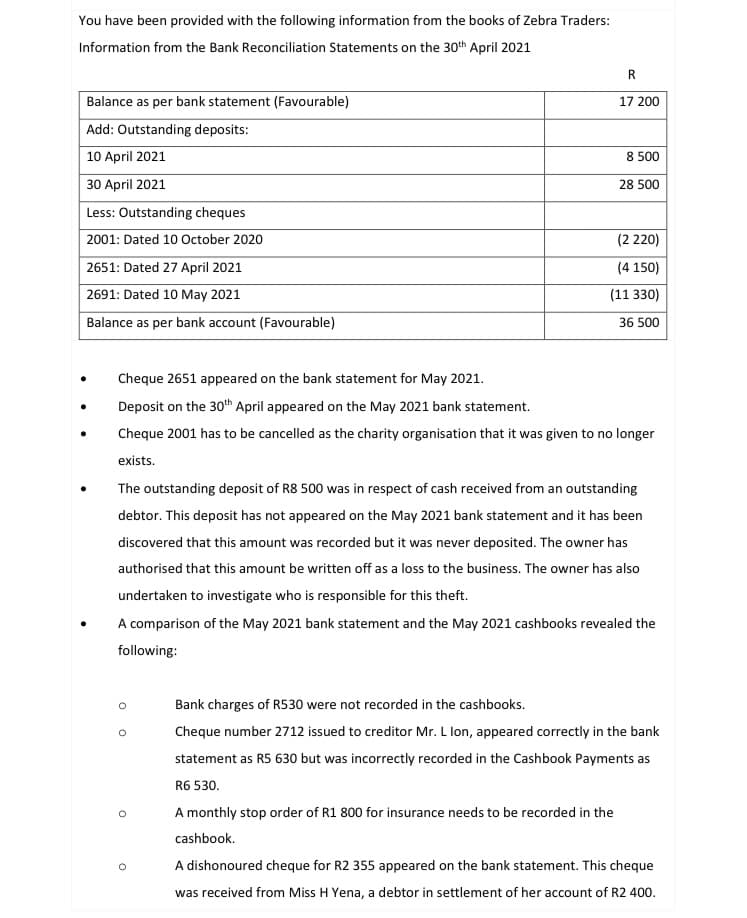

You have been provided with the following information from the books of Zebra Traders: Information from the Bank Reconciliation Statements on the 30th April 2021 R Balance as per bank statement (Favourable) 17 200 Add: Outstanding deposits: 10 April 2021 8 500 30 April 2021 28 500 Less: Outstanding cheques 2001: Dated 10 October 2020 (2 220) 2651: Dated 27 April 2021 (4 150) 2691: Dated 10 May 2021 (11 330) Balance as per bank account (Favourable) 36 500 Cheque 2651 appeared on the bank statement for May 2021. Deposit on the 30th April appeared on the May 2021 bank statement. Cheque 2001 has to be cancelled as the charity organisation that it was given to no longer exists. The outstanding deposit of R8 500 was in respect of cash received from an outstanding debtor. This deposit has not appeared on the May 2021 bank statement and it has been discovered that this amount was recorded but it was never deposited. The owner has authorised that this amount be written off as a loss to the business. The owner has also undertaken to investigate who is responsible for this theft. A comparison of the May 2021 bank statement and the May 2021 cashbooks revealed the following: Bank charges of RS30 were not recorded in the cashbooks. Cheque number 2712 issued to creditor Mr. L lon, appeared correctly in the bank statement as R5 630 but was incorrectly recorded in the Cashbook Payments as R6 530. A monthly stop order of R1 800 for insurance needs to be recorded in the cashbook. A dishonoured cheque for R2 355 appeared on the bank statement. This cheque was received from Miss H Yena, a debtor in settlement of her account of R2 400.

You have been provided with the following information from the books of Zebra Traders: Information from the Bank Reconciliation Statements on the 30th April 2021 R Balance as per bank statement (Favourable) 17 200 Add: Outstanding deposits: 10 April 2021 8 500 30 April 2021 28 500 Less: Outstanding cheques 2001: Dated 10 October 2020 (2 220) 2651: Dated 27 April 2021 (4 150) 2691: Dated 10 May 2021 (11 330) Balance as per bank account (Favourable) 36 500 Cheque 2651 appeared on the bank statement for May 2021. Deposit on the 30th April appeared on the May 2021 bank statement. Cheque 2001 has to be cancelled as the charity organisation that it was given to no longer exists. The outstanding deposit of R8 500 was in respect of cash received from an outstanding debtor. This deposit has not appeared on the May 2021 bank statement and it has been discovered that this amount was recorded but it was never deposited. The owner has authorised that this amount be written off as a loss to the business. The owner has also undertaken to investigate who is responsible for this theft. A comparison of the May 2021 bank statement and the May 2021 cashbooks revealed the following: Bank charges of RS30 were not recorded in the cashbooks. Cheque number 2712 issued to creditor Mr. L lon, appeared correctly in the bank statement as R5 630 but was incorrectly recorded in the Cashbook Payments as R6 530. A monthly stop order of R1 800 for insurance needs to be recorded in the cashbook. A dishonoured cheque for R2 355 appeared on the bank statement. This cheque was received from Miss H Yena, a debtor in settlement of her account of R2 400.

Century 21 Accounting Multicolumn Journal

11th Edition

ISBN:9781337679503

Author:Gilbertson

Publisher:Gilbertson

Chapter5: Cash Control Systems

Section: Chapter Questions

Problem 2AP

Related questions

Question

1.3

BANK

| date | details | fol. | amount | date | details | fol. | amount | |

Transcribed Image Text:You have been provided with the following information from the books of Zebra Traders:

Information from the Bank Reconciliation Statements on the 30th April 2021

R

Balance as per bank statement (Favourable)

17 200

Add: Outstanding deposits:

10 April 2021

8 500

30 April 2021

28 500

Less: Outstanding cheques

2001: Dated 10 October 2020

(2 220)

2651: Dated 27 April 2021

(4 150)

2691: Dated 10 May 2021

(11 330)

Balance as per bank account (Favourable)

36 500

Cheque 2651 appeared on the bank statement for May 2021.

Deposit on the 30th April appeared on the May 2021 bank statement.

Cheque 2001 has to be cancelled as the charity organisation that it was given to no longer

exists.

The outstanding deposit of R8 500 was in respect of cash received from an outstanding

debtor. This deposit has not appeared on the May 2021 bank statement and it has been

discovered that this amount was recorded but it was never deposited. The owner has

authorised that this amount be written off as a loss to the business. The owner has also

undertaken to investigate who is responsible for this theft.

A comparison of the May 2021 bank statement and the May 2021 cashbooks revealed the

following:

Bank charges of RS530 were not recorded in the cashbooks.

Cheque number 2712 issued to creditor Mr. L lon, appeared correctly in the bank

statement as R5 630 but was incorrectly recorded in the Cashbook Payments as

R6 530.

A monthly stop order of R1 800 for insurance needs to be recorded in the

cashbook.

A dishonoured cheque for R2 355 appeared on the bank statement. This cheque

was received from Miss H Yena, a debtor in settlement of her account of R2 400.

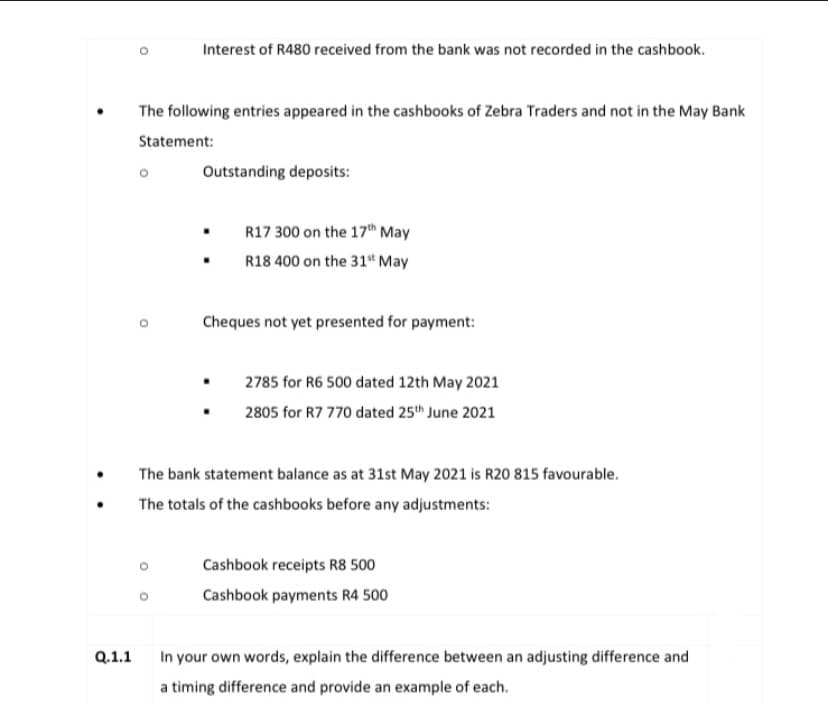

Transcribed Image Text:Interest of R480 received from the bank was not recorded in the cashbook.

The following entries appeared in the cashbooks of Zebra Traders and not in the May Bank

Statement:

Outstanding deposits:

R17 300 on the 17"™ May

R18 400 on the 31" May

Cheques not yet presented for payment:

2785 for R6 500 dated 12th May 2021

2805 for R7 770 dated 25th June 2021

The bank statement balance as at 31st May 2021 is R20 815 favourable.

The totals of the cashbooks before any adjustments:

Cashbook receipts R8 500

Cashbook payments R4 500

Q.1.1

In your own words, explain the difference between an adjusting difference and

a timing difference and provide an example of each.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning