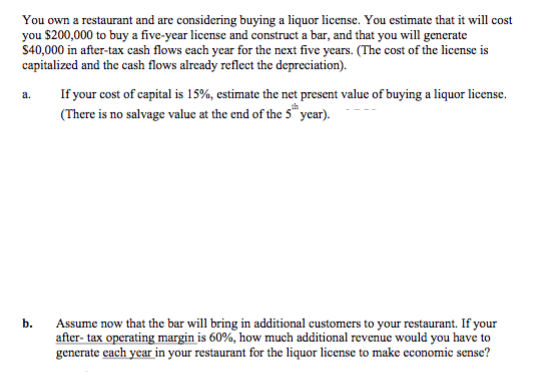

You own a restaurant and are considering buying a liquor license. You estimate that it will cost you $200,000 to buy a five-year license and construct a bar, and that you will generate $40,000 in after-tax cash flows each year for the next five years. (The cost of the license is capitalized and the cash flows already reflect the depreciation). If your cost of capital is 15%, estimate the net present value of buying a liquor license. a. (There is no salvage value at the end of the 5 year). b. Assume now that the bar will bring in additional customers to your restaurant. If your after- tax operating margin is 60%, how much additional revenue would you have to generate cach year in your restaurant for the liquor license to make economic sense?

You own a restaurant and are considering buying a liquor license. You estimate that it will cost you $200,000 to buy a five-year license and construct a bar, and that you will generate $40,000 in after-tax cash flows each year for the next five years. (The cost of the license is capitalized and the cash flows already reflect the depreciation). If your cost of capital is 15%, estimate the net present value of buying a liquor license. a. (There is no salvage value at the end of the 5 year). b. Assume now that the bar will bring in additional customers to your restaurant. If your after- tax operating margin is 60%, how much additional revenue would you have to generate cach year in your restaurant for the liquor license to make economic sense?

Chapter10: Capital Budgeting: Decision Criteria And Real Option

Section: Chapter Questions

Problem 4P

Related questions

Question

Transcribed Image Text:You own a restaurant and are considering buying a liquor license. You estimate that it will cost

you $200,000 to buy a five-year license and construct a bar, and that you will generate

$40,000 in after-tax cash flows each year for the next five years. (The cost of the license is

capitalized and the cash flows already reflect the depreciation).

If your cost of capital is 15%, estimate the net present value of buying a liquor license.

a.

(There is no salvage value at the end of the 5 year).

b.

Assume now that the bar will bring in additional customers to your restaurant. If your

after- tax operating margin is 60%, how much additional revenue would you have to

generate cach year in your restaurant for the liquor license to make economic sense?

Expert Solution

Step 1

The question is based on the concept of capital budgeting . The concept of net present value (NPV) should be used in the question for investment decision making.

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning