Which of the following statements is/correct regarding the Cash Budget? The cash budget is a statement of a firm's planned inflows and outflows of cas that is used to estimate its long-term cash requirement Cash budgets and pro forma statements are useful not only for internal financial planning but also are routinely required by the Internal Revenue Service (IRS) IL A cash budget gives the financial manager a clear view of the timing of a firm expected profitability over a given period IV Since depreciation and other noncash charges represent a scheduled write- off of an earlier cash outflow, they should not be included in the cash budget, thougt depreciation charges will affect the taxes that a firm pays O Il and III I and IV OV only O l onty

Which of the following statements is/correct regarding the Cash Budget? The cash budget is a statement of a firm's planned inflows and outflows of cas that is used to estimate its long-term cash requirement Cash budgets and pro forma statements are useful not only for internal financial planning but also are routinely required by the Internal Revenue Service (IRS) IL A cash budget gives the financial manager a clear view of the timing of a firm expected profitability over a given period IV Since depreciation and other noncash charges represent a scheduled write- off of an earlier cash outflow, they should not be included in the cash budget, thougt depreciation charges will affect the taxes that a firm pays O Il and III I and IV OV only O l onty

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter8: Budgeting For Planning And Control

Section: Chapter Questions

Problem 32E: Which of the following describes the order in which the four types of budgets must be prepared? a....

Related questions

Question

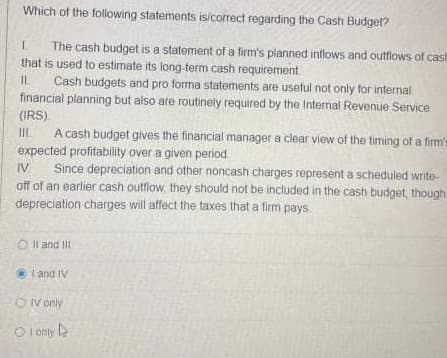

Transcribed Image Text:Which of the following statements is/correct regarding the Cash Budget?

The cash budget is a statement of a firm's planned inflows and outflows of cash

that is used to estimate its long-term cash requirement.

Cash budgets and pro forma statements are usetul not only for internal

financial planning but also are routinely required by the Internal Revenue Service

(IRS)

A cash budget gives the financial manager a clear view of the timing of a firm's

expected profitability over a given period

Since depreciation and other noncash charges represent a scheduled write-

off of an earlier cash outflow, they should not be included in the cash budget, though

depreciation charges will affect the taxes that a firm pays

IIL.

IV

O Il and III

land IV

O V only

O I only l

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,