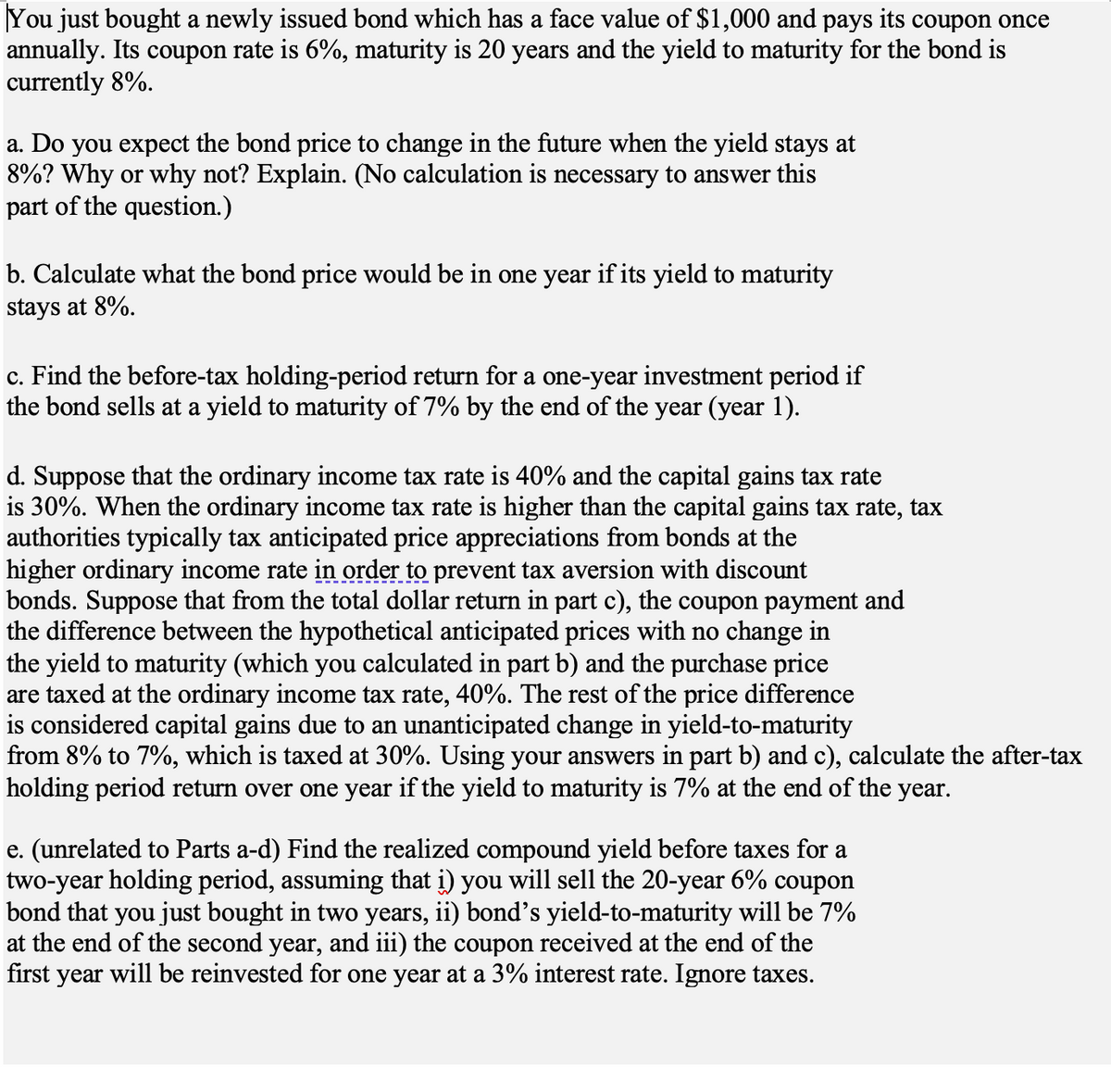

You just bought a newly issued bond which has a face value of $1,000 and pays its coupon once annually. Its coupon rate is 6%, maturity is 20 years and the yield to maturity for the bond is currently 8%. a. Do you expect the bond price to change in the future when the yield stays at 8%? Why or why not? Explain. (No calculation is necessary to answer this part of the question.) b. Calculate what the bond price would be in one year if its yield to maturity stays at 8%. c. Find the before-tax holding-period return for a one-year investment period if the bond sells at a yield to maturity of 7% by the end of the year (year 1). d. Suppose that the ordinary income tax rate is 40% and the capital gains tax rate is 30%. When the ordinary income tax rate is higher than the capital gains tax rate, tax authorities typically tax anticipated price appreciations from bonds at the higher ordinary income rate in order to prevent tax aversion with discount bonds. Suppose that from the total dollar return in part c), the coupon payment and the difference between the hypothetical anticipated prices with no change in the yield to maturity (which you calculated in part b) and the purchase price are taxed at the ordinary income tax rate, 40%. The rest of the price difference is considered capital gains due to an unanticipated change in yield-to-maturity from 8% to 7%, which is taxed at 30%. Using your answers in part b) and c), calculate the after-ta holding period return over one year if the yield to maturity is 7% at the end of the year. e. (unrelated to Parts a-d) Find the realized compound yield before taxes for a two-year holding period, assuming that i) you will sell the 20-year 6% coupon bond that you just bought in two years, ii) bond's yield-to-maturity will be 7% at the end of the second year, and iii) the coupon received at the end of the first year will be reinvested for one year at a 3% interest rate. Ignore taxes.

You just bought a newly issued bond which has a face value of $1,000 and pays its coupon once annually. Its coupon rate is 6%, maturity is 20 years and the yield to maturity for the bond is currently 8%. a. Do you expect the bond price to change in the future when the yield stays at 8%? Why or why not? Explain. (No calculation is necessary to answer this part of the question.) b. Calculate what the bond price would be in one year if its yield to maturity stays at 8%. c. Find the before-tax holding-period return for a one-year investment period if the bond sells at a yield to maturity of 7% by the end of the year (year 1). d. Suppose that the ordinary income tax rate is 40% and the capital gains tax rate is 30%. When the ordinary income tax rate is higher than the capital gains tax rate, tax authorities typically tax anticipated price appreciations from bonds at the higher ordinary income rate in order to prevent tax aversion with discount bonds. Suppose that from the total dollar return in part c), the coupon payment and the difference between the hypothetical anticipated prices with no change in the yield to maturity (which you calculated in part b) and the purchase price are taxed at the ordinary income tax rate, 40%. The rest of the price difference is considered capital gains due to an unanticipated change in yield-to-maturity from 8% to 7%, which is taxed at 30%. Using your answers in part b) and c), calculate the after-ta holding period return over one year if the yield to maturity is 7% at the end of the year. e. (unrelated to Parts a-d) Find the realized compound yield before taxes for a two-year holding period, assuming that i) you will sell the 20-year 6% coupon bond that you just bought in two years, ii) bond's yield-to-maturity will be 7% at the end of the second year, and iii) the coupon received at the end of the first year will be reinvested for one year at a 3% interest rate. Ignore taxes.

Chapter8: Analysis Of Risk And Return

Section: Chapter Questions

Problem 9P

Related questions

Question

Transcribed Image Text:You just bought a newly issued bond which has a face value of $1,000 and pays its coupon once

annually. Its coupon rate is 6%, maturity is 20 years and the yield to maturity for the bond is

currently 8%.

a. Do you expect the bond price to change in the future when the yield stays at

8%? Why or why not? Explain. (No calculation is necessary to answer this

part of the question.)

b. Calculate what the bond price would be in one year if its yield to maturity

stays at 8%.

c. Find the before-tax holding-period return for a one-year investment period if

the bond sells at a yield to maturity of 7% by the end of the year (year 1).

d. Suppose that the ordinary income tax rate is 40% and the capital gains tax rate

is 30%. When the ordinary income tax rate is higher than the capital gains tax rate, tax

authorities typically tax anticipated price appreciations from bonds at the

higher ordinary income rate in order to prevent tax aversion with discount

bonds. Suppose that from the total dollar return in part c), the coupon payment and

the difference between the hypothetical anticipated prices with no change in

the yield to maturity (which you calculated in part b) and the purchase price

are taxed at the ordinary income tax rate, 40%. The rest of the price difference

is considered capital gains due to an unanticipated change in yield-to-maturity

from 8% to 7%, which is taxed at 30%. Using your answers in part b) and c), calculate the after-tax

holding period return over one year if the yield to maturity is 7% at the end of the year.

e. (unrelated to Parts a-d) Find the realized compound yield before taxes for a

two-year holding period, assuming that i) you will sell the 20-year 6% coupon

bond that you just bought in two years, ii) bond's yield-to-maturity will be 7%

at the end of the second year, and iii) the coupon received at the end of the

first year will be reinvested for one year at a 3% interest rate. Ignore taxes.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning